While federal government proposals calling for $1 trillion in infrastructure spending would be credit positive for state and local economies, several constraints suggest that investment will be slow to ramp up, according to Moody’s Investors Service in a new report. Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Budget pressure at all levels of U.S. government in recent years has limited the ability to adequately reinvest in the nation’s critical infrastructure. Both parties in Washington have called for initiatives to address the funding gap, but disagreements over private sector involvement may prevent progress toward a consensus.

“Either proposal would amount to a $100 billion annual increase in spending on infrastructure,” says AJ Sabatelle, a Moody’s Managing Director and the lead author of the report. “But finding a reasonable balance between direct government spending and private investment will take time.”

In addition to political disagreement, regulatory approval issues like environmental reviews and litigation can slow the rate at which new infrastructure projects can materialize, according to the report, “US Infrastructure: Large Increase in US Infrastructure Spending Will Be Slow to Develop.” Meaningful acceleration of lead times for new projects would likely require regulatory reform involving federal, state and local agencies or passage of new legislation.

Practical considerations regarding the pace at which new projects can proceed are also likely to hamper near-term investment.

“Such a rapid increase would pose significant challenges to large engineering and construction firms, which would need to hire and train new project managers and locate skilled laborers,” says Sabatelle. “The sector is going to need time to gear up.”

If private capital is to play a significant role in facilitating the increase in infrastructure spending, the use of public-private partnerships (P3s) will likely be necessary. While the pipeline has grown, P3s currently fund less than 5% of annual infrastructure investment. Moody’s anticipates continued evolution of public policy and additional legislative action that promotes P3s and simplifies their legal framework.

Related Stories

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.

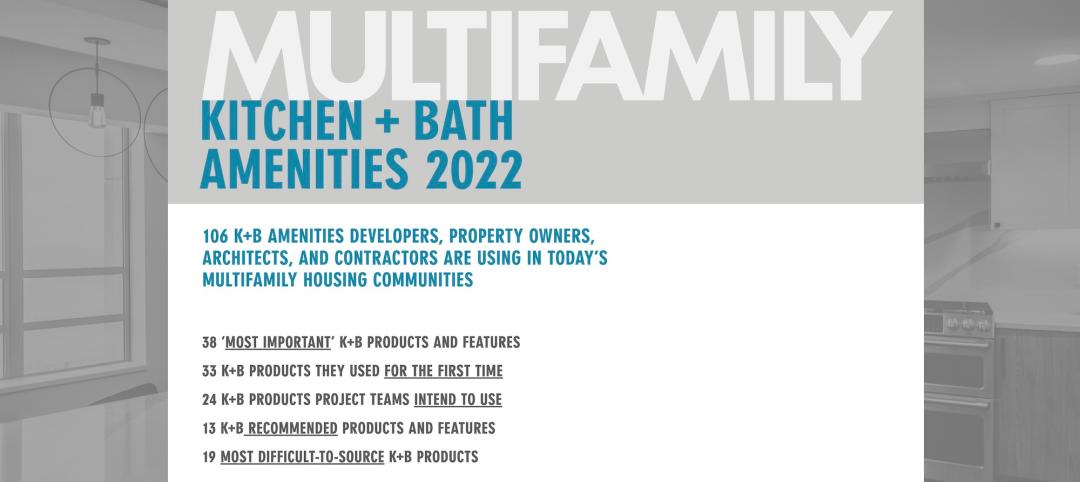

Multifamily Housing | Dec 13, 2022

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Contractors | Nov 30, 2022

Construction industry’s death rate hasn’t improved in 10 years

Fatal accidents in the construction industry have not improved over the past decade, “raising important questions about the effectiveness of OSHA and what it would take to save more lives,” according to an analysis by Construction Dive.