The cost of goods and services used in construction accelerated further in April as more items logged double-digit increases over the past year, according to an analysis by the Associated General Contractors of America of government data released today. Meanwhile, nonresidential contractors struggled with delays in receiving materials and intensifying competition that limited their ability to pass on higher costs. Association officials urged the Biden administration to quickly roll back tariffs and quotas on imported construction materials that are adding to costs and availability problems.

“Today’s producer price index report—bad though it is—actually understates the severity of the problems contractors are experiencing,” said Ken Simonson, the association’s chief economist. “Many items have posted even steeper price increases since the data for this report were collected in mid-April, while lead times for producing goods and delivery times to distributors and worksites have grown ever longer and less certain.”

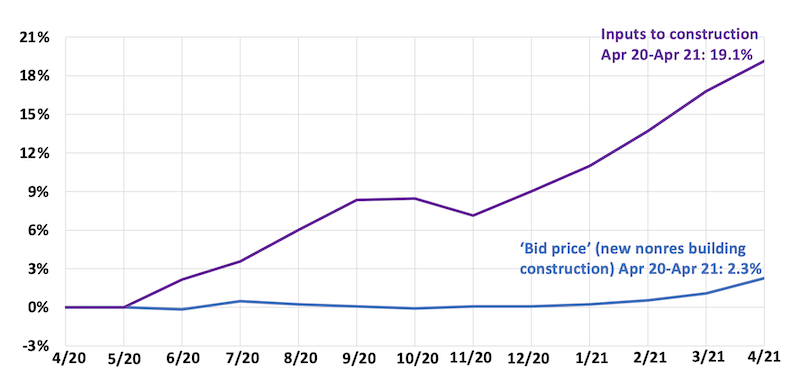

Prices for materials used in construction jumped 19.7% from April 2020 to last month. That was by far the largest increase in the 35-year history of the series, Simonson said. A series that includes services as well as goods purchased by contractors increased nearly as much, 19.1%. Meanwhile, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—rose only 2.3% over the past 12 months, as competition for a shrinking pool of new projects forced contractors to absorb most of the increases.

Items with especially steep price increases over the past year ranged from lumber to metals to plastics. The producer price index for lumber and plywood soared 85.7% from April 2020 to last month. The index for steel mill products climbed 67%, while the index for copper and brass mill shapes rose 49% and the index for aluminum mill shapes increased 20.5%. The index for plastic construction products rose 14.2% amid growing scarcity of items such as PVC pipe, vinyl siding and moisture barriers, and resins used in paints and adhesives. The index for gypsum products such as wallboard climbed 12.1%.

Association officials said some of the supply chain problems have resulted from the pandemic or one-time events like the freeze in Texas last February that damaged plants producing inputs for construction plastics. But they added that federal policies, particularly tariffs and quotas on key building materials like lumber, steel, and aluminum have exacerbated the price spikes, supply shortages, and delivery delays. They urged the administration to end those import obstacles and explore ways to help uncork supply-chain bottlenecks.

“The Biden administration must address these unprecedented lumber and steel costs and broader supply-chain woes or risk undermining the economic recovery,” said Stephen E. Sandherr, the association’s chief executive officer. “Without tariff relief and other measures, vital construction projects will fall behind schedule or be canceled.”

View producer price index data. View chart of gap between input costs and bid prices. View AGC’s Construction Inflation Alert.

