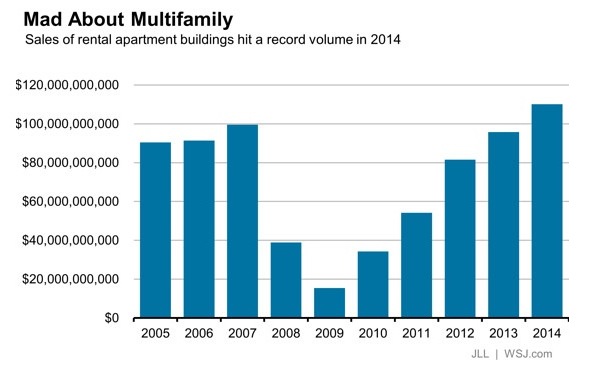

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year, according to Jones Lang LaSalle (JLL), a professional services and investment management firm.

Nearly half of those transactions were for buildings in six metros: New York, Los Angeles, Atlanta, Houston, Dallas, and Washington D.C. And the allure of owning rental properties in America’s largest cities continues into 2015, the Wall Street Journal reported.

Blackstone Group, the world’s largest private equity holder of real estate, in late January agreed to pay $1.7 billion for 36 properties with an estimated 11,000 apartment units, half of which are in Washington D.C. and Boston. The seller was Praedium Group, which JLL and Evercore Partners advised. The deal increases to 43,000 the number of apartment units managed by LivCor, Blackstone’s multifamily real estate unit, according to Crain’s Chicago Business.

The multifamily sector “has become the preferred asset class of institutional investors” since the last economic downturn, says Jubeen Vaghefi, managing director of JLL’s capital markets division. That opinion is consistent with what Vaghefi wrote in JLL’s Fall 2014 Multifamily Outlook: “The ability for multifamily starts to occur 3.5 times faster than the overall market is due to the combination of higher oversupply of single-family homes throughout the United States, a marked preference for multi-unit buildings, and residential development in core submarkets, which continue to post high occupancy rates.”

The question now is how long investors will ride this gravy train, especially if increasing supply adversely impacts rent appreciation.

The Census Bureau’s latest data for housing starts, which it released on January 21, 2015, estimates that 456,000 units were under construction in buildings with five or more units at the end of December 2014, or 26% more than in December 2013. The possibility that this market may be overheating, though, is reflected in annualized multifamily starts, which inched up by only 0.3% in December to 339,000 units. Annualized multifamily permits issued stood at 338,000 units in December, down 12.4% from December 2013

On a less ambiguous note, rents increased by 3.6% nationwide in 2014, according to Reis, the real-estate research firm. Apartment vacancy rates, at 4.2%, were near their lowest levels in 2001. And the days of excess demand that has kept rents under control “are likely over,” Ryan Severino, Reis’ senior economist, stated.

JLL contends that with vacancies stabilizing and with the market average of inventory under construction at 4.4% and growing, “the pace of multifamily tightening is softening, with projected rent growth between 2% and 3% over the next 18 months.”

Related Stories

ProConnect Events | Apr 23, 2024

5 more ProConnect events scheduled for 2024, including all-new 'AEC Giants'

SGC Horizon present 7 ProConnect events in 2024.

Mixed-Use | Apr 23, 2024

A sports entertainment district is approved for downtown Orlando

This $500 million mixed-use development will take up nearly nine blocks.

Resiliency | Apr 22, 2024

Controversy erupts in Florida over how homes are being rebuilt after Hurricane Ian

The Federal Emergency Management Agency recently sent a letter to officials in Lee County, Florida alleging that hundreds of homes were rebuilt in violation of the agency’s rules following Hurricane Ian. The letter provoked a sharp backlash as homeowners struggle to rebuild following the devastating 2022 storm that destroyed a large swath of the county.

Student Housing | Apr 19, 2024

$115 million Cal State Long Beach student housing project will add 424 beds

A new $115 million project recently broke ground at California State University, Long Beach (CSULB) that will add housing for 424 students at below-market rates. The 108,000 sf La Playa Residence Hall, funded by the State of California’s Higher Education Student Housing Grant Program, will consist of three five-story structures connected by bridges.

Sponsored | Multifamily Housing | Apr 19, 2024

5 Reasons to Opt for Wood I-Joists in Multifamily Construction

From versatility to reliability and adaptability, engineered wood I-joists offer builders, designers and developers numerous advantages in multifamily construction. Discover the top five benefits and handy installation tips.

MFPRO+ News | Apr 18, 2024

Marquette Companies forms alliance with Orion Residential Advisors

Marquette Companies, a national leader in multifamily development, investment, and management, announces its strategic alliance with Deerfield, Ill.-based Orion Residential Advisors, an integrated multifamily investment and operating firm active in multiple markets nationwide.

MFPRO+ New Projects | Apr 16, 2024

Marvel-designed Gowanus Green will offer 955 affordable rental units in Brooklyn

The community consists of approximately 955 units of 100% affordable housing, 28,000 sf of neighborhood service retail and community space, a site for a new public school, and a new 1.5-acre public park.

MFPRO+ News | Apr 15, 2024

Two multifamily management firms merge together

MEB Management Services, a Phoenix-based multifamily management company, and Weller Management, a third-party property management and consulting company, officially merged to become Bryten Real Estate Partners—creating a nationally recognized management company.

Mixed-Use | Apr 13, 2024

Former industrial marina gets adaptive reuse treatment

At its core, adaptive reuse is an active reimagining of the built environment in ways that serve the communities who use it. Successful adaptive reuse uncovers the latent potential in a place and uses it to meet people’s present needs.

MFPRO+ News | Apr 12, 2024

Legal cannabis has cities grappling with odor complaints

Relaxed pot laws have led to a backlash of complaints linked to the odor emitted from smoking and vaping. To date, 24 states have legalized or decriminalized marijuana and several others have made it available for medicinal use.