Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

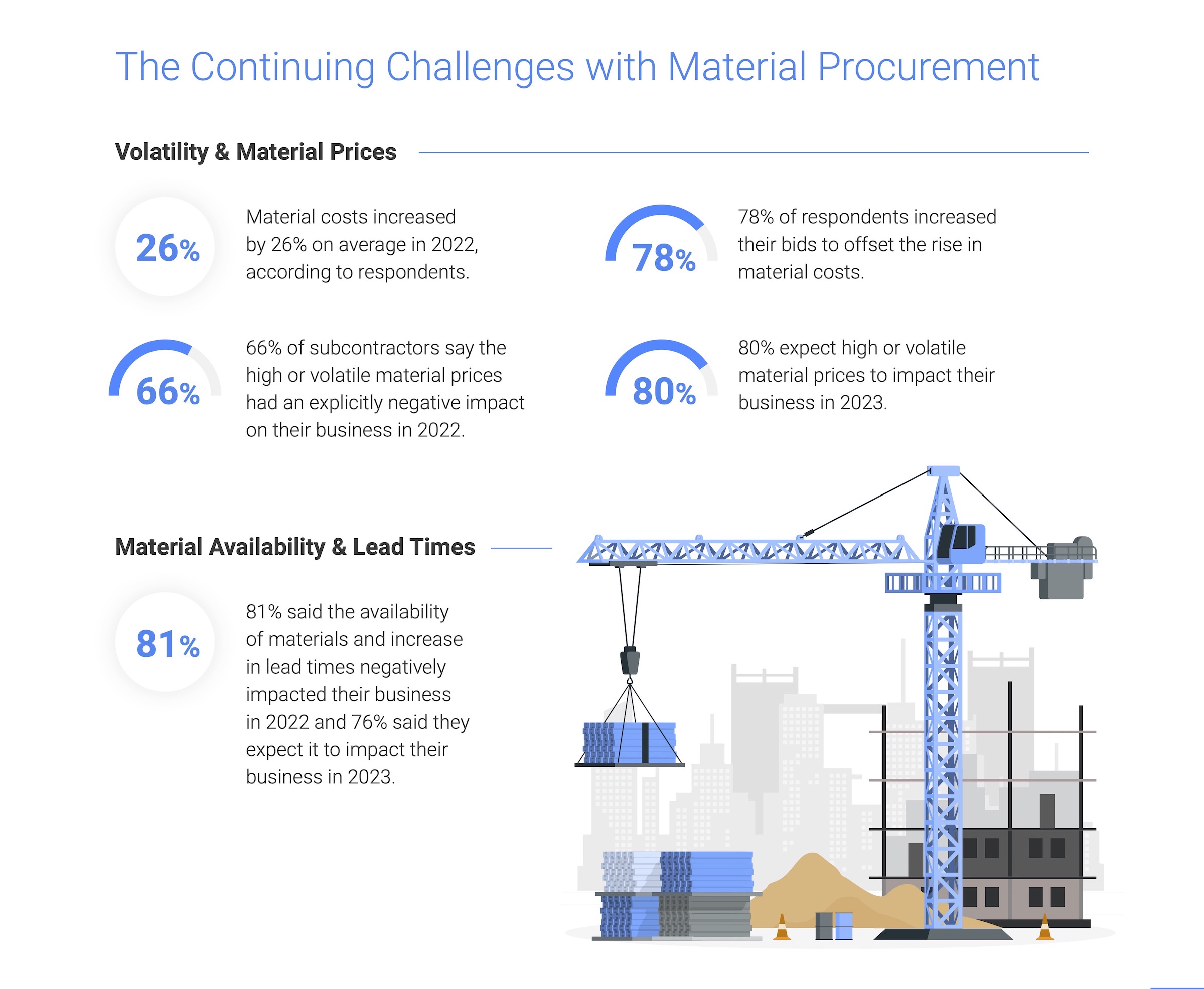

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

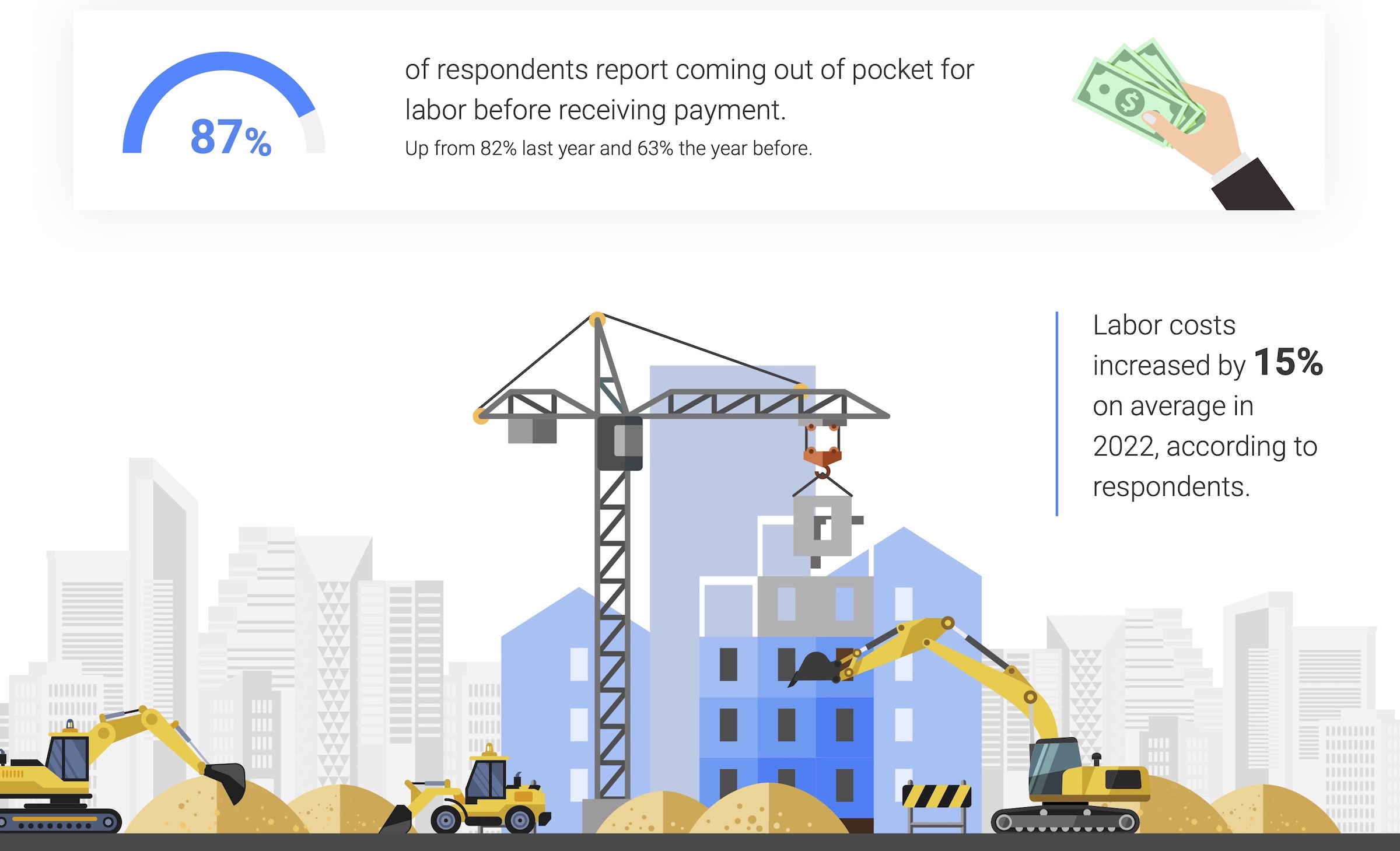

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Aug 11, 2010

PCA partners with MIT on concrete research center

MIT today announced the creation of the Concrete Sustainability Hub, a research center established at MIT in collaboration with the Portland Cement Association (PCA) and Ready Mixed Concrete (RMC) Research & Education Foundation.

| Aug 11, 2010

Study explains the financial value of green commercial buildings

Green building may be booming, especially in the Northwest, but the claims made for high-performance buildings have been slow to gain traction in the financial community. Appraisers, lenders, investors and brokers have found it difficult to confirm the value of high-performance green features and related savings. A new study of office buildings identifies how high-performance green features and systems can increase the value of commercial buildings.

| Aug 11, 2010

Architecture Billings Index drops to lowest level since June

Another stall in the recovery for the construction industry as the Architecture Billings Index (ABI) dropped to its lowest level since June. The American Institute of Architects (AIA) reported the August ABI rating was 41.7, down slightly from 43.1 in July. This score indicates a decline in demand for design services (any score above 50 indicates an increase in billings).

| Aug 11, 2010

Construction employment declined in 333 of 352 metro areas in June