Related Stories

Market Data | Apr 16, 2019

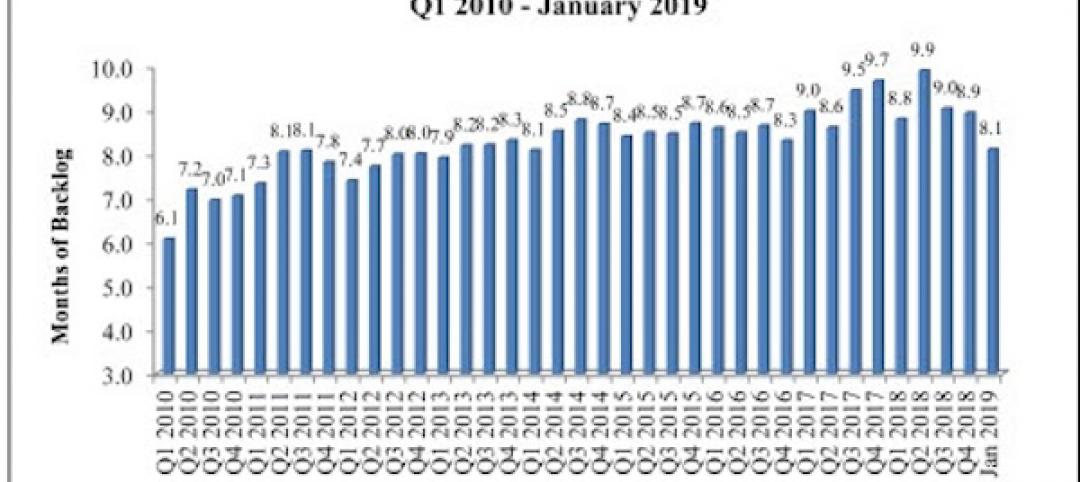

ABC’s Construction Backlog Indicator rebounds in February

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

Nonresidential spending expands again in February

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

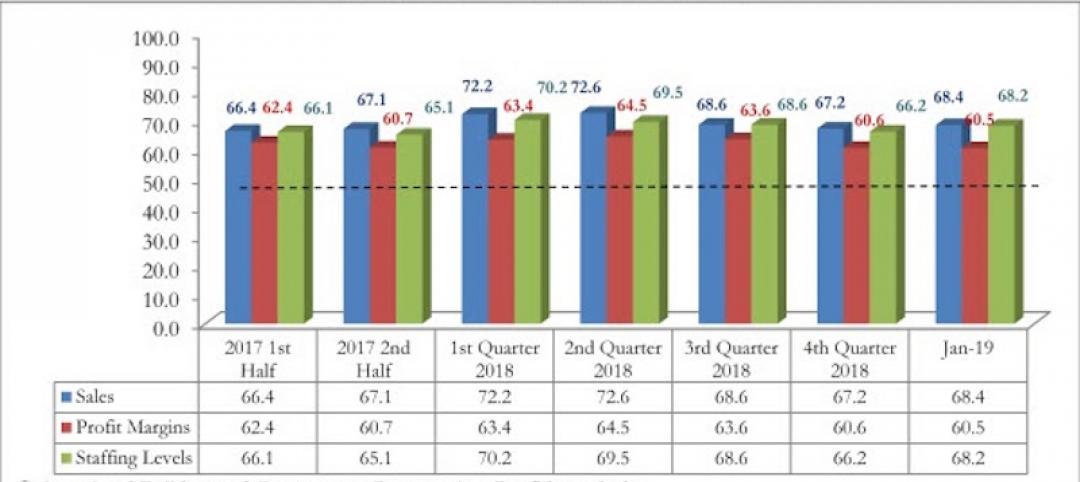

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

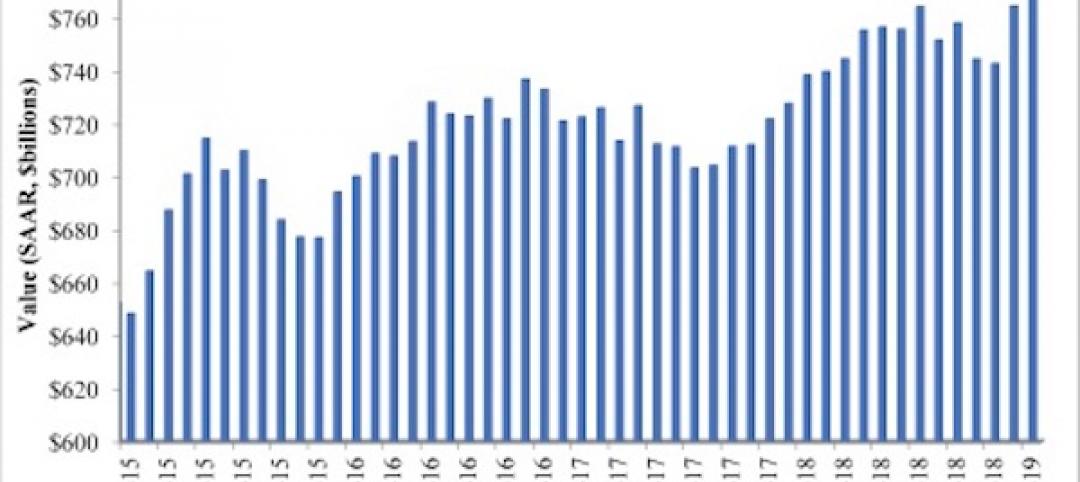

