The Q1 2018 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index (Index), released today, reveals nearly two-thirds of contractors are highly confident that demand for commercial construction will increase over the next year, however, continued concerns around labor shortages have put even greater pressure on the industry. To increase jobsite efficiency and improve labor productivity, increasingly more builders are turning to alternative construction solutions, like prefabrication and modularization.

The Q1 Index indicates contractors turn to innovations such as prefabricated and modular building materials to create more efficient jobsites (89%), increase labor productivity (85%), drive cost savings (58%), and provide a competitive advantage in the marketplace (51%). In fact, 50% of contractors report their companies already use prefabricated and modular components and the number was even higher among general contractors (72%). Nearly two-thirds (63%) of contractors report at least moderate demand for these building materials.

"Access to skilled labor is a continued concern, which has led contractors to increasingly seek solutions that help offset jobsite challenges,” said Jennifer Scanlon, President and Chief Executive Officer of USG Corporation. “There is significant opportunity to introduce innovations that confront jobsite efficiency and strengthen the industry – such as solutions that enable prefabricated and modular building components.”

Contractors in the Northeast (69%) reported the most frequent usage of prefabricated and modular components, compared to the South where only 24% indicate their companies are using these materials. Firms in the Northeast also expect to hire fewer workers—38% of contractors in the region expect to employ more staff in the next six months, compared with 57% in the South, 59% in the West, and 68% in the Midwest. Across all regions, concern over the cost of hiring skilled labor has remained consistent over the past year—nearly two-thirds (64%) of contractors expect these costs to increase in the next six months.

Despite labor concerns, contractor sentiment remained steady for the first quarter, as a result of strong revenue expectations and higher profit margins, with a composite score of 74.

“As we work to continually build our neighborhoods, towns, regions, and roads, as well as the workforce that supports our growth, innovation becomes a key component in advancing our country into the 21st century,” said Thomas J. Donohue, President and CEO of the U.S. Chamber. “We must invest in a skilled, competitive, motivated workforce and embrace new innovations to ensure we are able to compete on a global scale.”

The Index looks at the results of three leading indicators to gauge confidence in the commercial construction industry – backlog levels, new business opportunities and revenue forecasts – generating a composite index on a scale of 0 to 100 that serves as an indicator of health for the contractor segment on a quarterly basis. The Q1 2018 composite score was 74, holding steady from Q4 2017.

The Q1 2018 results from the three key drivers were:

- Backlog: On average, contractors currently hold 8.9 months of backlog, relatively close to the average ideal amount of 12.2 months, continuing the stability of the market, although there is room for growth. Down two points from Q4 2017, this represents 73% of ideal backlog levels.

- New Business: Nearly all (98%) contractors report high or moderate confidence in the demand for commercial construction. Year-over-year, the number of contractors who have high confidence in demand over the next 12 months jumped 11 percentage points (from 51% in Q1 2017 to 62% in Q1 2018).

- Revenues: Over half (54%) of contractors expect to see revenue gains in the next year. This percentage jumped seven points from last quarter (47% in Q4 2017).

The research was developed with Dodge Data & Analytics (DD&A), the leading provider of insights and data for the construction industry, by surveying commercial and institutional contractors.

