Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation.

That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about their seeking healthier shopping experiences. (Download the full report.)

Nearly half of the respondents said they were aware of the effects that displays which communicate “wellness” have on their minds and bodies. About three in five respondents agreed that sounds generated by physical events—like waves or rain—coupled with natural light can establish a sense of calm. And about the same ratio preferred shopping environments with activity spaces, such as meditation or exercise rooms.

MG2’s report delineates the survey’s respondents by age, location (i.e., suburban, urban, or rural), gender, and household income. The report also groups the respondents into three categories:

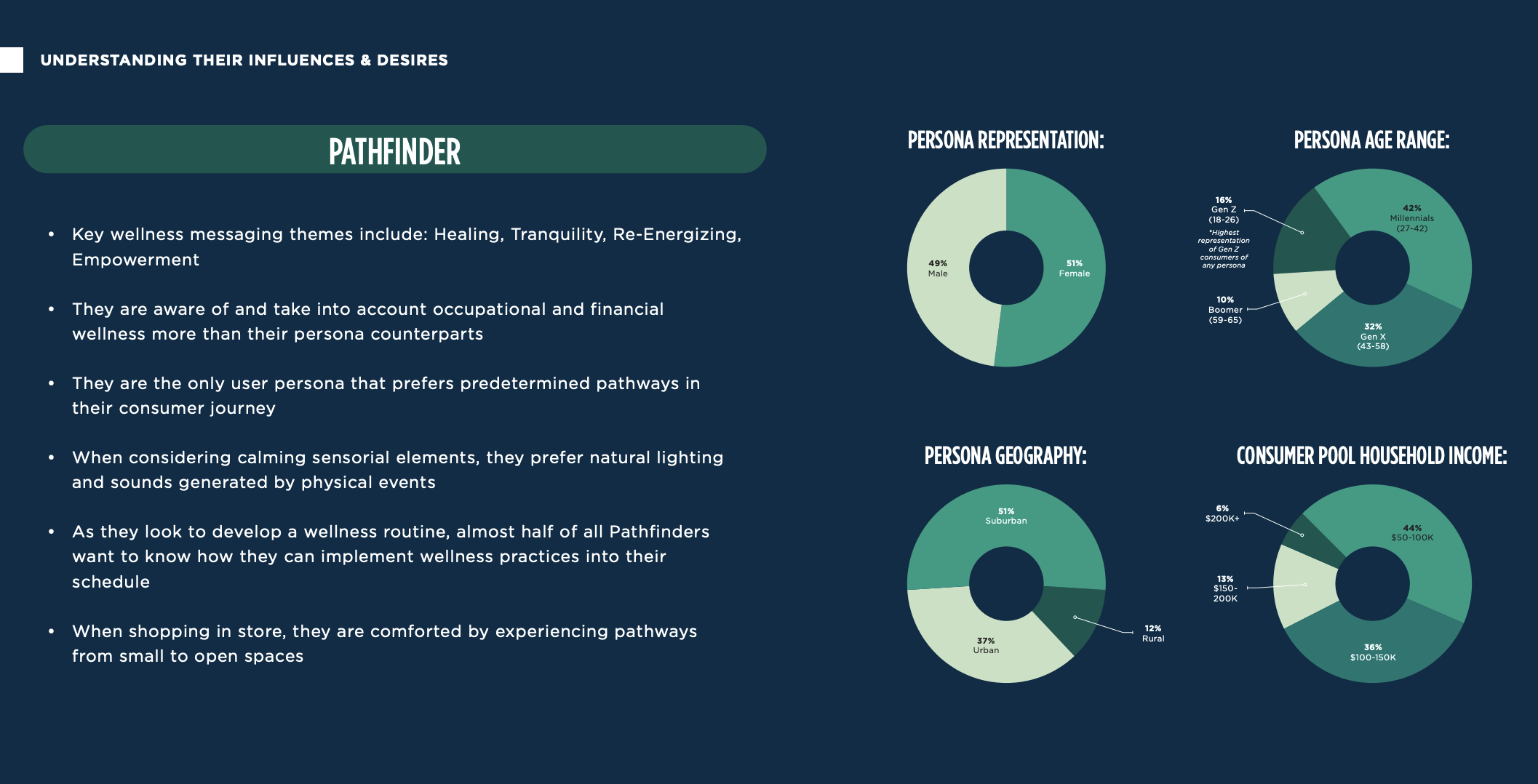

- Pathfinders, who like to find, learn about, or develop wellness practices that will fit their lifestyles. Pathfinders accounted for 42% of respondents;

