Retail health clinics, which have been around since 2001, and until recently have been profit question marks, are having their moment in the sun.

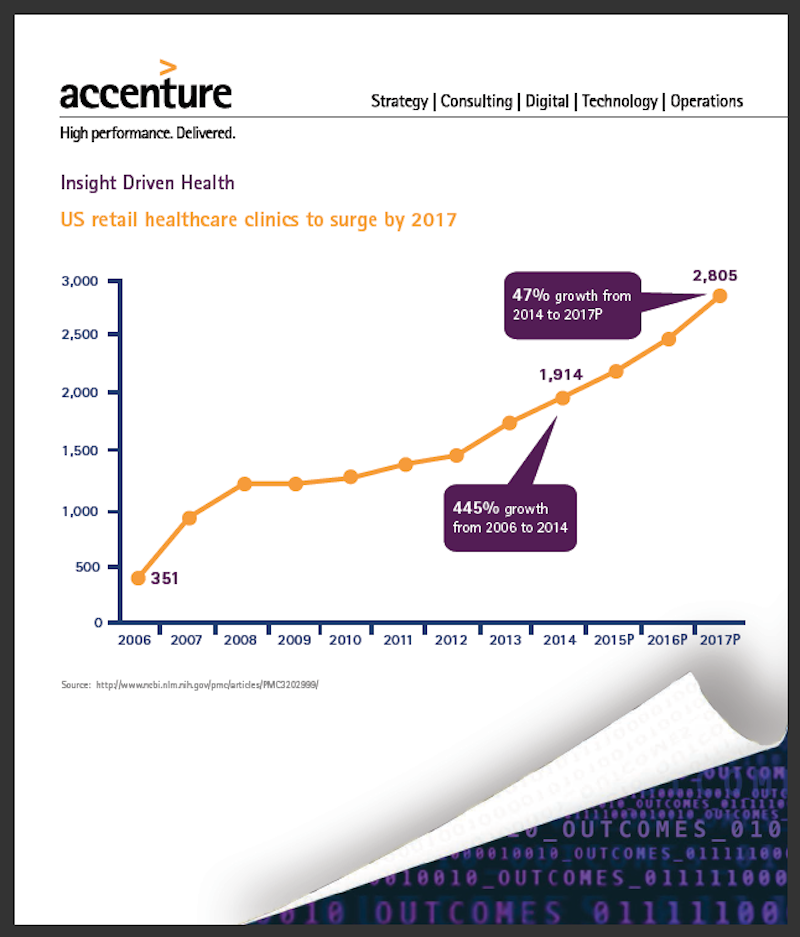

A recent report by Accenture Consulting predicts that the clinics sector will grow at an average annual rate of 14% through 2017, when their numbers will exceed 2,800, compared to 1,914 in 2014.

“Retail health clinics are impacting the broader U.S. landscape by offering a new, lower-cost peer channel,” said Alan Nalle, Accenture’s Senior Manager-Retail Strategy, in a video clip that accompanied the release of the report.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture Consulting predicts that retail health clinics will exceed 2,800 in the U.S. in 2017. Insurers favor these clinics over more expensive urgent care or emergency room options. Image: Accenture Consulting.

Accenture says that retail health clients have been closing their “profitability gap” by shifting their focus from “retail” elements, and emphasizing the clinical in three distinct ways:

• Clinics are expanding their services to broaden appeal: More retail stores are bringing the pharmacist out from behind the counter to interact directly with patients—“something many in the industry see as a clear differentiator,” Accenture points out.

Other new services include primary and preventive care, pediatrics and wellness, health screening and testing, chronic disease monitoring and management, and transitional care. Walgreens’ Health Clinics now offer chronic care assessments and medication reconciliation. Walmart recently launched new primary care clinics that offer more sophisticated services—like chronic disease management—than patients can receive at the retailer’s other health centers.

• Retail clinics are investing in healthcare IT to expand their roles: Leading organizations are purchasing more advanced medical equipment and records management systems. For example, CVS Health’s MinuteClinics have been installing a proven electronic health record system nationwide, which makes it easier to transmit clinical data to regional health information exchanges.

