The prices contractors pay for construction materials far outstripped the prices contractors charge in the 12 months ending in September, despite a recent decline in a few materials prices, while delivery problems intensified, according to an analysis by the Associated General Contractors of America of government data released today. Association officials urged Washington officials to end tariffs on key construction materials and take steps to help unknot snarled supply points.

“Construction materials costs remain out of control despite a decline in some inputs last month,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply bottlenecks continue to worsen.”

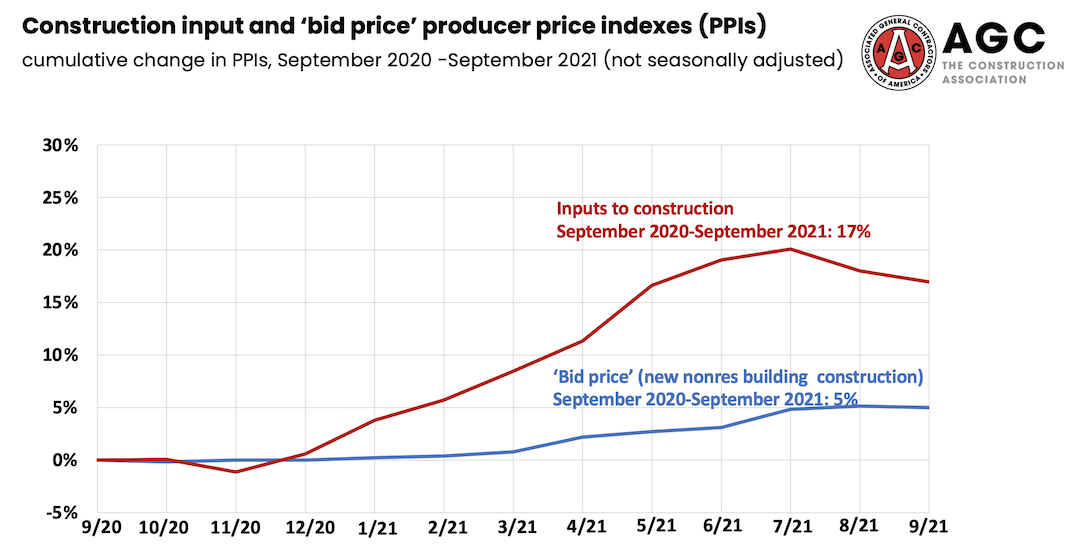

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose 5.2% over the past 12 months, despite a decline of 0.9% in the latest month. From September 2020 to last month, the prices that producers and service providers such as distributors and transportation firms charged for construction inputs jumped 17%, Simonson noted.

There were double-digit percentage increases in the selling prices of most materials used in every type of construction with the exclusion of lumber and plywood, which fell 12.3% during the past 12 months.

The producer price index for steel mill products increased by 134% compared to last September. The index for copper and brass mill shapes rose 39.5% and the index for aluminum mill shapes increased 35.1%. The index for plastic construction products rose 29.5%. The index for gypsum products such as wallboard climbed 23%. The index for insulation materials rose 19%, while the index for prepared asphalt and tar roofing and siding products rose 13.1%.

In addition to increases in materials costs, transportation and fuel costs also spiked. The index for truck transportation of freight jumped 15%. Fuel costs, which contractors pay directly to operate their own trucks and off-road equipment, as well as through surcharges on freight deliveries, have also jumped.

Association officials added that many contractors are experiencing extreme delays or uncertainty about delivery dates for receiving shipments of many types of construction materials. The association officials urged the Biden administration to immediately end tariffs on key construction materials. In addition, they asked for an all-out effort to help ports and freight transportation businesses move goods more quickly

“The tariffs on lumber, steel, aluminum, and many construction components have added fuel to already overheated prices,” said Stephen E. Sandherr, the association’s chief executive officer. “Ending the tariffs would help immediately, while other steps should be taken to relieve supply-chain bottlenecks.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Market Data | Oct 9, 2019

Two ULI reports foresee a solid real estate market through 2021

Market watchers, though, caution about a “surfeit” of investment creating a bubble.

Market Data | Oct 4, 2019

Global construction output growth will decline to 2.7% in 2019

It will be the slowest pace of growth in a decade, according to GlobalData.