Related Stories

Market Data | Jul 19, 2021

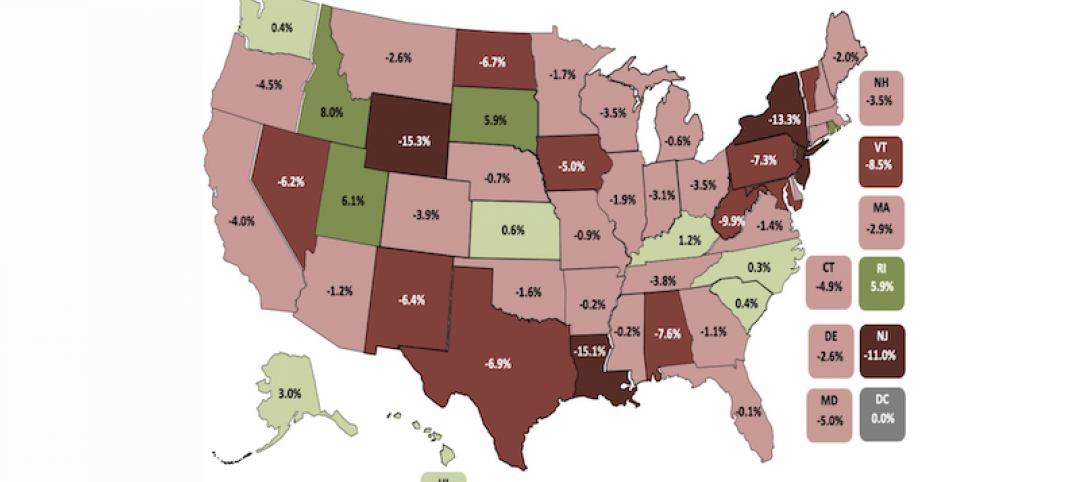

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

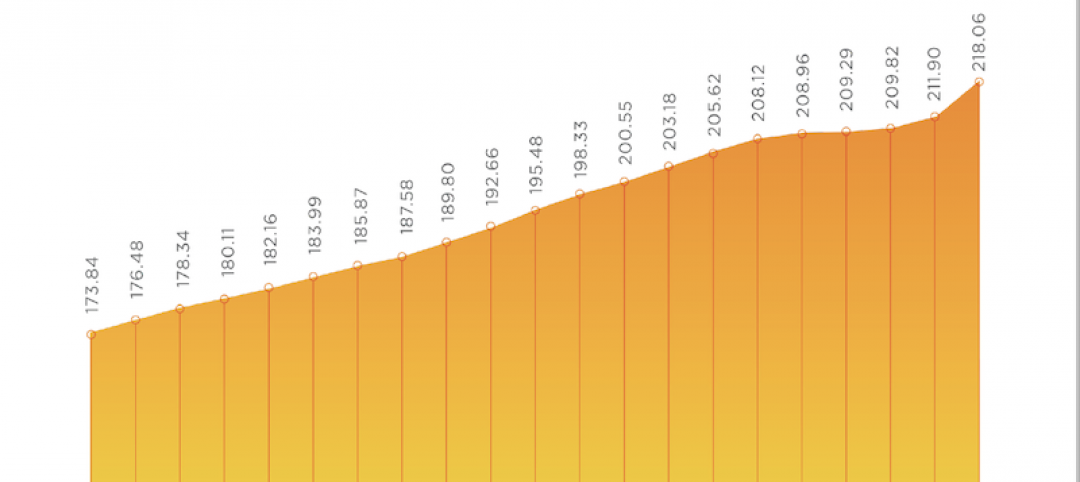

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

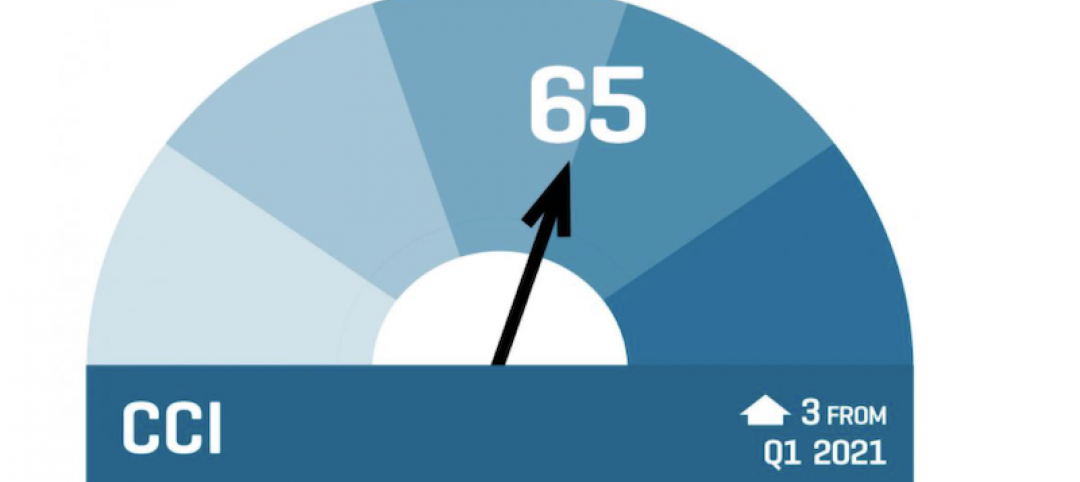

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.