• Clinics are working with partners to coordinate care: Target, for one, is partnering with Kaiser Permanente to launch a number of retail clinics in California that provide greater levels of service and information sharing between clinics and the integrated delivery network. Services include pediatric and adolescent care, family planning, wellness for women and the management of chronic conditions such as high blood pressure and diabetes.

Likewise, Walgreens is collaborating with one of the largest health systems in the U.S., Trinity Health, to coordinate patient care to improve outcomes and increase access to care while reducing overall costs.

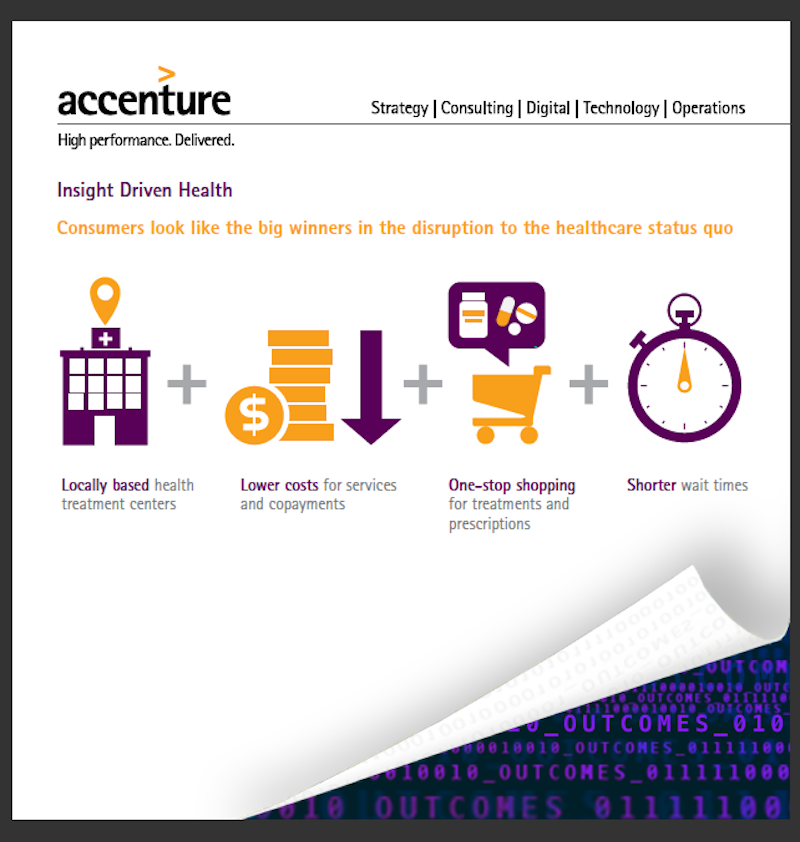

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

Some healthcare providers are teaming with clinics, and exchanging files electronically, to provide their patients with after-hours care. Image: Accenture Consulting.

Nalle noted that all of these changes have been wins for consumers, who now have greater healthcare convenience and access.

Payers have also found the expansion of retail health clinics to their liking, said Nalle. “Increasingly we’re seeing our payer clients offer lower copay or waive copays for clinic visits,” to redirect volumes of patients who might otherwise go to more-expensive urgent care or emergency room care.

For providers, the expansion of retail health clinics is a double-edged sword. On the positive side, some providers are using retail clinics as a way to offer after-hours access to patients. “But some might view clinics as competition,” says Nalle. So providers have two choices: to partner with clients via electronic record exchanges, or to compete, with extended office hours, or extended coverage.

There is no question, however, that retailers see clinics in more in terms of growth and profit. During a speech they delivered at America’s Health Insurance Plans Institute and Expo in Las Vegas earlier this month, Larry Merlo, CVS Health’s CEO, and Dr. Troyen Brennan, its Chief Medical Officer, noted that the cumulative cost of chronic illness alone is expected to increase to $42 billion by 2030.

“I believe the way to find solutions is to look at the problems through the eyes of your customers, and at CVS Health, we are working to do just that by collaborating with stakeholders across the health care continuum including patients, caregivers, providers and payers to provide better, more cost-effective care.”

