Retail health clinics, which have been around since 2001, and until recently have been profit question marks, are having their moment in the sun.

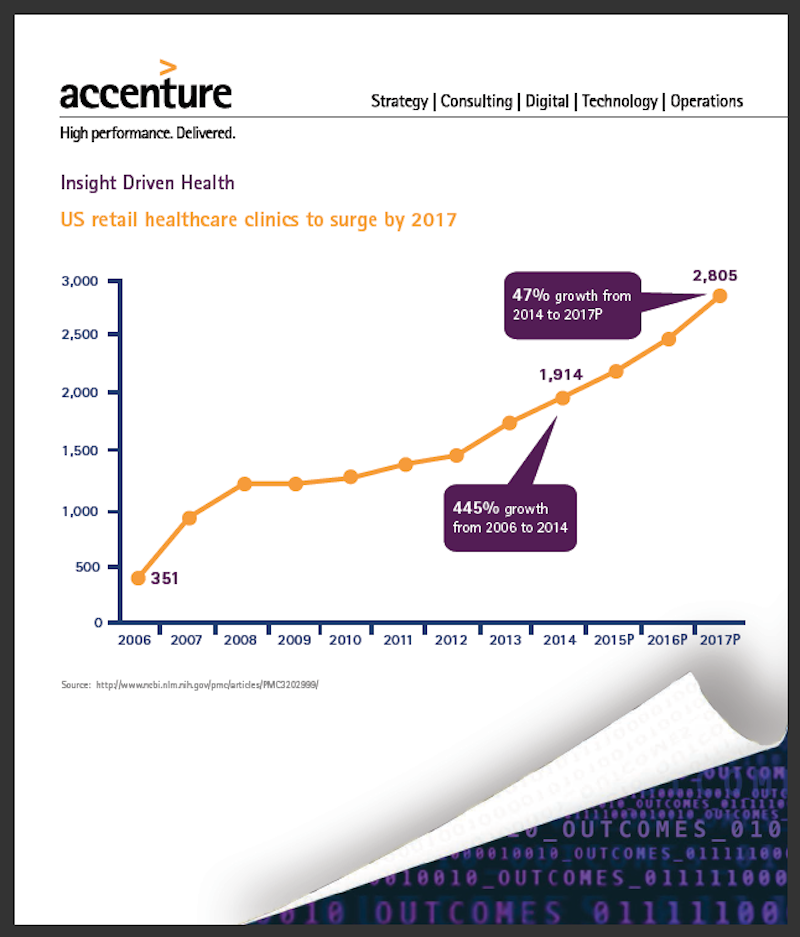

A recent report by Accenture Consulting predicts that the clinics sector will grow at an average annual rate of 14% through 2017, when their numbers will exceed 2,800, compared to 1,914 in 2014.

“Retail health clinics are impacting the broader U.S. landscape by offering a new, lower-cost peer channel,” said Alan Nalle, Accenture’s Senior Manager-Retail Strategy, in a video clip that accompanied the release of the report.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture says that retail health clients have been closing their “profitability gap” by shifting their focus from “retail” elements, and emphasizing the clinical in three distinct ways:

• Clinics are expanding their services to broaden appeal: More retail stores are bringing the pharmacist out from behind the counter to interact directly with patients—“something many in the industry see as a clear differentiator,” Accenture points out.

Other new services include primary and preventive care, pediatrics and wellness, health screening and testing, chronic disease monitoring and management, and transitional care. Walgreens’ Health Clinics now offer chronic care assessments and medication reconciliation. Walmart recently launched new primary care clinics that offer more sophisticated services—like chronic disease management—than patients can receive at the retailer’s other health centers.

• Retail clinics are investing in healthcare IT to expand their roles: Leading organizations are purchasing more advanced medical equipment and records management systems. For example, CVS Health’s MinuteClinics have been installing a proven electronic health record system nationwide, which makes it easier to transmit clinical data to regional health information exchanges.

• Clinics are working with partners to coordinate care: Target, for one, is partnering with Kaiser Permanente to launch a number of retail clinics in California that provide greater levels of service and information sharing between clinics and the integrated delivery network. Services include pediatric and adolescent care, family planning, wellness for women and the management of chronic conditions such as high blood pressure and diabetes.

Likewise, Walgreens is collaborating with one of the largest health systems in the U.S., Trinity Health, to coordinate patient care to improve outcomes and increase access to care while reducing overall costs.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

