Financing solutions provider Billd recently surveyed nearly 900 commercial construction professionals across the U.S. for its 2023 National Subcontractor Market Report. Its key finding: rising input prices for materials and labor cost subcontractors $97 billion in unplanned expenses last year.

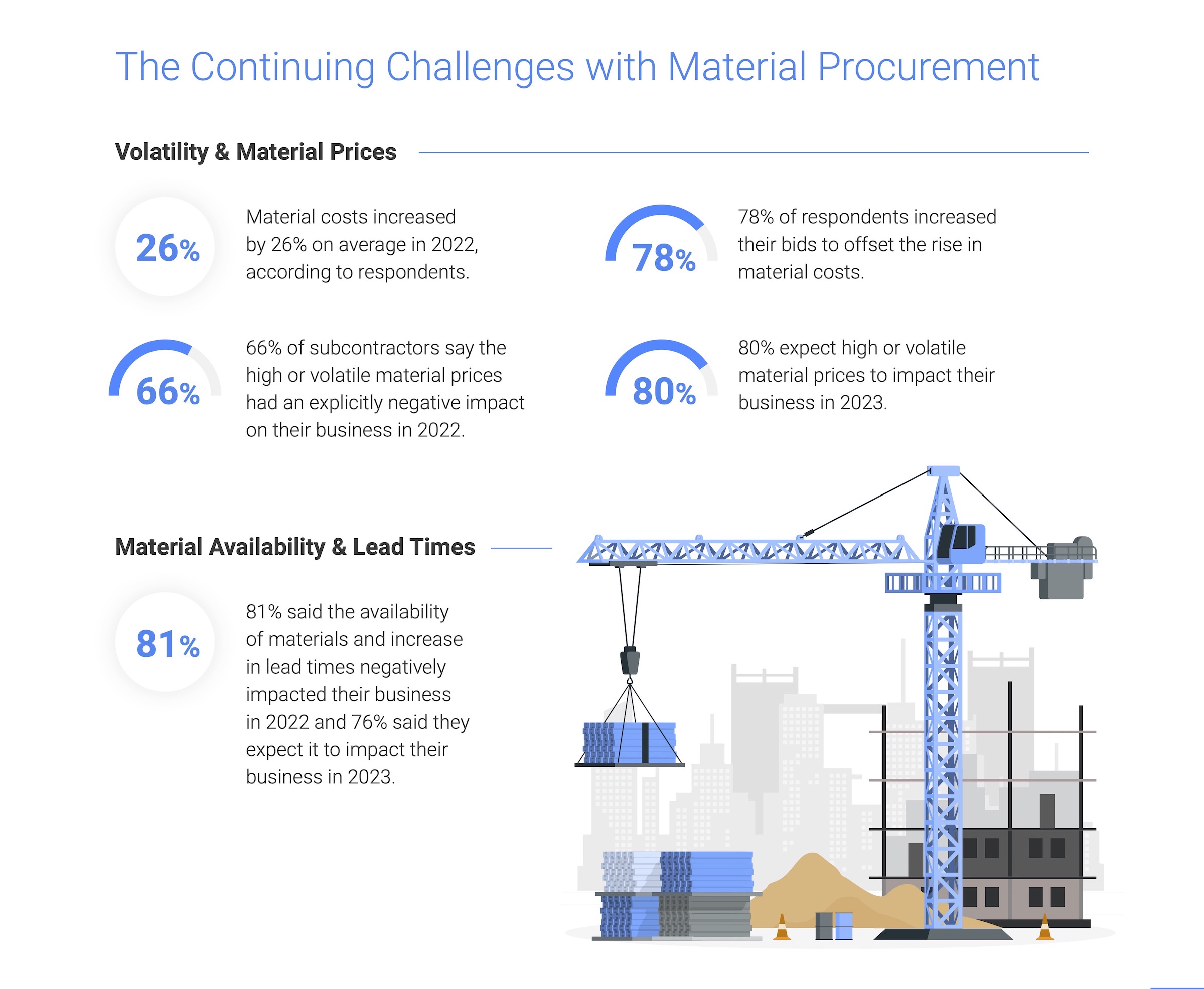

Rising material costs and price volatility are not new issues for subcontractors, with 81% of those surveyed reporting a negative effect on their businesses in 2022; 80% expect that trend to continue. It is no surprise given material costs jumped a staggering 26%, according to respondents. Similarly, competition for labor due to the longtime labor shortage was validated by a 15% average increase in labor cost. Together, those increases amounted to $97 billion in additional expenses for the subcontractor. While some subcontractors increased their bids to offset these rapidly rising costs, one third of respondents were unable to raise those bids commensurate with their expenses. This resulted in 57% of businesses reporting a decrease in profitability, despite 61% reporting revenue growth.

"Subcontractors are the foundation of the construction industry, providing all material and labor to complete a project," said Chris Doyle, CEO of Billd. "They purchase that material and pay for that labor upfront, not being paid for their work for 74 days, a result of the dysfunctional payment cycle. If you add unplanned expenses due to rising costs in material and labor, it puts an unrealistic burden on subcontractors to provide that foundation."

The report examines how macroeconomic conditions from this and prior years impacted subcontractors in 2022, as well as their outlook for 2023. It also creates hope by providing perspective on new financing options subcontractors can leverage as mainstays – like supplier terms – become less reliable. 72% of respondents report having supplier terms of 30 days or less. Compared to a 74-day average wait time for payment, it is no surprise that 51% deem the length of their terms insufficient.