Construction employment declined in all but 19 communities nationwide this June as compared to June-2008, according to a new analysis of metropolitan-area employment data released today by the Associated General Contractors of America. The analysis shows that few places in America have been spared the widespread downturn in construction employment over the past year.

| Aug 11, 2010

Jacobs, Hensel Phelps among the nation's 50 largest design-build contractors

A ranking of the Top 50 Design-Build Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Balfour Beatty agrees to acquire Parsons Brinckerhoff for $626 million

Balfour Beatty, the international engineering, construction, investment and services group, has agreed to acquire Parsons Brinckerhoff for $626 million. Balfour Beatty executives believe the merger will be a major step forward in accomplishing a number of Balfour Beatty’s objectives, including establishing a global professional services business of scale, creating a leading position in U.S. civil infrastructure, particularly in the transportation sector, and enhancing its global reach.

| Aug 11, 2010

Construction unemployment rises to 17.1% as another 64,000 construction workers are laid off in September

The national unemployment rate for the construction industry rose to 17.1 percent as another 64,000 construction workers lost their jobs in September, according to an analysis of new employment data released today. With 80 percent of layoffs occurring in nonresidential construction, Ken Simonson, chief economist for the Associated General Contractors of America, said the decline in nonresidential construction has eclipsed housing’s problems.