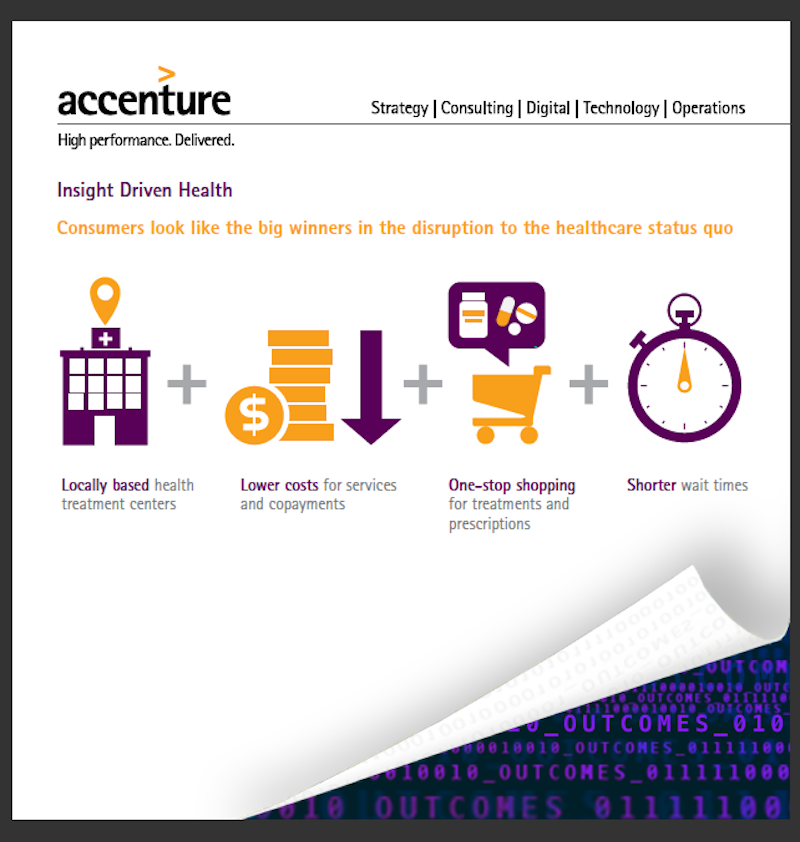

Nalle noted that all of these changes have been wins for consumers, who now have greater healthcare convenience and access.

Payers have also found the expansion of retail health clinics to their liking, said Nalle. “Increasingly we’re seeing our payer clients offer lower copay or waive copays for clinic visits,” to redirect volumes of patients who might otherwise go to more-expensive urgent care or emergency room care.

For providers, the expansion of retail health clinics is a double-edged sword. On the positive side, some providers are using retail clinics as a way to offer after-hours access to patients. “But some might view clinics as competition,” says Nalle. So providers have two choices: to partner with clients via electronic record exchanges, or to compete, with extended office hours, or extended coverage.

There is no question, however, that retailers see clinics in more in terms of growth and profit. During a speech they delivered at America’s Health Insurance Plans Institute and Expo in Las Vegas earlier this month, Larry Merlo, CVS Health’s CEO, and Dr. Troyen Brennan, its Chief Medical Officer, noted that the cumulative cost of chronic illness alone is expected to increase to $42 billion by 2030.

“I believe the way to find solutions is to look at the problems through the eyes of your customers, and at CVS Health, we are working to do just that by collaborating with stakeholders across the health care continuum including patients, caregivers, providers and payers to provide better, more cost-effective care.”

Last December, CVS Health acquired all of Target’s pharmacies and retail clinics in 47 states, and a CVS Pharmacy will be included in all new Target stores. This acquisition expanded CVS Health’s pharmacy footprint by approximately 20% and its clinic footprint by about 8%.

Related Stories

Healthcare Facilities | Oct 30, 2018

Orthopedic Associates of Hartford unveils plans for 45,000-sf surgical center

MBH ARCHITECTURE is the architect for the project.

Healthcare Facilities | Oct 29, 2018

Outpatient clinics bring the VA closer to injured veterans

The Department of Veterans Affairs is making efforts to improve its construction management and align its design guidelines to industry standards.

Healthcare Facilities | Oct 22, 2018

WSP-HKS JV signs deal for U.S. Navy construction work

The contract is not exclusive to the two firms, but it lets NAVFAC assign certain projects to them.

Healthcare Facilities | Oct 12, 2018

N.Y. builder pushes to get military trauma centers up and running quicker

To date, seven NICoE Spirit satellite centers have been built on the grounds of Fort Belvoir in Virginia, Camp Lejeune and Fort Bragg in North Carolina, Fort Campbell in Kentucky, Fort Hood in Texas, Joint Base Lewis-McChord in Washington, and Camp Pendleton in California.

Healthcare Facilities | Sep 7, 2018

Medical office construction isn’t keeping pace with the aging of America

A new Transwestern report suggests a “rethinking” of healthcare delivery approaches that lean heavier on technology.

Engineers | Aug 22, 2018

An electrical engineer’s take on designing successful pharmaceutical lab space

Patrick Licklider, PE, CEM, GGP, LEED AP BD+C, an electrical engineer in Clark Nexsen’s Science + technology practice, shares his perspective on what it takes to successfully design laboratory and manufacturing environments for the fast-changing pharmaceutical and biotech industry.

Healthcare Facilities | Aug 3, 2018

Seismic deadlines approaching for healthcare companies

California hospitals can save money with a holistic approach to retrofit issues.

Healthcare Facilities | Jul 30, 2018

Best in healthcare design 2018: Seven projects win AIA/AAH Healthcare Design Awards

The Steven Holl-designed Maggie’s Centre Barts cancer treatment facility in London highlights the honorees of the AIA Academy of Architecture for Health 2018 Healthcare Design Awards.

Healthcare Facilities | Jul 26, 2018

Healthcare market trends 2018: Health systems get leaner, more resilient

Hospitals set their sights on improving patient convenience and operational efficiency.

Healthcare Facilities | Jul 11, 2018

5 ways design is transforming behavioral healthcare

Circadian lighting, calming materials, and transparency are helping to normalize the patient experience in behavioral healthcare.