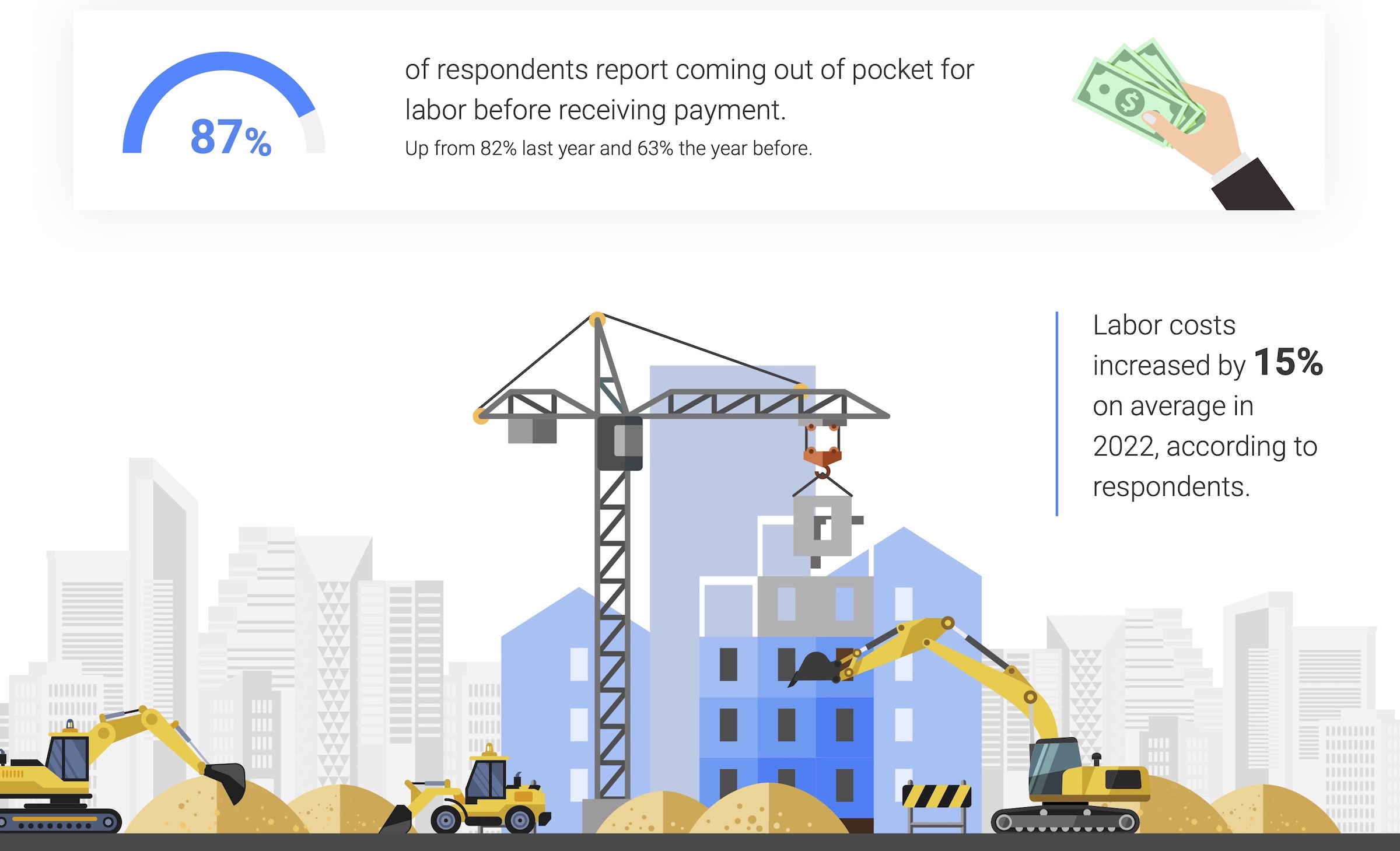

Supplier terms also have an unforeseen cost; most suppliers (also surveyed) state that they offer discounts for upfront payment. Despite those disadvantages, 87% of respondents still rely on supplier terms as their predominant means of buying materials. When it comes to funding their increasing labor costs, traditional financing options are even less accessible, leaving 87% of respondents coming out of pocket for labor before getting paid themselves. Luckily, the report highlights financial relief for labor as well as materials.

Related Stories

| Aug 11, 2010

Structure Tone, Turner among the nation's busiest reconstruction contractors, according to BD+C's Giants 300 report

A ranking of the Top 75 Reconstruction Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Populous selected to design 'crystalline skin' stadium for 2014 Winter Olympics

Russian officials have selected global architect Populous to design the main stadium for the 2014 Winter Olympic and Paralympic Games in Sochi, Russia. The 40,000-seat stadium will feature a crystalline skin that "engages with its surroundings by day and provides an iconic representation of the color and spectacle of the games when illuminated at night," said Populous senior principal John Barrow.

| Aug 11, 2010

Three Opus Corporation companies file for bankruptcy

Opus Corporation, a developer headquartered in Minnetonka, Minn., filed for bankruptcy in three of its five regional operating companies: Opus East, Opus South, and Opus West. CEO Mark Rauenhorst said sharp declines in commercial real estate values and tight credit markets caused difficulties in refinancing assets and restructuring lending agreements.

| Aug 11, 2010

Best AEC Firms of 2011/12

