Retail health clinics, which have been around since 2001, and until recently have been profit question marks, are having their moment in the sun.

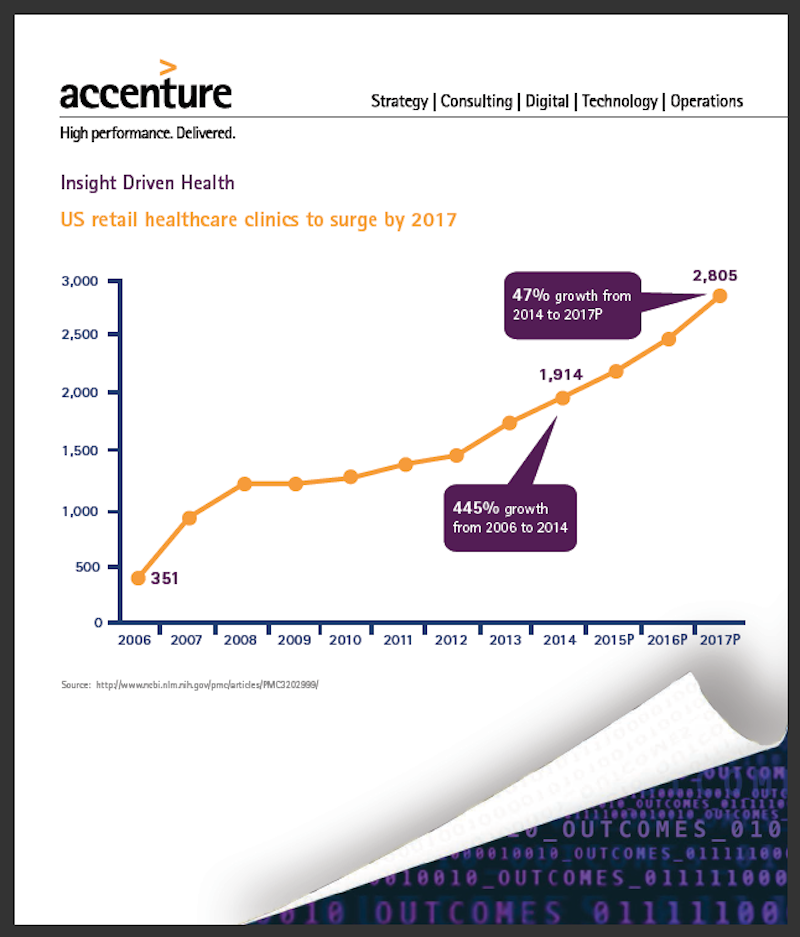

A recent report by Accenture Consulting predicts that the clinics sector will grow at an average annual rate of 14% through 2017, when their numbers will exceed 2,800, compared to 1,914 in 2014.

“Retail health clinics are impacting the broader U.S. landscape by offering a new, lower-cost peer channel,” said Alan Nalle, Accenture’s Senior Manager-Retail Strategy, in a video clip that accompanied the release of the report.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture says that retail health clients have been closing their “profitability gap” by shifting their focus from “retail” elements, and emphasizing the clinical in three distinct ways:

• Clinics are expanding their services to broaden appeal: More retail stores are bringing the pharmacist out from behind the counter to interact directly with patients—“something many in the industry see as a clear differentiator,” Accenture points out.

Other new services include primary and preventive care, pediatrics and wellness, health screening and testing, chronic disease monitoring and management, and transitional care. Walgreens’ Health Clinics now offer chronic care assessments and medication reconciliation. Walmart recently launched new primary care clinics that offer more sophisticated services—like chronic disease management—than patients can receive at the retailer’s other health centers.

• Retail clinics are investing in healthcare IT to expand their roles: Leading organizations are purchasing more advanced medical equipment and records management systems. For example, CVS Health’s MinuteClinics have been installing a proven electronic health record system nationwide, which makes it easier to transmit clinical data to regional health information exchanges.

• Clinics are working with partners to coordinate care: Target, for one, is partnering with Kaiser Permanente to launch a number of retail clinics in California that provide greater levels of service and information sharing between clinics and the integrated delivery network. Services include pediatric and adolescent care, family planning, wellness for women and the management of chronic conditions such as high blood pressure and diabetes.

Likewise, Walgreens is collaborating with one of the largest health systems in the U.S., Trinity Health, to coordinate patient care to improve outcomes and increase access to care while reducing overall costs.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