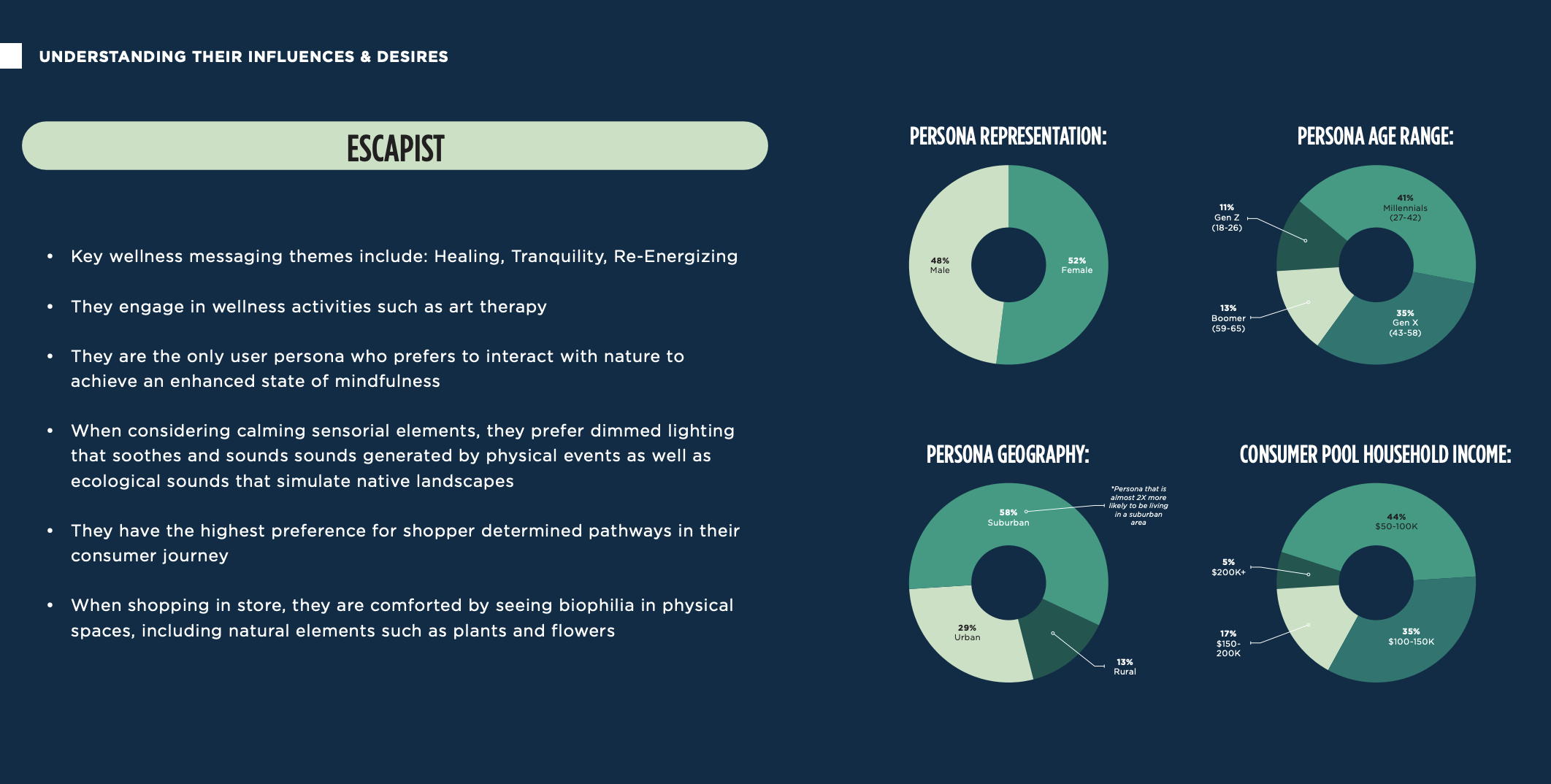

- Escapists, who look for relaxing or centering wellness outlets. This group represented 35% of respondents; and

