Only 30% of the nation’s metro areas added construction jobs in the past year, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials said construction employment in most parts of the country was being impacted by pandemic as businesses and local governments curtail planned construction projects.

“The pandemic has devastated the finances for businesses, institutions, and state and local governments, leading to widespread postponements and cancellations of construction projects,” said Ken Simonson, the association’s chief economist. “As contractors use up the funds from Paycheck Protection Program loans, even more job losses are inevitable unless the federal government provides an immediate economic boost.”

Construction employment fell in 209, or 58%, of 358 metro areas between October 2019 and October 2020. Construction employment was stagnant in 40 other metro areas, meanwhile, and only 109 metro areas—30%—added construction jobs during the past year.

Houston-The Woodlands-Sugar Land, Texas lost the most construction jobs over those 12 months (-19,800 jobs, -8%), followed by New York City (-17,300 jobs, -11%); Montgomery-Bucks-Chester Counties, Pa. (-12,100 jobs, -21%); and Minneapolis-St. Paul-Bloomington, Minn. (-10,400 jobs, -11%). Brockton-Bridgewater-Easton, Mass. had the largest percentage decline (-43%, -2,500 jobs), followed by Bloomsburg-Berwick, Pa. (-36%, -500 jobs); Altoona, Pa. (-32%, -1,000 jobs); Johnstown, Pa. (-30%, -800 jobs); and East Stroudsburg, Pa. (-30%, -600 jobs).

Dallas-Plano-Irving, Texas added the most construction jobs over the year (7,100 jobs, 5%), followed by Seattle-Bellevue-Everett, Wash. (4,700 jobs, 4%); Kansas City, Mo. (3,700 jobs, 12%); and Boise, Idaho (3,500 jobs, 13%). Walla Walla, Wash. had the highest percentage increase (25%, 300 jobs), followed by Lewiston, Idaho-Wash. (18%, 300 jobs); Oshkosh-Neenah, Wisc. (16%, 900 jobs); Fond du Lac, Wisc. (15%, 500 jobs); and Springfield, Mo. (15%, 1,400 jobs).

Association officials said the best way to curtail future construction job losses was for Congress to pass new federal coronavirus relief measures. These measures should include making new infrastructure investments, eliminating plans to tax Paycheck Protection Program loans and enacting liability reform to protect honest businesses from baseless coronavirus lawsuits.

“Construction employment is likely to continue falling in many parts of the country unless Congress quickly passes new coronavirus relief measures,” said Stephen E. Sandherr, the association’s chief executive officer. “Boosting infrastructure projects, preserving the benefits of the Paycheck Protection Program and protecting businesses from predatory attorneys will help stabilize the economy and demand for construction.”

View the metro employment 12-month data, rankings, top 10, new highs and lows, map.