Last December, CVS Health acquired all of Target’s pharmacies and retail clinics in 47 states, and a CVS Pharmacy will be included in all new Target stores. This acquisition expanded CVS Health’s pharmacy footprint by approximately 20% and its clinic footprint by about 8%.

Related Stories

Healthcare Facilities | Apr 13, 2017

The rise of human performance facilities

A new medical facility in Chicago focuses on sustaining its customers’ human performance.

Healthcare Facilities | Apr 11, 2017

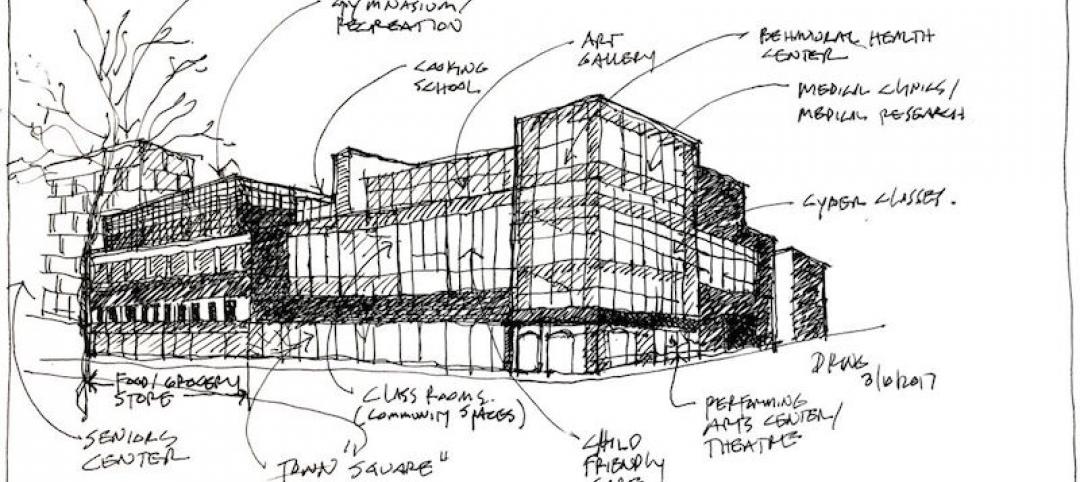

Today’s community centers offer glimpses of the healthy living centers of tomorrow

Creating healthier populations through local community health centers.

Healthcare Facilities | Apr 2, 2017

Comfort and durability were central to the design and expansion of a homeless clinic in Houston

For this adaptive reuse of an old union hall, the Building Team made the best of tight quarters.

Healthcare Facilities | Mar 31, 2017

The cost of activating a new facility

Understanding the costs specifically related to activation is one of the keys to successfully occupying the new space you’ve worked so hard to create.

Sponsored | Healthcare Facilities | Mar 29, 2017

Using Better Light for Better Healthcare

Proper lighting can improve staff productivity, patient healing, and the use of space in healthcare facilities

Healthcare Facilities | Mar 29, 2017

Obamacare to Republicare: Making sense of the chaos in healthcare

With a long road of political and financial uncertainty ahead for the healthcare sector, what does this mean for the nonresidential construction industry’s third-largest sector?

Healthcare Facilities | Mar 24, 2017

5 insights for designing a human-centered pediatric experience

Pediatric experience design must evolve beyond the common mantra of “make it fun” or “make it look kid-friendly.”

Healthcare Facilities | Mar 3, 2017

CBRE: Developing a total project budget for a healthcare capital project

Successfully developing a complete and well thought out Total Project Budget is perhaps the most important task you’ll perform in the initial phase of your project.

Healthcare Facilities | Feb 26, 2017

A Georgia Tech white paper examines the pros and cons of different delivery systems for ICUs

It concludes that a ceiling-mounted beam system is best suited to provide critical care settings with easier access to patients, gases, and equipment.

Healthcare Facilities | Feb 24, 2017

The transformation of outpatient healthcare design

Higher costs and low occupancy rates have forced healthcare facilities to rethink how healthcare is delivered in their community.