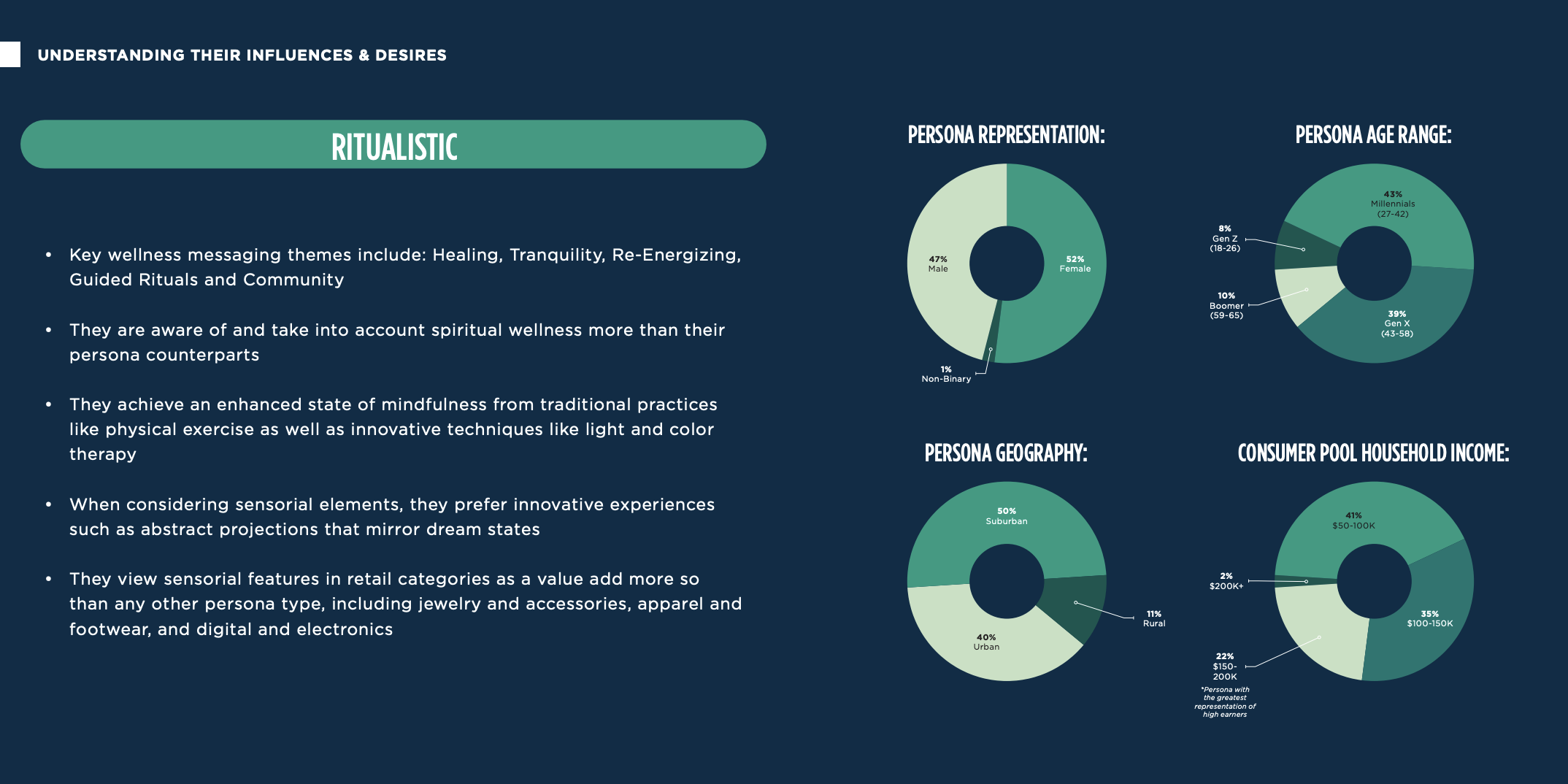

- Ritualistics, who are committed to wellness routines that address their mental well-being on a scheduled basis.

For many, wellness in retail design equates to calm

The survey elicited responses that accentuated the range of meaning that “wellness” now encompasses. For example, 54% identified physical exercise, like running or yoga, as a wellness practice that enhances mindfulness. When it comes to enhancing emotional wellness, 48% of the survey’s respondents cited personal spaces for meditation or relaxation.

