The prices contractors pay for construction materials far outstripped the prices contractors charge in the 12 months ending in September, despite a recent decline in a few materials prices, while delivery problems intensified, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged Washington officials to end tariffs on key construction materials and take steps to help unknot snarled supply points.

“Construction materials costs remain out of control despite a decline in some inputs last month,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply bottlenecks continue to worsen.”

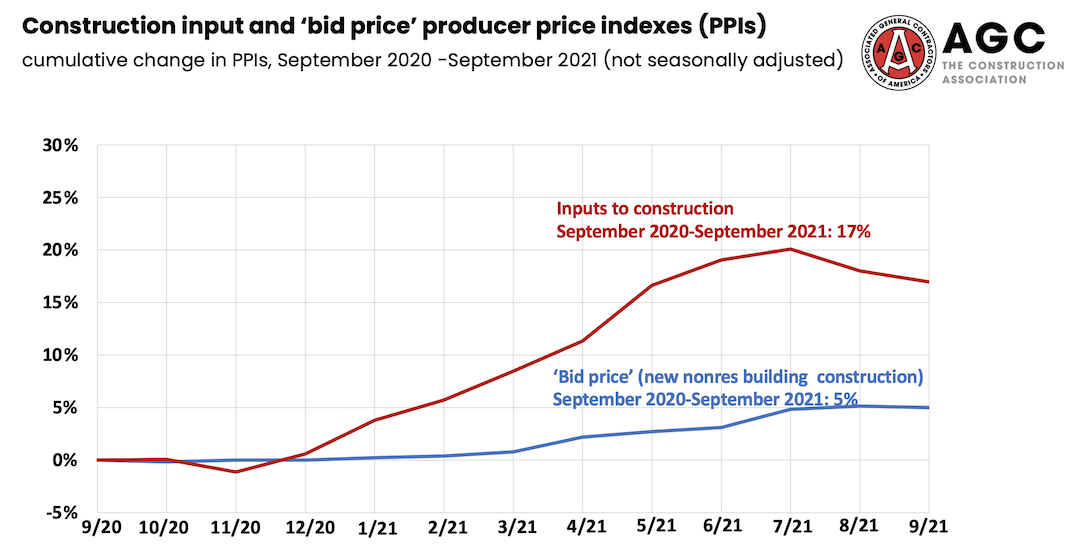

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose 5.2% over the past 12 months, despite a decline of 0.9% in the latest month. From September 2020 to last month, the prices that producers and service providers such as distributors and transportation firms charged for construction inputs jumped 17%, Simonson noted.

There were double-digit percentage increases in the selling prices of most materials used in every type of construction with the exclusion of lumber and plywood, which fell 12.3% during the past 12 months.

The producer price index for steel mill products increased by 134% compared to last September. The index for copper and brass mill shapes rose 39.5% and the index for aluminum mill shapes increased 35.1%. The index for plastic construction products rose 29.5%. The index for gypsum products such as wallboard climbed 23%. The index for insulation materials rose 19%, while the index for prepared asphalt and tar roofing and siding products rose 13.1%.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 15%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

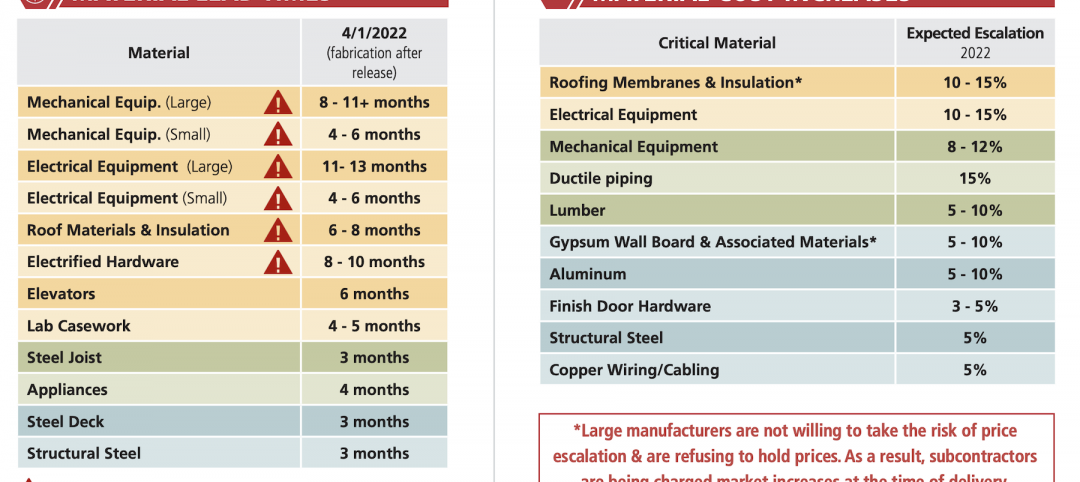

Association officials added that many contractors are experiencing extreme delays or uncertainty about delivery dates for receiving shipments of many types of construction materials. The association officials urged the Biden administration to immediately end tariffs on key construction materials. In addition, they asked for an all-out effort to help ports and freight transportation businesses move goods more quickly

“The tariffs on lumber, steel, aluminum, and many construction components have added fuel to already overheated prices,” said Stephen E. Sandherr, the association’s chief executive officer. “Ending the tariffs would help immediately, while other steps should be taken to relieve supply-chain bottlenecks.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment