The office vacancy rate plunged by 0.9% to 18.4% during the spring, and rental rates fell to levels more than 7% below those seen last year, according to BD+C Economist Jim Haughey. A number of large office markets, such as New York and San Francisco, saw vacancy levels reach 20%. Overall, net space rentals fell during the spring in every major office market except Pittsburgh.

Developers responded quickly to reduced profit prospects in the office market. Office construction spending expanded through September 2008 but has since declined 16.4% through June. Office project starts declined slowly in early 2009 and then dropped sharply in the last two months, with starts for June-July more than 50% below the average for the previous 18 months. These slow starts shrink the pipeline of work under way and assure a further 6% drop in monthly jobsite spending by next spring.

The 2009-10 office recession will be relatively mild compared to the recession earlier this decade when construction spending dropped 47% over 27 months. This time the expected decline is 22% over 19 months. Recession declines are approximately proportional to the rise in the preceding expansion period. The 2004-08 expansion in office construction was shorter and smaller than the overheated expansion that preceded the previous recession.

The good news is that three market niches show promise of relatively slight declines over the next year. Government office construction, which has so far fared worse than private development, is likely to reverse course when stimulus-funded buildings get started next year. Financial offices, a relatively small niche, appears to be past the worst of its recession, and job site spending has been stable in recent months after a 20% drop last year as a result of forced mergers by the Federal Reserve Bank and the FDIC. Lastly, office renovation projects show promise because they typically decline much less in a recession than does new office construction.

Related Stories

Great Solutions | Jul 23, 2024

41 Great Solutions for architects, engineers, and contractors

AI ChatBots, ambient computing, floating MRIs, low-carbon cement, sunshine on demand, next-generation top-down construction. These and 35 other innovations make up our 2024 Great Solutions Report, which highlights fresh ideas and innovations from leading architecture, engineering, and construction firms.

MFPRO+ News | Jul 22, 2024

Miami luxury condominium tower will have more than 50,000 sf of amenities

Continuum Club & Residences, a new 32-story luxury condominium tower in the coveted North Bay Village of Miami will feature more than 50,000 sf of indoor and outdoor amenities. The program includes a waterfront restaurant, dining terraces with resident privileges, and a private dining room outdoor pavilion.

Healthcare Facilities | Jul 22, 2024

5 healthcare building sector trends for 2024-2025

Interactive patient care systems and trauma-informed design are among two emerging trends in the U.S. healthcare building sector, according to BD+C's 2024 Healthcare Annual Report (free download; short registration required).

Office Buildings | Jul 22, 2024

U.S. commercial foreclosures increased 48% in June from last year

The commercial building sector continues to be under financial pressure as foreclosures nationwide increased 48% in June compared to June 2023, according to ATTOM, a real estate data analysis firm.

Codes and Standards | Jul 22, 2024

Tennessee developers can now hire their own building safety inspectors

A new law in Tennessee allows developers to hire their own building inspectors to check for environmental, safety, and construction violations. The law is intended to streamline the building process, particularly in rapidly growing communities.

Codes and Standards | Jul 22, 2024

New FEMA rules include climate change impacts

FEMA’s new rules governing rebuilding after disasters will take into account the impacts of climate change on future flood risk. For decades, the agency has followed a 100-year floodplain standard—an area that has a 1% chance of flooding in a given year.

Construction Costs | Jul 18, 2024

Data center construction costs for 2024

Gordian’s data features more than 100 building models, including computer data centers. These localized models allow architects, engineers, and other preconstruction professionals to quickly and accurately create conceptual estimates for future builds. This table shows a five-year view of costs per square foot for one-story computer data centers.

Sustainability | Jul 18, 2024

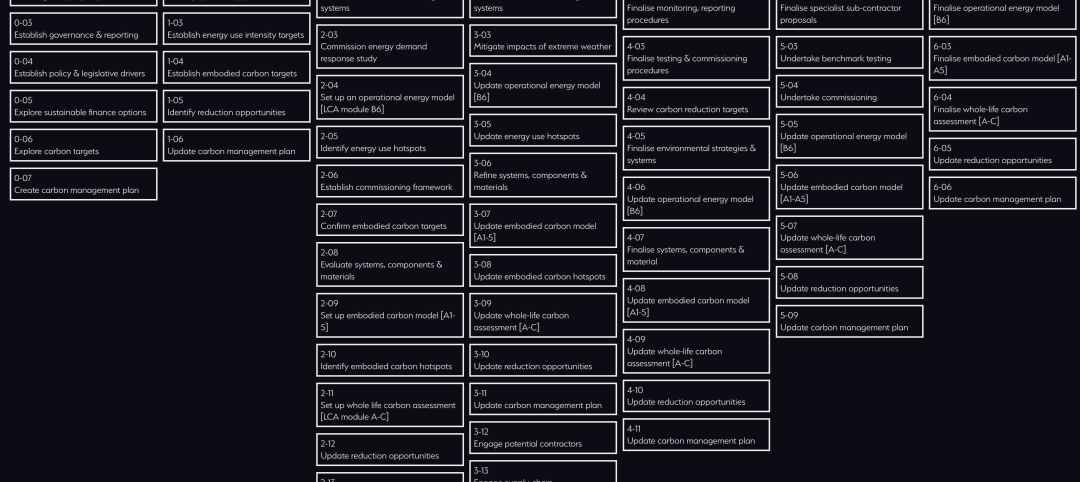

Grimshaw launches free online tool to help accelerate decarbonization of buildings

Minoro, an online platform to help accelerate the decarbonization of buildings, was recently launched by architecture firm Grimshaw, in collaboration with more than 20 supporting organizations including World Business Council for Sustainable Development (WBCSD), RIBA, Architecture 2030, the World Green Building Council (WorldGBC) and several national Green Building Councils from across the globe.

University Buildings | Jul 17, 2024

University of Louisville Student Success Building will be new heart of engineering program

A new Student Success Building will serve as the heart of the newly designed University of Louisville’s J.B. Speed School of Engineering. The 115,000-sf structure will greatly increase lab space and consolidate student services to one location.

Healthcare Facilities | Jul 16, 2024

Watch on-demand: Key Trends in the Healthcare Facilities Market for 2024-2025

Join the Building Design+Construction editorial team for this on-demand webinar on key trends, innovations, and opportunities in the $65 billion U.S. healthcare buildings market. A panel of healthcare design and construction experts present their latest projects, trends, innovations, opportunities, and data/research on key healthcare facilities sub-sectors. A 2024-2025 U.S. healthcare facilities market outlook is also presented.