Indeed, “healing,” “tranquility,” and “re-energizing” were the top three themes cited for brands to emphasize in a consumer-focused wellness experience.

When taking a wellness-driven journey, Pathfinders prefer predetermined routes, as do consumers within the 27-43 and 43-49 age groups, whereas Escapists want to determine their own paths. (Ritualistics split down the middle.) All but the Baby Boomer cohort prefer visual messaging cues that help them navigate a wellness journey.

Knowledge about a product or service’s wellness characteristics and its effects on a consumer’s body and mind was deemed important information sought by the greatest percentage of respondents. It’s worth noting, too, that more than one-third of Generation Z consumers wants to know how a product will factor into their daily routines. “Brands and retailers have the ability to establish greater trust with their consumer audience by communicating these details, providing a deeper sense of confidence when deciding to invest in a product or service in support of their wellness journey,” the report states.

Sound, smell, and sight were identified by respondents as the three top integrated in-store senses for memorable experiences. And among the myriad “sensory scapes” that a shopping environment can present, sounds generated by physical events combined with natural light were the mostly likely to add a sense of calm for consumers, followed by ecological scenes and sounds that simulate native landscapes.

Synchronized music and lighting, on the other hand, ranked highest among the sensory scapes that would best add a sense of stimulation within consumers.

Lighting and tech can boost a retail store’s wellness ambience

“You can’t put a price tag on what delivers health and happiness,” says the report, which found that 85% of respondents differentiate wellness-driven retail experiences from conventional shopping.

For Ritualistics, what separates one from the other is how the experience enhances their daily lives. Escapists said it’s an experience that supports their emotional needs. And Pathfinders find wellness in shopping experiences that correspond with their everyday routines. (Boomers were the group least-inclined to see any difference between wellness-driven and traditional shopping.)

Lighting can be a significant factor in how consumers relate to a shopping environment. Nearly half of respondents to MG2’s survey said that dimmed lighting which soothes and provides a sense of leisure best contributes to a feeling of wellness, followed by lighting that mimics the patterns of natural light during the day. (Intriguingly, two out of five respondents with household incomes of $200,000 or more find bright light that energizes to be a contributing factor for wellness in stores.)