Later this year, we will launch Best AEC Firms 2012. We’re looking for firms that create truly positive workplaces for their AEC professionals and support staff. Keep an eye on this page for entry information. +

| Aug 11, 2010

Clark Group, Mortenson among nation's busiest state/local government contractors, according to BD+C's Giants 300 report

A ranking of the Top 40 State/Local Government Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit /giants

| Aug 11, 2010

Report: Building codes and regulations impede progress toward uber-green buildings

The enthusiasm for super green Living Buildings continues unabated, but a key stumbling block to the growth of this highest level of green building performance is an existing set of codes and regulations. A new report by the Cascadia Region Green Building Council entitled "Code, Regulatory and Systemic Barriers Affecting Living Building Projects" presents a case for fundamental reassessment of building codes.

| Aug 11, 2010

Call for entries: Building enclosure design awards

The Boston Society of Architects and the Boston chapter of the Building Enclosure Council (BEC-Boston) have announced a High Performance Building award that will assess building enclosure innovation through the demonstrated design, construction, and operation of the building enclosure.

| Aug 11, 2010

Portland Cement Association offers blast resistant design guide for reinforced concrete structures

Developed for designers and engineers, "Blast Resistant Design Guide for Reinforced Concrete Structures" provides a practical treatment of the design of cast-in-place reinforced concrete structures to resist the effects of blast loads. It explains the principles of blast-resistant design, and how to determine the kind and degree of resistance a structure needs as well as how to specify the required materials and details.