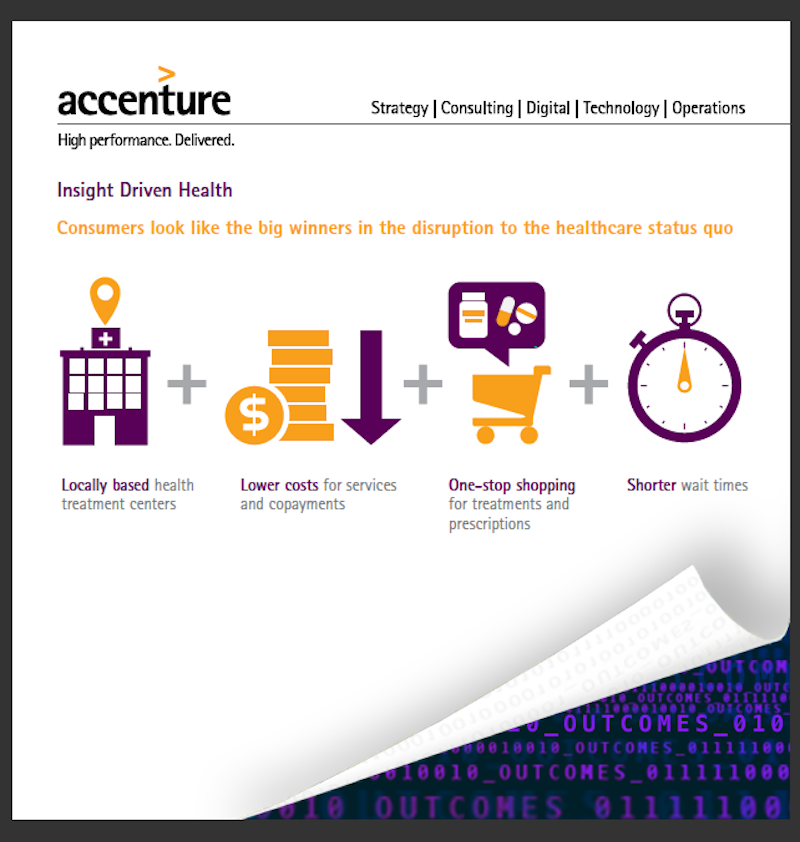

Nalle noted that all of these changes have been wins for consumers, who now have greater healthcare convenience and access.

Payers have also found the expansion of retail health clinics to their liking, said Nalle. “Increasingly we’re seeing our payer clients offer lower copay or waive copays for clinic visits,” to redirect volumes of patients who might otherwise go to more-expensive urgent care or emergency room care.

For providers, the expansion of retail health clinics is a double-edged sword. On the positive side, some providers are using retail clinics as a way to offer after-hours access to patients. “But some might view clinics as competition,” says Nalle. So providers have two choices: to partner with clients via electronic record exchanges, or to compete, with extended office hours, or extended coverage.

There is no question, however, that retailers see clinics in more in terms of growth and profit. During a speech they delivered at America’s Health Insurance Plans Institute and Expo in Las Vegas earlier this month, Larry Merlo, CVS Health’s CEO, and Dr. Troyen Brennan, its Chief Medical Officer, noted that the cumulative cost of chronic illness alone is expected to increase to $42 billion by 2030.

“I believe the way to find solutions is to look at the problems through the eyes of your customers, and at CVS Health, we are working to do just that by collaborating with stakeholders across the health care continuum including patients, caregivers, providers and payers to provide better, more cost-effective care.”

Last December, CVS Health acquired all of Target’s pharmacies and retail clinics in 47 states, and a CVS Pharmacy will be included in all new Target stores. This acquisition expanded CVS Health’s pharmacy footprint by approximately 20% and its clinic footprint by about 8%.

Related Stories

Healthcare Facilities | Jul 10, 2018

HGA designs acute care hospital for MetroHealth in Cleveland

The facility’s master plan creates a ‘hospital in a park.’

BIM and Information Technology | Jul 9, 2018

Healthcare and the reality of artificial intelligence

Regardless of improved accuracy gains, caregivers may struggle with the idea of a computer logic qualifying decisions that have for decades relied heavily on instinct and medical intuition.

Healthcare Facilities | Jun 28, 2018

New Stanford Healthcare outpatient building opens in Redwood City

The facility recently celebrated its grand opening with a ribbon-cutting ceremony.

Healthcare Facilities | Jun 26, 2018

The future of the ambulatory surgery centers and acuity levels

Offering the one-two punch of cost savings and convenience, ASCs are increasingly becoming the venue of choice for both physicians and patients.

Healthcare Facilities | Jun 26, 2018

Mesquite, Texas to receive 60-acre ‘wellness village’

Construction is anticipated to begin on the initial phase in mid-2019.

University Buildings | Jun 25, 2018

Virginia Commonwealth has at least three major expansion projects under construction

New buildings for outpatient care, engineering, and rehabilitation of serious injuries and debilities are scheduled to be completed in 2020.

Healthcare Facilities | Jun 6, 2018

French 'Alzheimer’s Village' designed to resemble a medieval bastide

The new facility will provide research on a new way of treating Alzheimer’s patients.

Healthcare Facilities | May 29, 2018

Will telemedicine change the face of healthcare architecture?

Telemedicine is a broad term that covers many aspects and mediums of care, but primarily it refers to the use of video monitors to allow a virtual face to face consultation to take place.

| May 24, 2018

Accelerate Live! talk: Security and the built environment: Insights from an embassy designer

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), embassy designer Tom Jacobs explores ways that provide the needed protection while keeping intact the representational and inspirational qualities of a design.

Healthcare Facilities | May 24, 2018

The design of the new Omaha VA Ambulatory Care Center incorporates veteran symbolism throughout the building

Leo A Daly designed the facility.