Only 16 states and the District of Columbia have added construction jobs since just before the start of the pandemic in February 2020, according to a new analysis of federal employment data released today by the Associated General Contractors of America. Association officials noted that prospects for the sector’s recovery will be diminished should the House-passed Build Back Better bill become law.

“Although activity picked up in most states in October, construction employment remains below pre-pandemic levels in two out of three states,” said Ken Simonson, the association’s chief economist. “The record number of job openings shows contractors are eager to hire more workers but can’t find enough qualified applicants.”

From February 2020—the month before the pandemic caused projects to be halted or canceled—to last month, construction employment decreased in 33 states, stalled in Hawaii, and increased in only 16 states and D.C. Texas shed the most construction jobs over the period (-46,400 jobs or -5.9%), followed by New York (-42,800 jobs, -10.5%) and California (-21,300 jobs, -2.3%). The largest percentage losses were in Wyoming (-14.0%, -3,200 jobs), New York, and Vermont (-9.8%, -1,500 jobs),

Utah added the most construction jobs since February 2020 (8,200 jobs, 7.2%), followed by North Carolina (7,700 jobs, 3.3%), Washington (4,900 jobs, 2.2%), and Idaho (4,900 jobs, 8.9%). The largest percentage gains were in South Dakota (10.5%, 2,500 jobs), Idaho, and Utah.

From September to October construction employment decreased in 14 states, increased in 34 states and D.C., and was unchanged in Alabama and Virginia. South Carolina lost the most construction jobs over the month (-1,900 jobs, -1.7%), followed by Missouri (-1,500 jobs, -1.2%). The largest percentage decline was in New Hampshire (-2.2%, -600 jobs), followed by Vermont (-2.1%, -300 jobs).

Louisiana added the largest number and percentage of construction jobs between September and October (8,200 jobs, 7.1%). California was second in construction job gains (7,500 jobs, 0.8%), while West Virginia had the second-highest percentage increase (2.3%, 700 jobs).

Association officials cautioned that the Build Back Better measure, which passed in the House earlier today, will undermine the construction sector’s recovery. They noted that the measure’s tax and labor provisions will stifle investments in construction activity and make it even harder for firms to find qualified workers to hire. They urged Senators to reject the massive new spending bill.

“The last thing Washington should be doing is making it even harder for firms to find projects to build or workers to hire,” said Stephen E. Sandherr, the association’s chief executive officer. “Yet the hyper-partisan Build Back Better bill will hobble employers with new mandates even as it stifles private sector demand with new taxes and regulations.”

View state February 2020-October 2021 data and rankings, 1-month rankings.

Related Stories

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

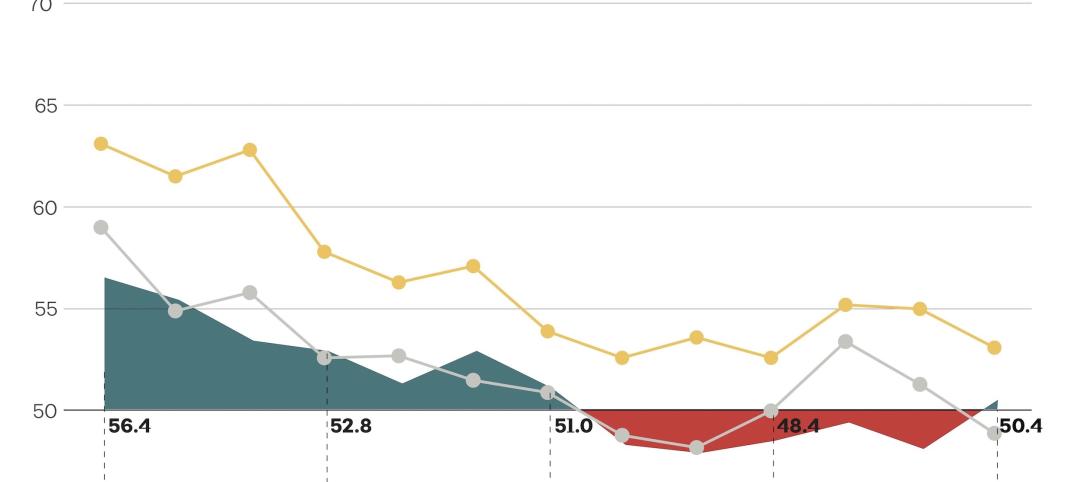

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

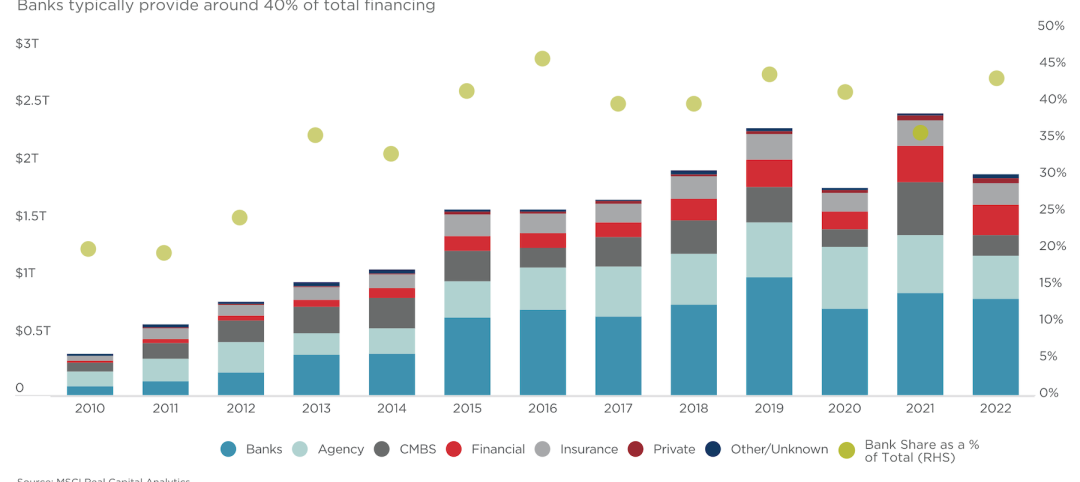

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.