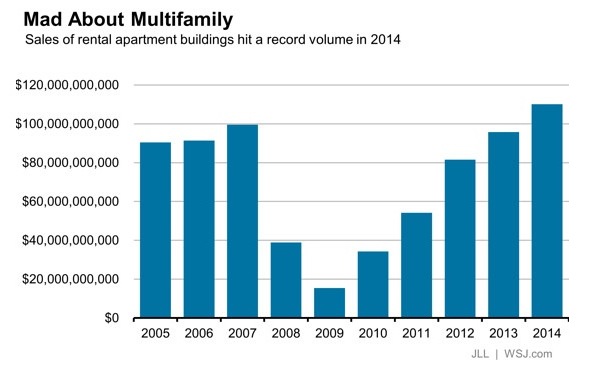

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year, according to Jones Lang LaSalle (JLL), a professional services and investment management firm.

Nearly half of those transactions were for buildings in six metros: New York, Los Angeles, Atlanta, Houston, Dallas, and Washington D.C. And the allure of owning rental properties in America’s largest cities continues into 2015, the Wall Street Journal reported.

Blackstone Group, the world’s largest private equity holder of real estate, in late January agreed to pay $1.7 billion for 36 properties with an estimated 11,000 apartment units, half of which are in Washington D.C. and Boston. The seller was Praedium Group, which JLL and Evercore Partners advised. The deal increases to 43,000 the number of apartment units managed by LivCor, Blackstone’s multifamily real estate unit, according to Crain’s Chicago Business.

The multifamily sector “has become the preferred asset class of institutional investors” since the last economic downturn, says Jubeen Vaghefi, managing director of JLL’s capital markets division. That opinion is consistent with what Vaghefi wrote in JLL’s Fall 2014 Multifamily Outlook: “The ability for multifamily starts to occur 3.5 times faster than the overall market is due to the combination of higher oversupply of single-family homes throughout the United States, a marked preference for multi-unit buildings, and residential development in core submarkets, which continue to post high occupancy rates.”

The question now is how long investors will ride this gravy train, especially if increasing supply adversely impacts rent appreciation.

The Census Bureau’s latest data for housing starts, which it released on January 21, 2015, estimates that 456,000 units were under construction in buildings with five or more units at the end of December 2014, or 26% more than in December 2013. The possibility that this market may be overheating, though, is reflected in annualized multifamily starts, which inched up by only 0.3% in December to 339,000 units. Annualized multifamily permits issued stood at 338,000 units in December, down 12.4% from December 2013

On a less ambiguous note, rents increased by 3.6% nationwide in 2014, according to Reis, the real-estate research firm. Apartment vacancy rates, at 4.2%, were near their lowest levels in 2001. And the days of excess demand that has kept rents under control “are likely over,” Ryan Severino, Reis’ senior economist, stated.

JLL contends that with vacancies stabilizing and with the market average of inventory under construction at 4.4% and growing, “the pace of multifamily tightening is softening, with projected rent growth between 2% and 3% over the next 18 months.”

Related Stories

Multifamily Housing | Apr 22, 2021

The Weekly Show, Apr 22, 2021: COVID-19's impact on multifamily amenities

This week on The Weekly show, BD+C's Robert Cassidy speaks with three multifamily design experts about the impact of COVID-19 on apartment and condo amenities, based on the 2021 Multifamily Amenities Survey.

Multifamily Housing | Apr 20, 2021

Two new residential towers set to rise in Nashville

Goettsch Partners is designing the buildings.

Multifamily Housing | Apr 14, 2021

Miami's Adela at MiMo Bay combines a residential building with an American Legion facility

The five-story residential building features 236 units and a new American Legions Facility for military veterans.

Multifamily Housing | Apr 12, 2021

103 income-restricted residential units under construction in Downtown Denver

KTGY is designing the project.

Multifamily Housing | Apr 2, 2021

250-unit rental building opens in Brooklyn

CetraRuddy designed the project.

Multifamily Housing | Mar 30, 2021

Bipartisan ‘YIMBY’ bill would provide $1.5B in grants to spur new housing

Resources for local leaders to overcome obstacles such as density-unfriendly or discriminatory zoning.

Multifamily Housing | Mar 30, 2021

ProCONNECT Multifamily, ProCONNECT Single-Family open for Developers, Builders, Architects

Sponsors and Attendees can still sign up for ProCONNECT Multifamily April 21-22, ProCONNECT Single-Family for May 18-19

Multifamily Housing | Mar 28, 2021

Smart home technology 101 for multifamily housing communities

Bulk-services Wi-Fi leads to better connectivity, products, and services to help multifamily developers create greater value for residents–and their own bottom line.

Multifamily Housing | Mar 27, 2021

Designing multifamily housing today for the post-Covid world of tomorrow

The multifamily market has changed dramatically due to the Covid pandemic. Here's how one architecture firm has accommodate their designs to what tenants are now demanding.