Renewable energy has a mixed outlook in the Middle East and Africa (MEA) region, due to a reluctance to invest from some countries and an inability to afford renewables in others, according to GlobalData.

Several major MEA countries are actively supporting the growth of renewable energy through mechanisms such as renewable targets, renewable portfolio standards (RPS), feed in tariffs (FiTs) or auctions, net metering and tax exemptions or subsidies.

Anchal Agarwal, Power Analyst at GlobalData, says: “Most of the countries covered in MEA* have renewable energy targets, implying that these governments are actively supporting the growth of renewable energy in their respective countries. Some countries have capacity targets, while others have targets to achieve a fixed share of generation from renewable sources.”

Iran set a target in 2014 of 5 Gigawatts (GW) from wind and solar power, by 2020. In spite of this, renewable energy did not make much progress in the country. Hence, in January 2018, the government again declared a target of installing 1 GW of renewable energy projects every year from 2018 to 2022.

The availability of oil in the MEA region presents a major challenge to renewables. For example, in 2016, Saudi Arabia reduced its 2040 renewable goals from 50% to 10% of the country’s electricity supply. In April 2017, the country declared that it will develop 30 solar and wind projects over the next 10 years as part of the kingdom’s $50 billion program to boost power generation and cut its oil consumption.

Agarwal continues: “A noticeable observation in the MEA region is the growing popularity of the auction/tender mechanism to develop large-scale renewable projects. Countries such as Egypt, Iraq, Israel, Morocco, Qatar, Saudi Arabia, South Africa and UAE have auction mechanism for various renewable energy technologies. However, countries including Algeria, Iran, Kenya, Nigeria and Tanzania have already proposed the renewable auctions and they are expected to announce it within a year.”

FiTs and net metering are other major policy support mechanisms used by governments of Middle East & African countries to promote renewable energy. Six countries have FiT schemes for various renewable technologies, and Ghana and UAE are the only countries to have proposed a net-metering scheme.

* MEA countries covered = Algeria, Angola, Egypt, Ghana, Iran, Iraq, Israel, Morocco, Nigeria, Qatar, Saudi Arabia, South Africa, Syria and UAE.

Related Stories

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

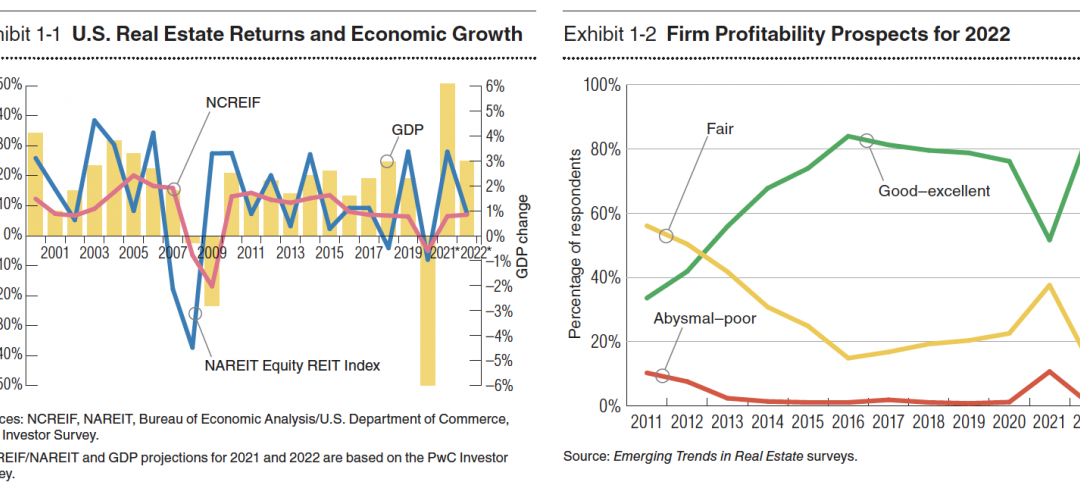

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

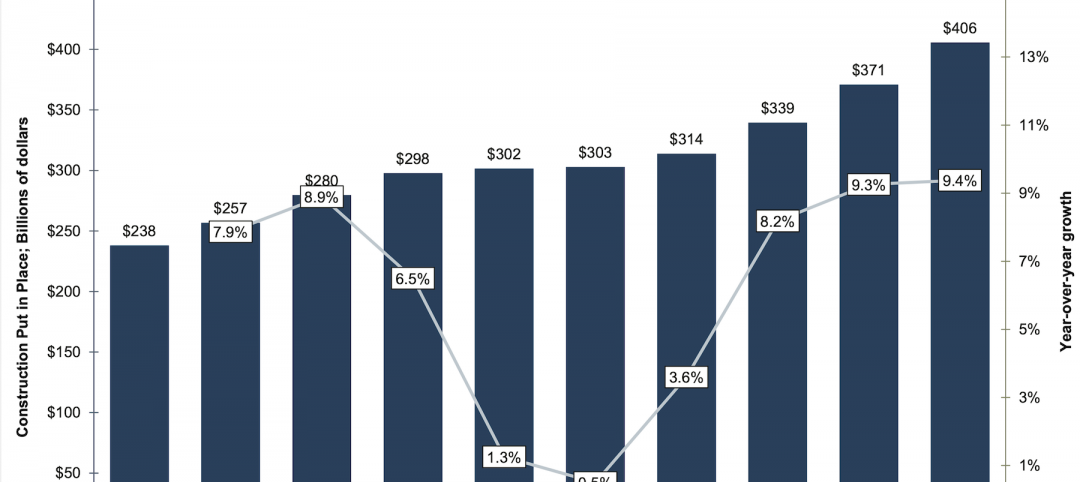

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

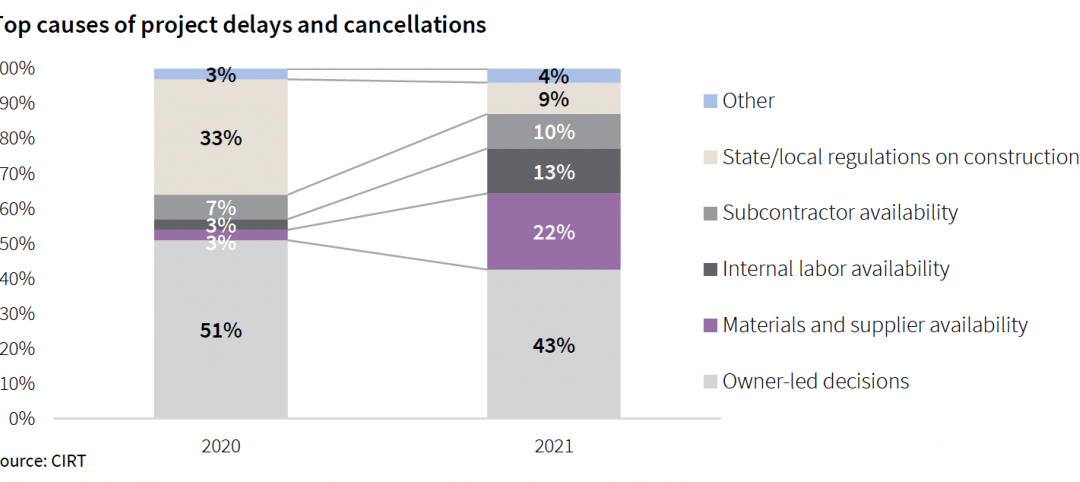

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.