Enabling talent, managing cost, and expanding influence are the three primary mandates that corporate real estate (CRE) executives are grappling with in their companies.

In its inaugural Americas Occupier Survey 2015/16, the CBRE Institute polled 229 executives about their strategies priorities, and practices. Forty-five percent of those respondents are in the Banking and Finance or in Tech and Telecom industries.

The majority (56%) of CRE executives say they are evaluated on the value and satisfaction they create among internal stakeholders. Throughout the survey, executives noted that their roles require them to address shortages in skilled labor, escalating costs, and economic uncertainties. Not surprisingly, uncertainties for execs in the Banking and Finance sectors revolve around tighter regulations.

CRE execs are dealing with a workforce that is more culturally, generationally, and ethnically diverse than ever. That workforce “strives to connect, integrate, and find community among peers in a world that is increasingly online” the report’s authors observe. Indeed, the highest portion of the survey’s respondents, 44%, says that connectivity to partners and supports is the most important factor to their labor forces, followed by flexible working hours, flexible space, and amenities.

Fifty-seven percent of respondents say their workplace strategies are driven by employee attraction and retention. And employers of choice are delivering the ideal work experience by linking their corporate real estate missions with human resources and information technology. Such “hyper-customized” environments emphasize brand, functionality, freedom of work style and community connectivity.

But CRE executives also insist that their strategic goals are thwarted when they don’t have support from their companies’ corporate suite. Productive and flexible workspaces and greater capital expenditure for real estate investment also rank high among the factors that give CRE execs the wherewithal to accomplish their objectives.

And when it comes to data, the majority of executives say they need information that enables data visualization and decision support. “Our research indicates that an optimal approach to CRE decisions will involve selective and discriminating use of analytics, paired with the irreplaceable role of a leader’s intuition and experience,” the report says.

CRE executives often manage their firms’ portfolio costs. A remarkable 85% of those polled said their companies had used space restructuring as a lever to reduce costs in the previous 12 months. But the pendulum is swinging away from smaller workstations and lower rents to smarter workplaces and agile leasing structures The survey finds that 31% of respondents’ companies are currently using shared office facilities, and another 15% say they are considering the merits of sharing space.

An emerging co-worker model “offers environments that inspire new levels of energy and connectivity that eluded earlier incarnations of the shared workplace model.”

Lease negotiation seems preferable to relocation as a cost-saving measure. For one out of every two companies, “talent determines the market; cost pinpoints the location,” the report says. However, expansion still dictates some moving decisions, as two out of five executives polled say accessing new markets and customers drive their companies’ relocation strategies.

AEC firms, take note: building and floorplan design is a leading decision driver when real estate executives are selecting a building to move into, even more important that real estate costs, lease options, or the quality of the location’s infrastructure or amenities.

Other findings of note from the survey include:

- 70% of CRE execs say their companies use external partnerships to deliver at least one function, like project or facilities management.

- Three quarters of CRE executives say their companies operate centrally.

- Half of the companies polled—which are all based in the Americas—favor India and Southeast Asia as expansion destinations.