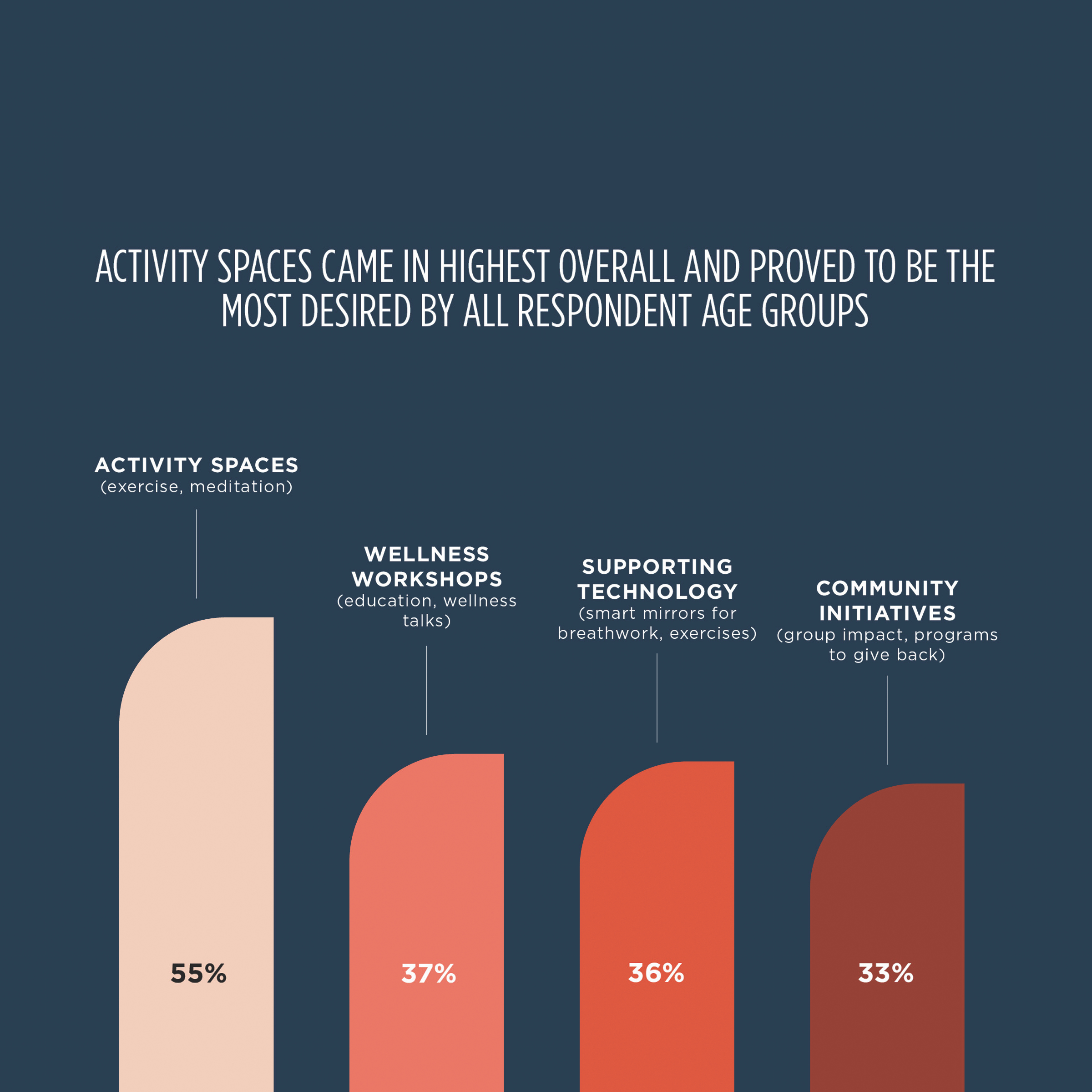

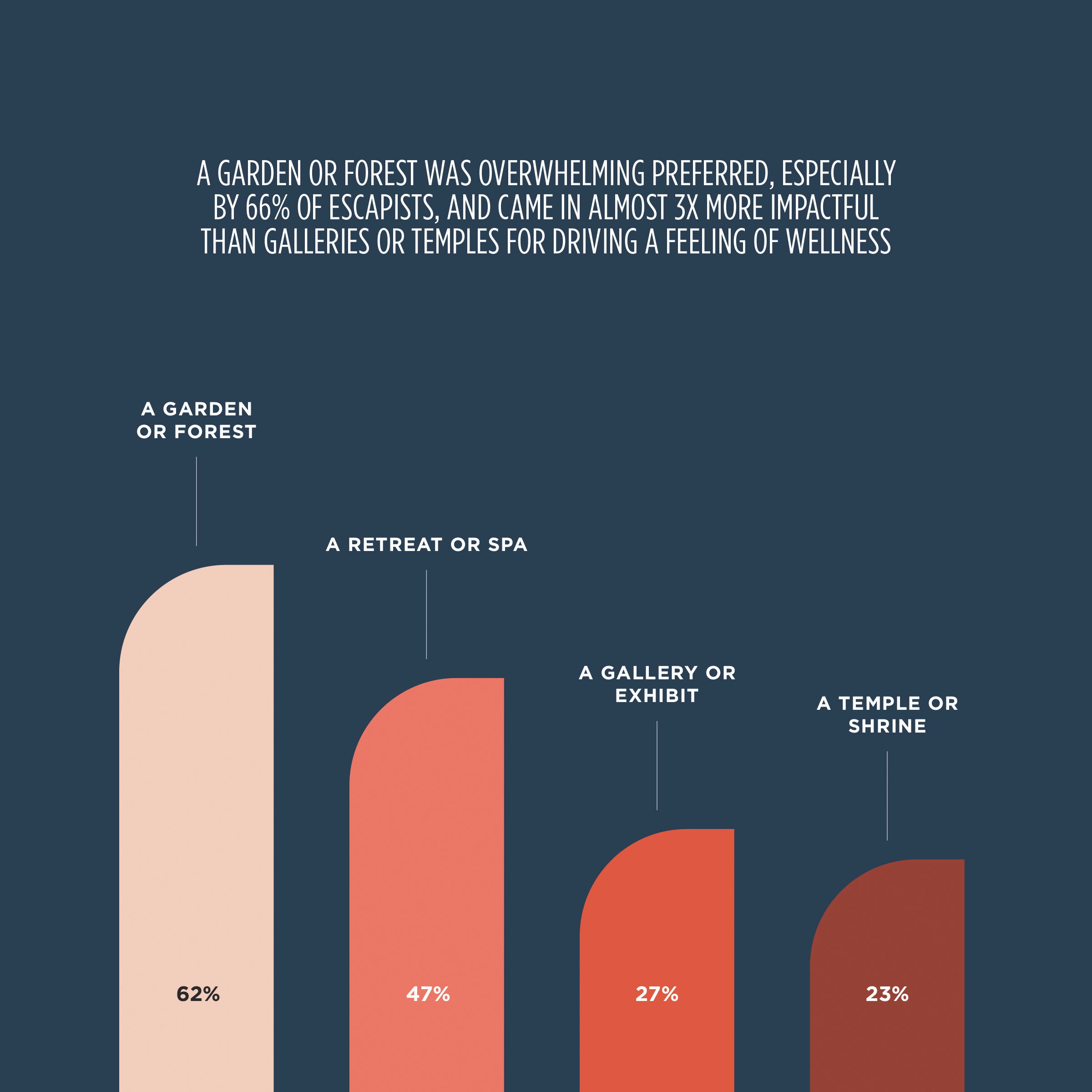

Fifty-five percent of respondents—and 66% of Boomers—cited activity spaces such as those carved out for meditation or exercise as the integrations they most desired in wellness-driven environments. A garden or forest was overwhelmingly preferred among aesthetics within shopping environments that would be most impactful in driving a feeling of wellness in consumers, followed by a retreat or spa.

MG2 posited that technology can be an “innovative and highly experiential” way to drive consumer education and engagement within the wellness space. More than one-third of Gen Z respondents thought that virtual reality can complement a wellness-driven consumer experience, while the highest percentage of Millennials and Gen X respondents (especially those who are female) singled out chromotherapy tech that uses light for physical and mental healing. Forty percent of Boomers saw wellness benefits in interactive wall and window displays that help them explore products and services.

Related Stories

| Sep 3, 2014

New designation launched to streamline LEED review process

The LEED Proven Provider designation is designed to minimize the need for additional work during the project review process.

| Sep 2, 2014

Ranked: Top green building sector AEC firms [2014 Giants 300 Report]

AECOM, Gensler, and Turner top BD+C's rankings of the nation's largest green design and construction firms.

| Aug 21, 2014

RTKL's parent company Arcadis acquires Callison

The acquisition of Callison, known predominantly for its leadership in retail and mixed-use design, builds on Arcadis’ strong global design and architecture position, currently provided by RTKL.

| Aug 19, 2014

Goettsch Partners unveils design for mega mixed-use development in Shenzhen [slideshow]

