Residential construction enjoyed its seventh consecutive year of growth in 2016. But it still fell far short of annual averages during the 1980s and 1990s. And multifamily construction, which has been the industry’s engine for nearly a decade, flattened.

In its “State of the Nation’s Housing 2017,” which it released today, Harvard University’s Joint Center for Housing Studies notes that home prices rose 5.6% last year, “finally surpassing the high reached nearly a decade earlier.” But in inflation-adjusted terms, home values still remained nearly 15% below their previous high.

More significantly, housing availability, especially at the affordable end of the spectrum, remains in woefully short supply. Completions in the past 10 years totaled just 9 million units, or more than 4 million units less than the next-worst decade going back to the 1970s.

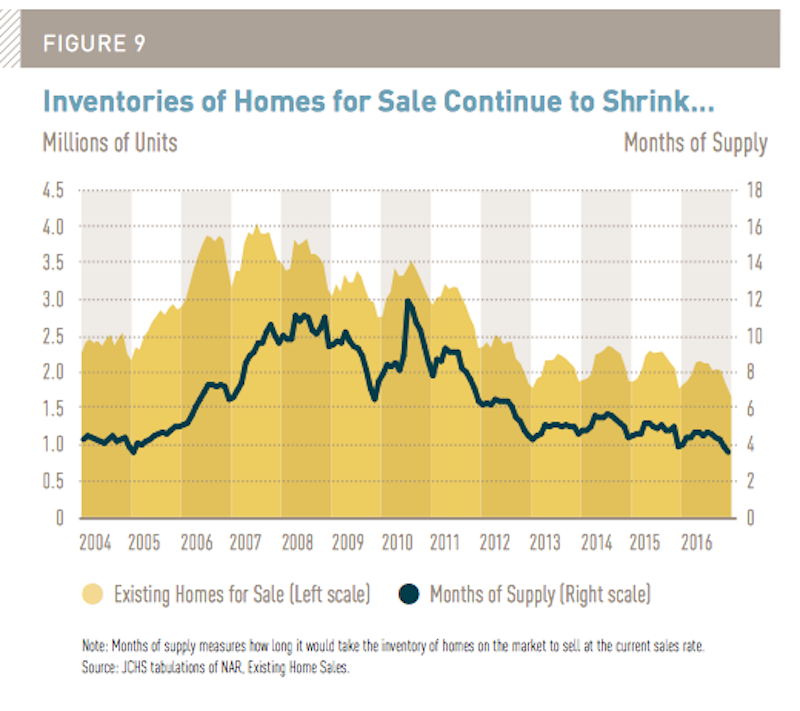

There were only 1.65 million existing homes available for sale last year, the lowest count in 16 years. “With sales volumes picking up, the inventory represented just 3.6 months of supply, an 11-year low,” the Joint Center states.

The inventory of existing homes for sale stood at 1.65 million at the end of 2016, a 16-year low. Inventory represented only a 3.6 month supply, an 11-year low. Image: Joint Center for Housing Studies.

The inventory of existing homes for sale stood at 1.65 million at the end of 2016, a 16-year low. Inventory represented only a 3.6 month supply, an 11-year low. Image: Joint Center for Housing Studies.

Its report cites myriad factors behind these numbers. Labor shortages continue to constrain construction, as do regulatory and financing restrictions. And too many younger adults still don’t have the financial wherewithal to live independently. While the Millennial generation formed 7.6 million new households last year, 35.6% of adults aged 18 to 34 are still living with parents or grandparents, an all-time high.

The homeownership rate, which had been declining for 12 years, stabilized last year (it stood at 63.6% in the first quarter of 2017). But choosing renting over buying is no longer a transitory proposition for many Americans. Growth in renters continued to outpace owners, with their numbers increasing by 600,000 last year.

Some 43.3 million households now rent, and the rental share of U.S. households stands at a 50-year high of 37%, up more than five percentage points from 2004, when ownership peaked. Families with children are increasingly likely to rent rather than own their homes. The share of these households living in rental housing jumped to 39 percent in 2016 from 32 percent in 2005, accounting for 22 percent of renter household growth over this period.

The share of high-income households (earning more than $100,000) that rented also increased to 18% last year, from 12% in 2005.

Spending on multifamily housing was at a 10-year high, at $60.4 billion last year. However, multifamily construction—which many AEC firms engage—might be losing some steam.

Excluding the Northeast, multifamily starts rose 7.1% last year. But nationally, there were 393,000 multifamily starts in 2016, down slightly from 397,000 in 2015, and significantly below the annual averages in the 1970s (625,000), and the 1980s (507,000).

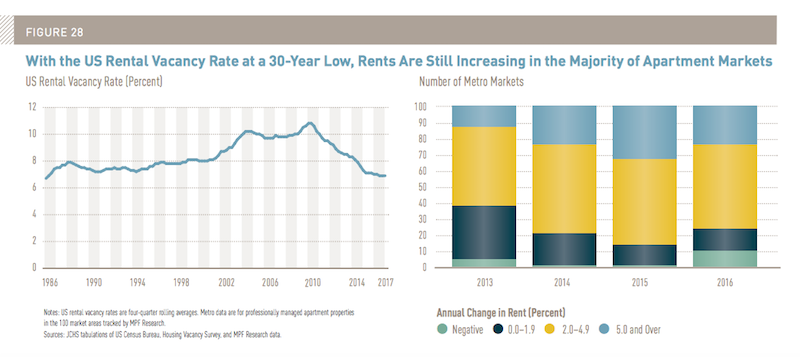

As rental inventory hasn't kept pace with demand, rents continue to rise across the country. Image: Joint Center for Housing Studies.

Over 90% of multifamily starts and completions last year were intended for the rental market, and more than 80% were in properties with 20 or more units. But this construction activity isn’t keeping up with demand, as rental vacancy rates slipped for the seventh straight year to a 30-year low of 6.9% in 2016. Rental markets in most areas of the country remain tight, the Joint Center states.

(A newly released study, by Hoyt Advisory Services, the National Multifamily Housing Council, and the National Apartment Association, estimates that the U.S. will need at least 325,000 new apartment units to meet demand through 2030.)

One bit of good news: The Joint Center estimates that completions of multifamily units totaled 321,000 in 2016, only slightly higher than the 2015 level but up 5 percent from annual averages in the 2000s. Construction of townhouses, often a desirable option for first-time buyers, has risen recently but still does not approach its pre-recession high. Townhouse completions stood at 98,000 units in 2016, more than double the number in 2009 but less than half that in 2005.

The bridge that, historically, has been a pathway for renters to homeownership looks shakier, primarily because of renters’ financial situations and escalating rents. The typical renter household had an annual income of $37,900, or about half of the $70,800 annual income of a typical homeowner household. Sixteen million renter households had annual incomes of less than $25,000, including 11 million with incomes below the federal poverty threshold.

Given its findings, the Joint Center projects that 13.6 million new U.S. households will be created between 2015 and 2025. Minorities will drive three quarters of that gain, with Hispanics alone accounting for one third. During this period, renter households could increase by 4.7 million if ownership rates stabilize, or by 8.7 million if renting continues to gain favor with more American families.

But in the following decade, total household creation is expected to slow to 11.5 million, with minorities accounting for a jaw-dropping 90% of that growth from 2025-2035. Millennials are projected to form an additional 34 million new households by 2035, “lifting the total number to just under 50 million—considerably more than the 43.2 million currently headed by members of Generation X,” the report states.

And don’t forget about those aging baby boomers. The number of households headed by adults age 65 of older will increase by 44% through 2025, and by 90% from 2025-2035. One in three households could be headed by older adults by 2035.

But where are people going to live? As it has perennially, the Joint Center decries the lack of affordable housing in the U.S. It expects demand for rental and entry-level owner-occupied homes to soar, but questions whether there will be adequate supply, “particularly for the most vulnerable—the very young and very old, those with disabilities, and those living in poverty.”