Related Stories

Market Data | Nov 2, 2018

Nonresidential spending retains momentum in September, up 8.9% year over year

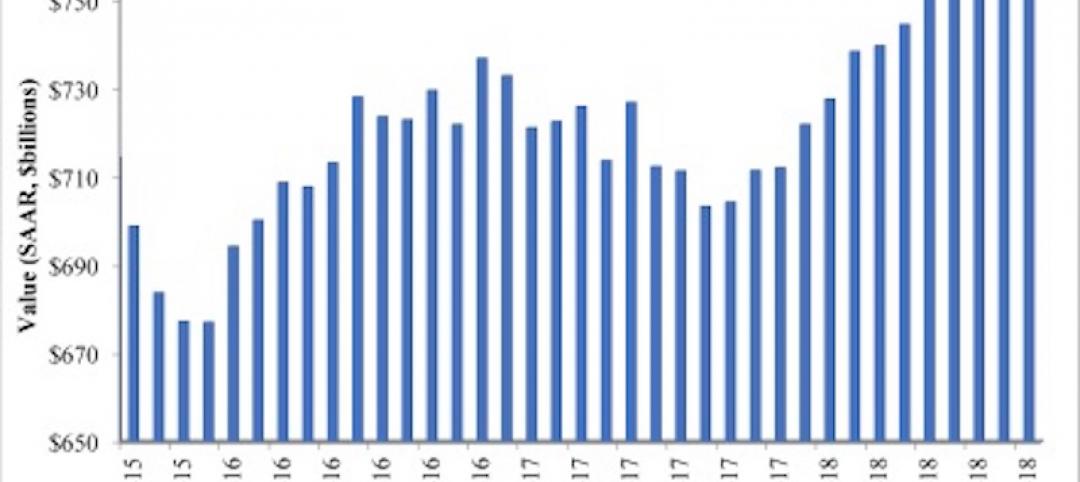

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

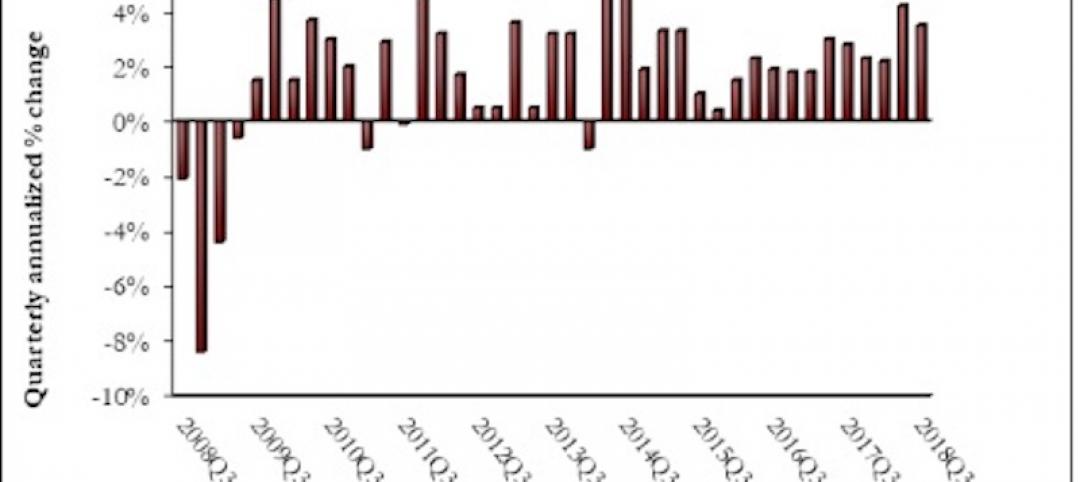

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

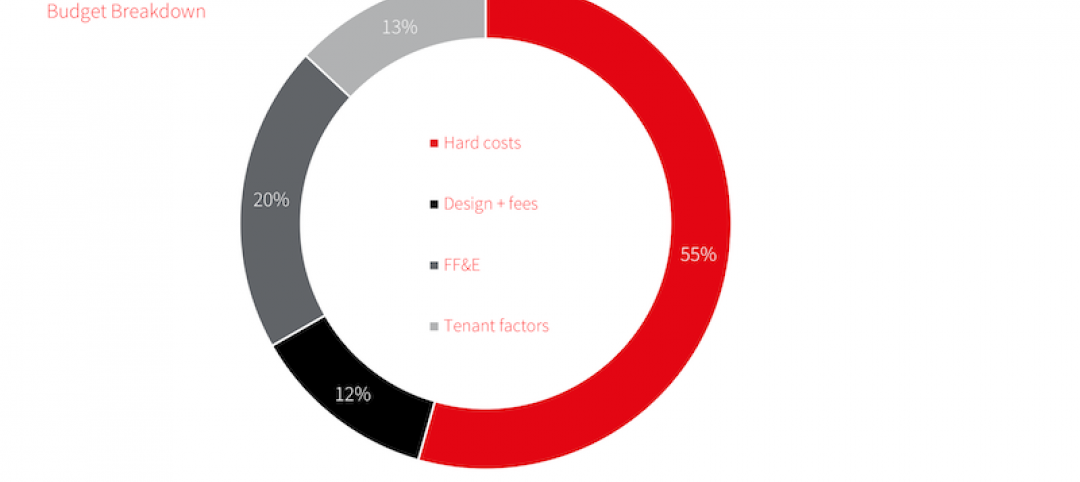

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.