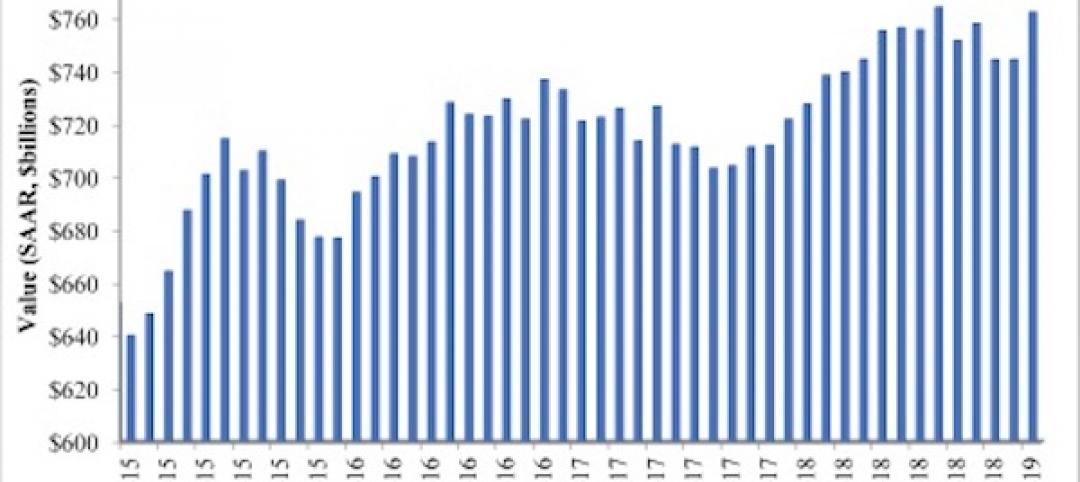

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.

Market Data | Mar 6, 2019

Global hotel construction pipeline hits record high at 2018 year-end

There are a record-high 6,352 hotel projects and 1.17 million rooms currently under construction worldwide.

Market Data | Feb 28, 2019

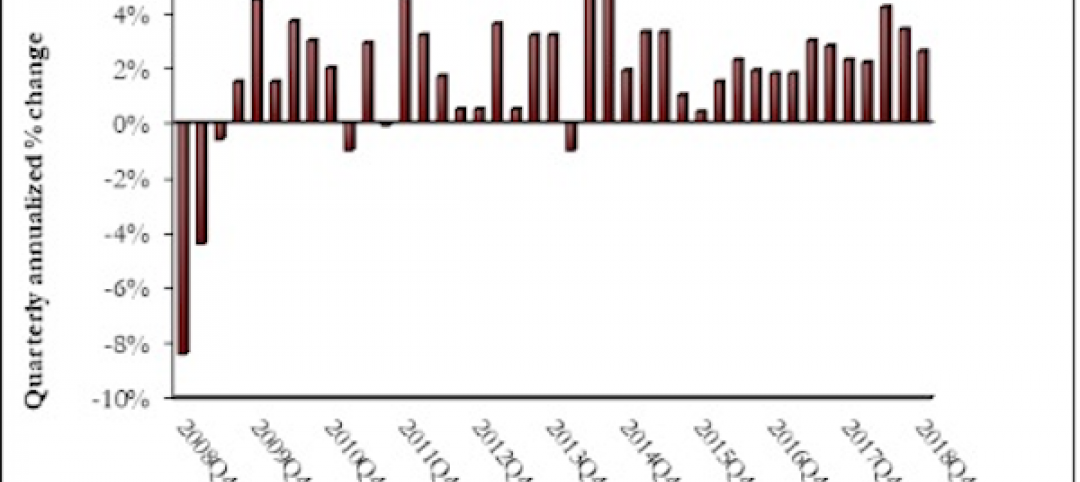

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.