Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

PSMJ’s latest Quarterly Market Forecast survey of 115 A/E/C executives (collected between December 28, 2022 and January 10, 2023) revealed an overall proposal activity Net Plus/Minus Index (NPMI) value of just 8.0. Any NPMI value above zero indicates that more respondents are seeing an increase in proposal activity compared to the prior quarter (+100 indicates all respondents are seeing an increase in proposal activity, -100 indicates all respondents are seeing a decrease in proposal activity). Since proposal activity is a leading indicator for backlog, revenue, and — ultimately — cash flow, the latest NPMI values provide a valuable glimpse into cash flow over the next 12 to 24 months.

While still barely clinging on to positive territory, this latest index value marks a continued decline from the record-setting 2022 Q1 value of 60.2 and a significant slide from the previous quarter value of 25.0. According to PSMJ President Gregory Hart, A/E/C firms’ marketing horsepower will be tested in the months ahead. “Huge streams of funding to support infrastructure projects are keeping the public-sector markets in pretty good shape,” states Hart. “But, if you have significant exposure to the private land development markets in your revenue mix, now is the time to act to avoid significant trouble ahead.”

Any index value greater than 20 generally indicates a healthy market. Three of the 12 client markets are now below that threshold and the two commercial markets have entered negative territory.

The Top 5 Markets for the 4th Quarter of 2022 are:

- Transportation: 62.9

- Heavy Industry: 57.9

- Water/Wastewater: 57.1

- Energy/Utilities: 55.2

- Environmental: 46.2

The following chart compares the NPMI values in each client to the same period last year:

Related Stories

Multifamily Housing | Feb 2, 2015

D.C. developer sees apartment project as catalyst for modeling neighborhood after N.Y.'s popular High Line district

It’s no accident that the word “Highline” is in this project’s name. The goal is for the building to be a kind of gateway into the larger redevelopment of the surrounding neighborhood to resemble New York’s City’s trendy downtown Meatpacking District, through which runs a portion the High Line elevated park.

Sponsored | Products and Materials | Feb 2, 2015

What should you consider when reviewing paint warranties?

Warranties can appear to be the same, but as a starting point, you should find out what paint technology your warranty is based on—polyester, silicon-modified polyester or PVDF. Once you’ve established an “apples to apples” comparison with the technologies, you must consider the color palette and its impact on warranty longevity. Review this with your builder, manufacturer or paint company representative.

Healthcare Facilities | Feb 1, 2015

7 new factors shaping hospital emergency departments

A new generation of highly efficient emergency care facilities is upping the ante on patient care and convenience while helping to reposition hospital systems within their local markets.

Multifamily Housing | Jan 31, 2015

5 intriguing trends to track in the multifamily housing game

Demand for rental apartments and condos hasn’t been this strong in years, and our experts think the multifamily sector still has legs. But you have to know what developers, tenants, and buyers are looking for to have any hope of succeeding in this fast-changing market sector.

Multifamily Housing | Jan 31, 2015

20% down?!! Survey exposes how thin renters’ wallets are

A survey of more than 25,000 adults found the renters to be more burdened by debt than homeowners and severely short of emergency savings.

Multifamily Housing | Jan 31, 2015

Production builders are still shying away from rental housing

Toll Brothers, Lennar, and Trumark are among a small group of production builders to engage in construction for rental customers.

| Jan 30, 2015

Investment in nonresidential structures expands in fourth quarter

Real gross domestic product expanded 2.6% during the fourth quarter of 2014, following a 5% increase in the third quarter.

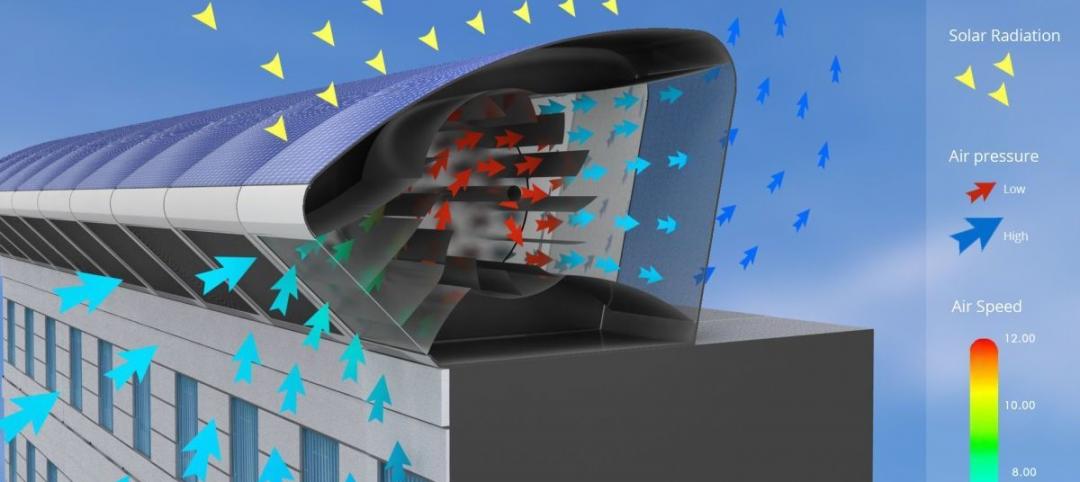

Energy Efficiency | Jan 28, 2015

An urban wind and solar energy system that may actually work

The system was designed to take advantage of a building's air flow and generate energy even if its in the middle of a city.

Multifamily Housing | Jan 27, 2015

Multifamily construction, focused on rentals, expected to slow in the coming years

New-home purchases, which recovered strongly in 2014, indicate that homeownership might finally be making a comeback.

Office Buildings | Jan 27, 2015

London plans to build Foggo Associates' 'can of ham' building

The much delayed high-rise development at London’s 60-70 St. Mary Axe resembles a can of ham, and the project's architects are embracing the playful sobriquet.