The report finds that, on average, 45 percent of renters in the nation’s metro areas could afford the monthly payments on a median-priced home in their market area. But in several high-cost metros of the Pacific Coast, Florida, and the Northeast, that share is under 25 percent.

With rents rising in general, there is a growing demand for housing assistance at a time when the government is cutting back. “For the 75 percent of households that are eligible for assistance but do not receive it, affordable housing choices are in increasingly limited supply,” the Joint Center states.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

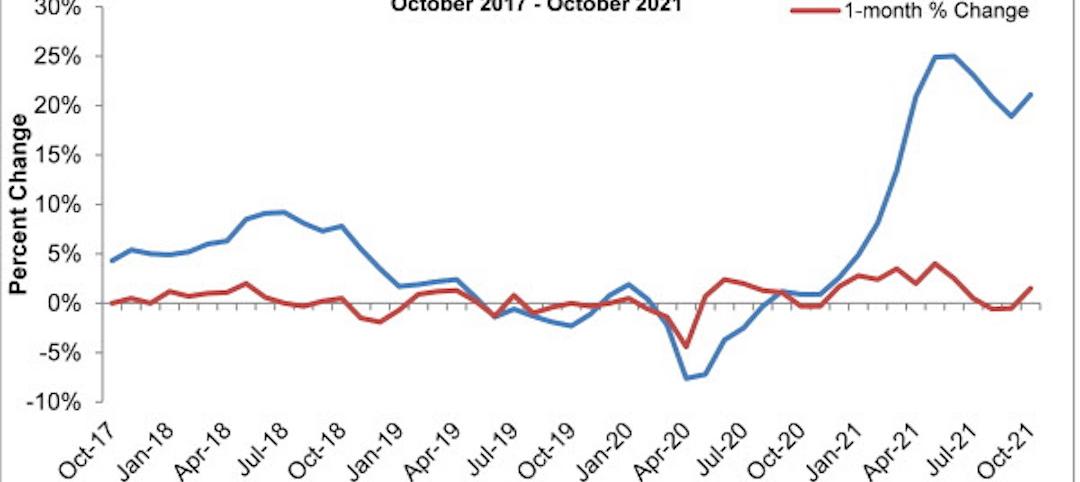

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

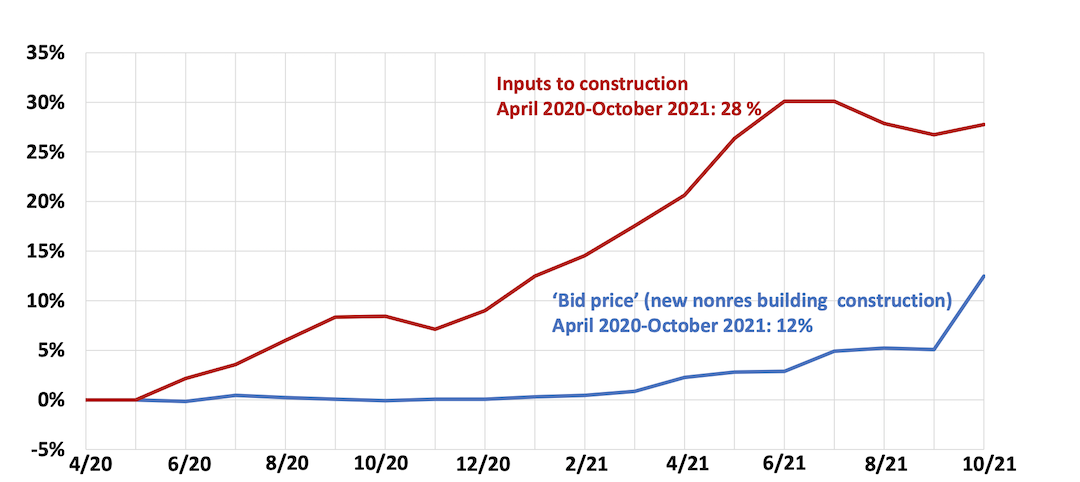

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.