Retail health clinics, which have been around since 2001, and until recently have been profit question marks, are having their moment in the sun.

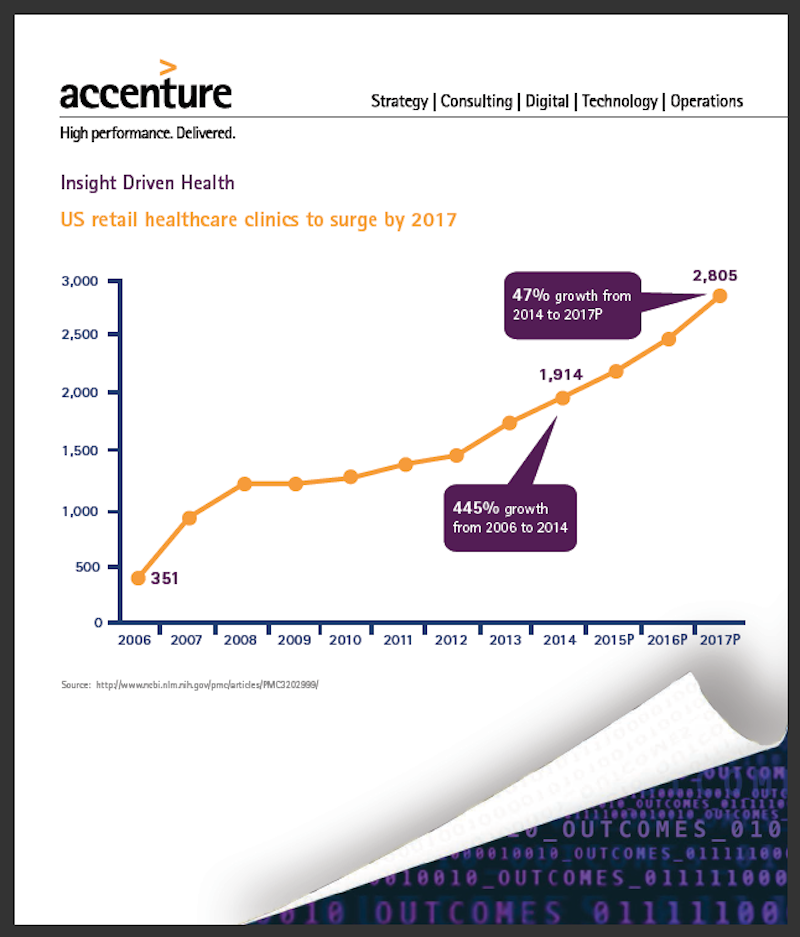

A recent report by Accenture Consulting predicts that the clinics sector will grow at an average annual rate of 14% through 2017, when their numbers will exceed 2,800, compared to 1,914 in 2014.

“Retail health clinics are impacting the broader U.S. landscape by offering a new, lower-cost peer channel,” said Alan Nalle, Accenture’s Senior Manager-Retail Strategy, in a video clip that accompanied the release of the report.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture says that retail health clients have been closing their “profitability gap” by shifting their focus from “retail” elements, and emphasizing the clinical in three distinct ways:

• Clinics are expanding their services to broaden appeal: More retail stores are bringing the pharmacist out from behind the counter to interact directly with patients—“something many in the industry see as a clear differentiator,” Accenture points out.

Other new services include primary and preventive care, pediatrics and wellness, health screening and testing, chronic disease monitoring and management, and transitional care. Walgreens’ Health Clinics now offer chronic care assessments and medication reconciliation. Walmart recently launched new primary care clinics that offer more sophisticated services—like chronic disease management—than patients can receive at the retailer’s other health centers.

• Retail clinics are investing in healthcare IT to expand their roles: Leading organizations are purchasing more advanced medical equipment and records management systems. For example, CVS Health’s MinuteClinics have been installing a proven electronic health record system nationwide, which makes it easier to transmit clinical data to regional health information exchanges.

• Clinics are working with partners to coordinate care: Target, for one, is partnering with Kaiser Permanente to launch a number of retail clinics in California that provide greater levels of service and information sharing between clinics and the integrated delivery network. Services include pediatric and adolescent care, family planning, wellness for women and the management of chronic conditions such as high blood pressure and diabetes.

Likewise, Walgreens is collaborating with one of the largest health systems in the U.S., Trinity Health, to coordinate patient care to improve outcomes and increase access to care while reducing overall costs.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