Related Stories

Market Data | Oct 5, 2020

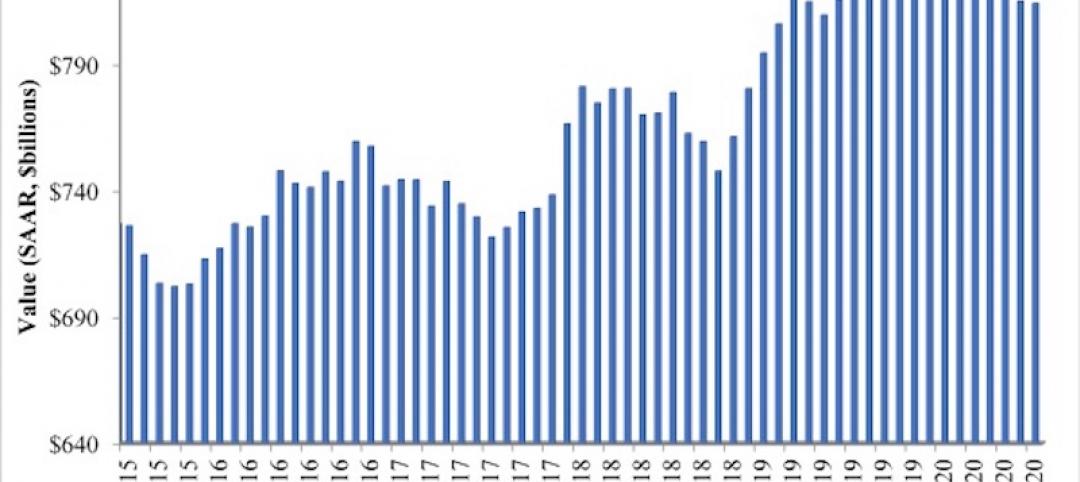

Nonresidential construction spending falls slightly in August

Of the 16 nonresidential subcategories, nine were down on a monthly basis.

Market Data | Oct 5, 2020

Construction spending rises 1.4% in August as residential boom outweighs private nonresidential decline and flat public categories

Construction officials caution that demand for non-residential construction will continue to stagnate without new federal coronavirus recovery measures, including infrastructure and liability reform.

Market Data | Oct 5, 2020

7 must reads for the AEC industry today: October 5, 2020

Zaha Hadid unveils 2 Murray Road and the AEC industry is weathering COVID-19 better than most.

Market Data | Oct 2, 2020

AEC industry is weathering COVID-19 better than most

Nearly one-third of firms have had layoffs, more than 90% have experienced project delays.

Market Data | Oct 2, 2020

6 must reads for the AEC industry today: October 2, 2020

BIG imagines how to live on the moon and smart buildings stand on good data.

Market Data | Oct 1, 2020

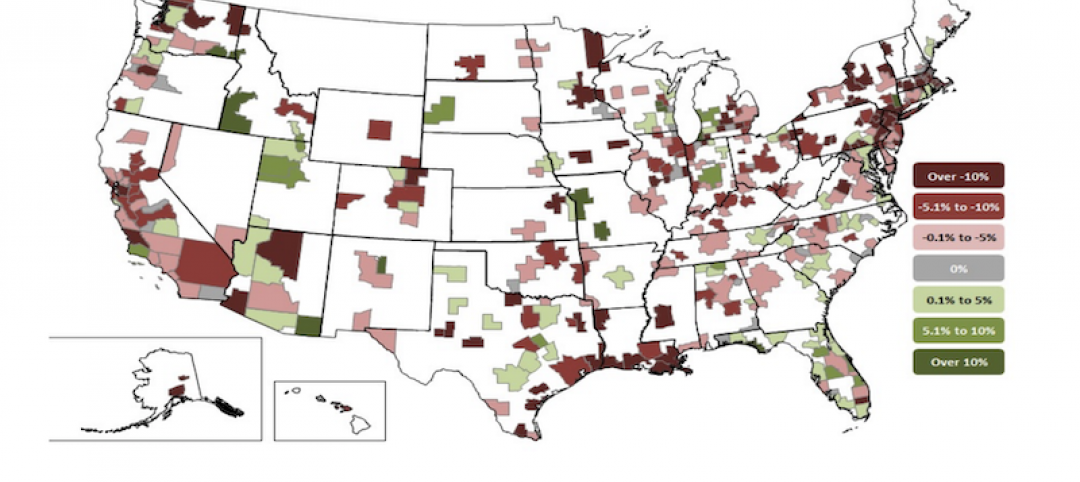

Two-thirds of metros shed construction jobs from August 2019 to August 2020

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 12-month losses, while Indianapolis-Carmel-Anderson, Ind. and Niles-Benton Harbor, Mich. top job gainers.

Market Data | Oct 1, 2020

6 must reads for the AEC industry today: October 1, 2020

David Adjaye to receive 2021 Royal Gold Medal for Architecture and SOM reimagines the former Cook County Hospital.

Market Data | Sep 30, 2020

6 must reads for the AEC industry today: September 30, 2020

Heatherwick Studio designs The Cove for San Francisco and Washington, D.C.'s first modular apartment building.

Market Data | Sep 29, 2020

6 must reads for the AEC industry today: September 29, 2020

Renovation to Providence's downtown library is completed and Amazon to build 1,500 new last-mile warehouses.

Market Data | Sep 25, 2020

5 must reads for the AEC industry today: September 25, 2020

AIA releases latest 2030 Commitment results and news delivery robots could generate trillions for U.S. economy.