The overall design concept is of a complex of textured buildings that would differentiate from the surrounding blue-glass buildings of Shenzhen.

| Aug 18, 2014

From icon to breadbasket: Gehry building to be turned into Whole Foods

The Howard Hughes Corporation, in association with architecture firm Cho Benn Holback + Associates, plans to turn the building—at least the majority of it—into a Whole Foods.

| Aug 18, 2014

SPARK’s newly unveiled mixed-use development references China's flowing hillscape

Architecture firm SPARK recently finished a design for a new development in Shenzhen. The 770,700 square-foot mixed-use structure's design mimics the hilly landscape of the site's locale.

| Aug 11, 2014

The Endless City: Skyscraper concept connects all floors with dual ramps

Rather than superimposing one floor on top of another, London-based SURE Architecture proposes two endless ramps, rising gradually with a low gradient from the ground floor to the sky.

| Aug 4, 2014

Retail Giants: Grocery-anchored centers, trophy malls among hot retail developments [2014 Giants 300 Report]

Despite the rapid growth of online shopping, the 'bricks and mortar' retail sector is faring quite well, headed by power centers, grocery-anchored centers, and trophy malls, according BD+C's 2014 Giants 300 Report.

| Jul 28, 2014

Reconstruction market benefits from improving economy, new technology [2014 Giants 300 Report]

Following years of fairly lackluster demand for commercial property remodeling, reconstruction revenue is improving, according to the 2014 Giants 300 report.

| Jul 28, 2014

Reconstruction Sector Construction Firms [2014 Giants 300 Report]

Structure Tone, Turner, and Gilbane top Building Design+Construction's 2014 ranking of the largest reconstruction contractor and construction management firms in the U.S.