The cost of goods and services used in construction accelerated further in April as more items logged double-digit increases over the past year, according to an analysis by the Associated General Contractors of America of government data released today. Meanwhile, nonresidential contractors struggled with delays in receiving materials and intensifying competition that limited their ability to pass on higher costs. Association officials urged the Biden administration to quickly roll back tariffs and quotas on imported construction materials that are adding to costs and availability problems.

“Today’s producer price index report—bad though it is—actually understates the severity of the problems contractors are experiencing,” said Ken Simonson, the association’s chief economist. “Many items have posted even steeper price increases since the data for this report were collected in mid-April, while lead times for producing goods and delivery times to distributors and worksites have grown ever longer and less certain.”

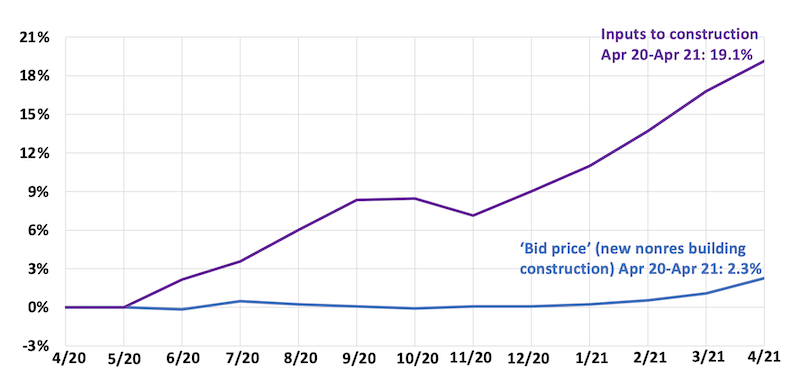

Prices for materials used in construction jumped 19.7% from April 2020 to last month. That was by far the largest increase in the 35-year history of the series, Simonson said. A series that includes services as well as goods purchased by contractors increased nearly as much, 19.1%. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose only 2.3% over the past 12 months, as competition for a shrinking pool of new projects forced contractors to absorb most of the increases.

Items with especially steep price increases over the past year ranged from lumber to metals to plastics. The producer price index for lumber and plywood soared 85.7% from April 2020 to last month. The index for steel mill products climbed 67%, while the index for copper and brass mill shapes rose 49% and the index for aluminum mill shapes increased 20.5%. The index for plastic construction products rose 14.2% amid growing scarcity of items such as PVC pipe, vinyl siding and moisture barriers, and resins used in paints and adhesives. The index for gypsum products such as wallboard climbed 12.1%.

Association officials said some of the supply chain problems have resulted from the pandemic or one-time events like the freeze in Texas last February that damaged plants producing inputs for construction plastics. But they added that federal policies, particularly tariffs and quotas on key building materials like lumber, steel, and aluminum have exacerbated the price spikes, supply shortages, and delivery delays. They urged the administration to end those import obstacles and explore ways to help uncork supply-chain bottlenecks.

“The Biden administration must address these unprecedented lumber and steel costs and broader supply-chain woes or risk undermining the economic recovery,” said Stephen E. Sandherr, the association’s chief executive officer. “Without tariff relief and other measures, vital construction projects will fall behind schedule or be canceled.”

View producer price index data. View chart of gap between input costs and bid prices. View AGC’s Construction Inflation Alert.

Related Stories

Codes and Standards | Oct 26, 2022

‘Landmark study’ offers key recommendations for design-build delivery

The ACEC Research Institute and the University of Colorado Boulder released what the White House called a “landmark study” on the design-build delivery method.

Building Team | Oct 26, 2022

The U.S. hotel construction pipeline shows positive growth year-over-year at Q3 2022 close

According to the third quarter Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE), the U.S. construction pipeline stands at 5,317 projects/629,489 rooms, up 10% by projects and 6% rooms Year-Over-Year (YOY).

Designers | Oct 19, 2022

Architecture Billings Index moderates but remains healthy

For the twentieth consecutive month architecture firms reported increasing demand for design services in September, according to a new report today from The American Institute of Architects (AIA).

Market Data | Oct 17, 2022

Calling all AEC professionals! BD+C editors need your expertise for our 2023 market forecast survey

The BD+C editorial team needs your help with an important research project. We are conducting research to understand the current state of the U.S. design and construction industry.

Market Data | Oct 14, 2022

ABC’s Construction Backlog Indicator Jumps in September; Contractor Confidence Remains Steady

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to 9.0 months in September, according to an ABC member survey conducted Sept. 20 to Oct. 5.

Market Data | Oct 12, 2022

ABC: Construction Input Prices Inched Down in September; Up 41% Since February 2020

Construction input prices dipped 0.1% in September compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Laboratories | Oct 5, 2022

Bigger is better for a maturing life sciences sector

CRB's latest report predicts more diversification and vertical integration in research and production.

Market Data | Aug 25, 2022

‘Disruptions’ will moderate construction spending through next year

JLL’s latest outlook predicts continued pricing volatility due to shortages in materials and labor

Market Data | Aug 2, 2022

Nonresidential construction spending falls 0.5% in June, says ABC

National nonresidential construction spending was down by 0.5% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Jul 28, 2022

The latest Beck Group report sees earlier project collaboration as one way out of the inflation/supply chain malaise

In the first six months of 2022, quarter-to-quarter inflation for construction materials showed signs of easing, but only slightly.