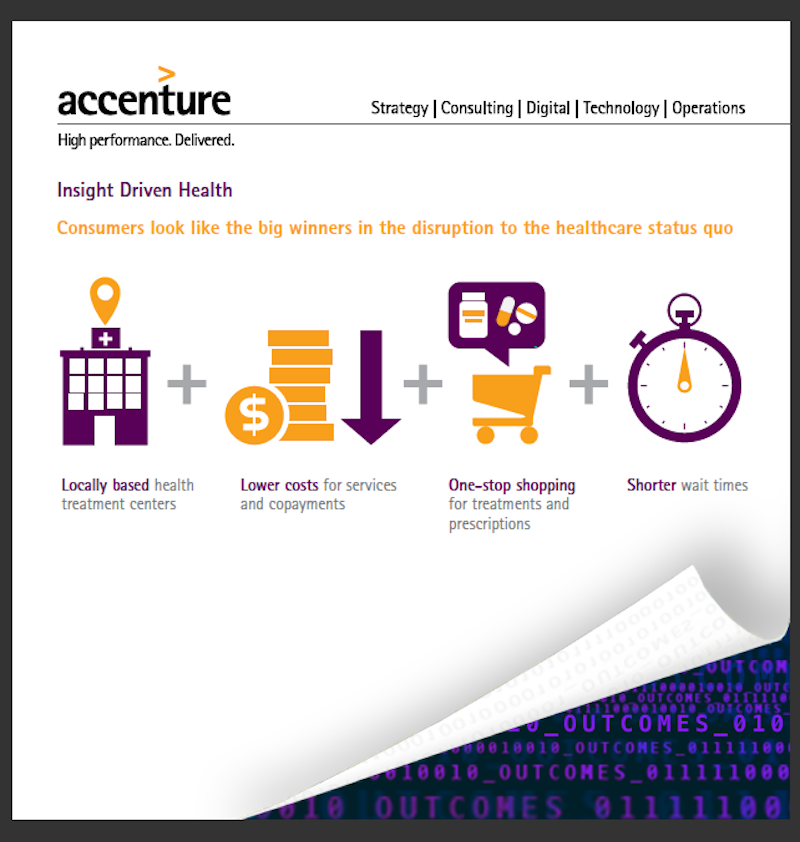

Nalle noted that all of these changes have been wins for consumers, who now have greater healthcare convenience and access.

Payers have also found the expansion of retail health clinics to their liking, said Nalle. “Increasingly we’re seeing our payer clients offer lower copay or waive copays for clinic visits,” to redirect volumes of patients who might otherwise go to more-expensive urgent care or emergency room care.

For providers, the expansion of retail health clinics is a double-edged sword. On the positive side, some providers are using retail clinics as a way to offer after-hours access to patients. “But some might view clinics as competition,” says Nalle. So providers have two choices: to partner with clients via electronic record exchanges, or to compete, with extended office hours, or extended coverage.

There is no question, however, that retailers see clinics in more in terms of growth and profit. During a speech they delivered at America’s Health Insurance Plans Institute and Expo in Las Vegas earlier this month, Larry Merlo, CVS Health’s CEO, and Dr. Troyen Brennan, its Chief Medical Officer, noted that the cumulative cost of chronic illness alone is expected to increase to $42 billion by 2030.

“I believe the way to find solutions is to look at the problems through the eyes of your customers, and at CVS Health, we are working to do just that by collaborating with stakeholders across the health care continuum including patients, caregivers, providers and payers to provide better, more cost-effective care.”

Last December, CVS Health acquired all of Target’s pharmacies and retail clinics in 47 states, and a CVS Pharmacy will be included in all new Target stores. This acquisition expanded CVS Health’s pharmacy footprint by approximately 20% and its clinic footprint by about 8%.

Related Stories

| May 30, 2017

Accelerate Live! talk: Health-generating buildings, Marcene Kinney, Angela Mazzi, GBBN Architects

Architects Marcene Kinney and Angela Mazzi share design hacks pinpointing specific aspects of the built environment that affect behavior, well-being, and performance.

| May 24, 2017

Accelerate Live! talk: Learning from Silicon Valley - Using SaaS to automate AEC, Sean Parham, Aditazz

Sean Parham shares how Aditazz is shaking up the traditional design and construction approaches by applying lessons from the tech world.

Healthcare Facilities | May 16, 2017

University of Pennsylvania’s new $1.5 billion hospital is being built with the future in mind

The Pavilion broke ground on May 3.

Healthcare Facilities | May 4, 2017

Mortenson provides details about its first building in Minnesota’s ambitious Destination Medical Center development

One district alone could add two million sf of commercial and residential space to Downtown Rochester.

Healthcare Facilities | May 1, 2017

Designing patient rooms for the entire family can improve patient satisfaction and outcomes

Hospital rooms are often not designed to accommodate extended stays for anyone other than the patient, which can have negative effects on patient outcome.

Healthcare Facilities | Apr 28, 2017

Can healthcare be retail?

Healthcare systems have much to learn from retail. While they have been laser-focused on delivering exceptional patient care on their primary campuses, they face an onslaught of new challenges as they embrace a retail strategy to expand outpatient services and their ambulatory network.

Healthcare Facilities | Apr 24, 2017

Treating the whole person: Designing modern mental health facilities

Mental health issues no longer carry the stigma that they once did. Awareness campaigns and new research have helped bring our understanding of the brain—and how to design for its heath—into the 21st century.

Sponsored | Glass and Glazing | Apr 14, 2017

Azuria glass from Vitro provides hospital with the desired pop of color

Located in Wilmington, Delaware, Nemours/duPont hospital has undergone a series of expansions since it was founded in the 1940s.

Healthcare Facilities | Apr 14, 2017

Nature as therapy

A famed rehab center is reconfigured to make room for more outdoor gardens, parks, and open space.

Healthcare Facilities | Apr 13, 2017

Investors and developers are still avid for medical office buildings

A new CBRE survey finds that equity set aside for purchases continues to outshoot the availability of in-demand supply.