Enabling talent, managing cost, and expanding influence are the three primary mandates that corporate real estate (CRE) executives are grappling with in their companies.

In its inaugural Americas Occupier Survey 2015/16, the CBRE Institute polled 229 executives about their strategies priorities, and practices. Forty-five percent of those respondents are in the Banking and Finance or in Tech and Telecom industries.

The majority (56%) of CRE executives say they are evaluated on the value and satisfaction they create among internal stakeholders. Throughout the survey, executives noted that their roles require them to address shortages in skilled labor, escalating costs, and economic uncertainties. Not surprisingly, uncertainties for execs in the Banking and Finance sectors revolve around tighter regulations.

CRE execs are dealing with a workforce that is more culturally, generationally, and ethnically diverse than ever. That workforce “strives to connect, integrate, and find community among peers in a world that is increasingly online” the report’s authors observe. Indeed, the highest portion of the survey’s respondents, 44%, says that connectivity to partners and supports is the most important factor to their labor forces, followed by flexible working hours, flexible space, and amenities.

Fifty-seven percent of respondents say their workplace strategies are driven by employee attraction and retention. And employers of choice are delivering the ideal work experience by linking their corporate real estate missions with human resources and information technology. Such “hyper-customized” environments emphasize brand, functionality, freedom of work style and community connectivity.

But CRE executives also insist that their strategic goals are thwarted when they don’t have support from their companies’ corporate suite. Productive and flexible workspaces and greater capital expenditure for real estate investment also rank high among the factors that give CRE execs the wherewithal to accomplish their objectives.

And when it comes to data, the majority of executives say they need information that enables data visualization and decision support. “Our research indicates that an optimal approach to CRE decisions will involve selective and discriminating use of analytics, paired with the irreplaceable role of a leader’s intuition and experience,” the report says.

CRE executives often manage their firms’ portfolio costs. A remarkable 85% of those polled said their companies had used space restructuring as a lever to reduce costs in the previous 12 months. But the pendulum is swinging away from smaller workstations and lower rents to smarter workplaces and agile leasing structures The survey finds that 31% of respondents’ companies are currently using shared office facilities, and another 15% say they are considering the merits of sharing space.

An emerging co-worker model “offers environments that inspire new levels of energy and connectivity that eluded earlier incarnations of the shared workplace model.”

Lease negotiation seems preferable to relocation as a cost-saving measure. For one out of every two companies, “talent determines the market; cost pinpoints the location,” the report says. However, expansion still dictates some moving decisions, as two out of five executives polled say accessing new markets and customers drive their companies’ relocation strategies.

AEC firms, take note: building and floorplan design is a leading decision driver when real estate executives are selecting a building to move into, even more important that real estate costs, lease options, or the quality of the location’s infrastructure or amenities.

Other findings of note from the survey include:

- 70% of CRE execs say their companies use external partnerships to deliver at least one function, like project or facilities management.

- Three quarters of CRE executives say their companies operate centrally.

- Half of the companies polled—which are all based in the Americas—favor India and Southeast Asia as expansion destinations.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

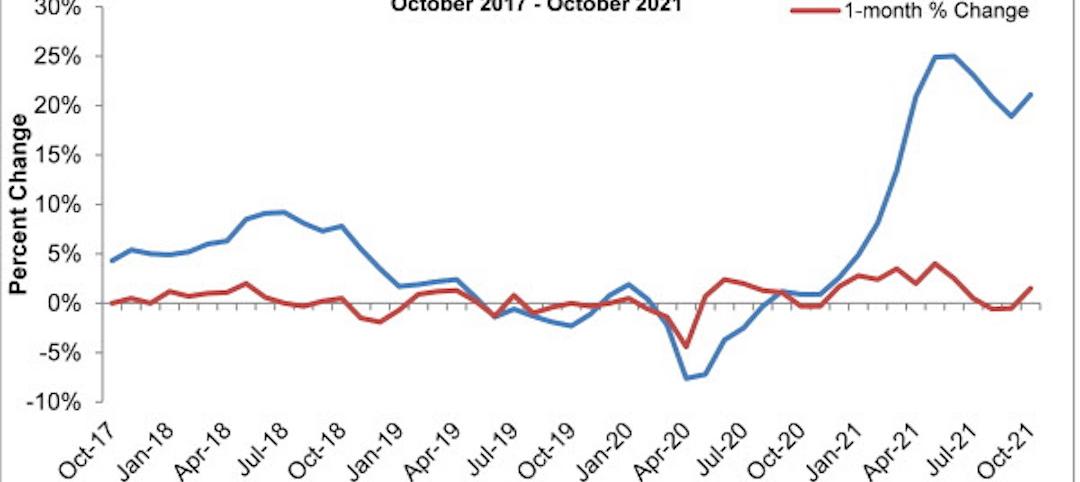

Market Data | Nov 10, 2021

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

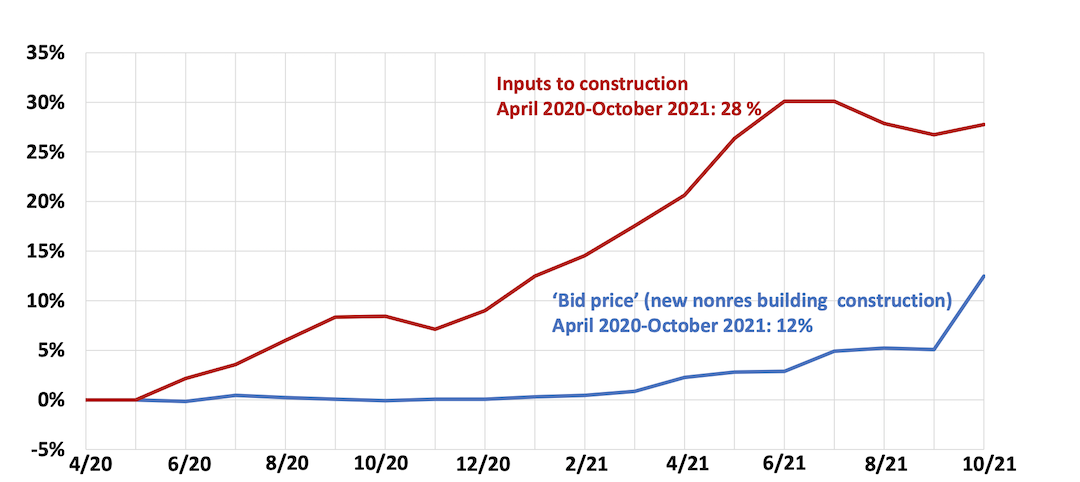

Market Data | Nov 9, 2021

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.