The CBRE Investor Survey was sent to influential senior housing investors, developers, and brokers throughout the U.S. with the objective of identifying key trends in the senior housing real estate industry in an effort to better understand the state of the rapidly evolving senior housing and care market.

The sector closed another record-setting year in 2015, with 514 institutional transactions closed and $18.7 billion in institutional sales, despite a slowdown in the fourth quarter, according to data from the National Investment Center for the Seniors Housing & Care Industry (NIC). The increase in volume over 2014 was 4.5%, revealing a significant decrease in growth rate, a trend that is consistent with the overall U.S. commercial real estate market.

Among the key findings from the survey: 48% of respondents expect no change in cap rates over the next 12-month period, while 31% expect an increase in cap rates; 21% are expecting to see compression.

The change in capitalization rates in 2015 was minimal compared to prior survey results, signaling that the market cycle is close to reaching a peak. Investor interest (old and new) remains high with 58% of respondents looking to increase their exposure to the space, while participation by public REITs in 2016 is a significant, yet unknown variable.

Senior housing cap rates have averaged at a spread of roughly 518 basis points (bps) to the 10-year Treasury, with the most recent indicated spread falling above the historical average at 554 bps. This indicates room for further compression as interest rates creep upward, according to CBRE. As a point of reference, multifamily cap rates currently represent a 215 bps spread.

Total senior housing returns were reported at 16.3%, 14.8%, and 13.3% over a one-, five-, and 10-year period. These returns have outperformed multifamily returns and the NCREIF Property Index over the same periods.

The number of units under construction has increased from 22,975 at the end of 2012 to 48,903 as of 4Q 2015. With an average development period of 12 to 15 months, a significant portion of this supply will come on line in 2016. This is a major concern in the industry.

“The seniors housing landscape is evolving with the increased presence of sophisticated capital, market transparency, operational efficiencies and technological advances. This can be compared to the institutionalization that the multifamily sector experienced from the mid-1990s to early 2000s,” said Zach Bowyer, MAI, National Practice Leader for CBRE’s seniors housing specialty practice. “Increased investment activity, coupled with increased construction activity, has resulted in an increased demand for experienced operators. Growing pains are expected as the market expands, and property management continues to be a key factor in protecting the value of a seniors housing asset.”

For a PDF copy of the CBRE Senior Housing Investor Survey & Market Outlook, click here.

Related Stories

Transit Facilities | Dec 4, 2023

6 guideposts for cities to create equitable transit-oriented developments

Austin, Texas, has developed an ETOD Policy Toolkit Study to make transit-oriented developments more equitable for current and future residents and businesses.

Multifamily Housing | Nov 30, 2023

A lasting housing impact: Gen-Z redefines multifamily living

Nathan Casteel, Design Leader, DLR Group, details what sets an apartment community apart for younger generations.

Products and Materials | Nov 30, 2023

Top building products for November 2023

BD+C Editors break down 15 of the top building products this month, from horizontal sliding windows to discreet indoor air infusers.

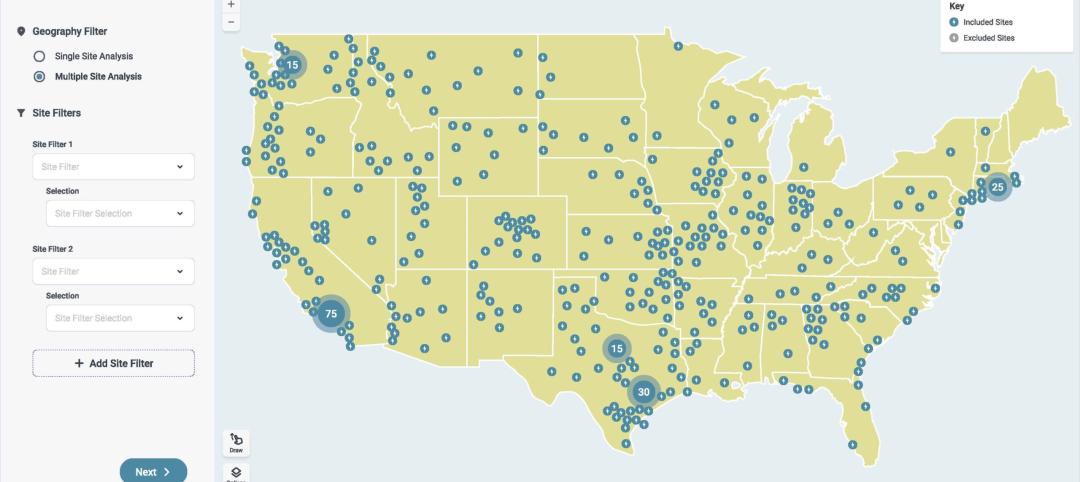

Engineers | Nov 27, 2023

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

MFPRO+ Blog | Nov 27, 2023

7 ways multifamily designers can promote wellness in urban communities

Shepley Bulfinch's Natalie Shutt-Banks, AIA, identifies design elements that multifamily developers can use to maximize space while creating a positive impact on residents and the planet

MFPRO+ New Projects | Nov 21, 2023

An 'eco-obsessed' multifamily housing project takes advantage of downtown Austin’s small lots

In downtown Austin, Tex., architecture firm McKinney York says it built Capitol Quarters to be “eco-obsessed, not just eco-minded.” With airtight walls, better insulation, and super-efficient VRF (variable refrigerant flow) systems, Capitol Quarters uses 30% less energy than other living spaces in Austin, according to a statement from McKinney York.

MFPRO+ News | Nov 21, 2023

California building electrification laws could prompt more evictions and rent increases

California laws requiring apartment owners to ditch appliances that use fossil fuels could prompt more evictions and rent increases in the state, according to a report from the nonprofit Strategic Actions for a Just Economy. The law could spur more evictions if landlords undertake major renovations to comply with the electrification rule.

MFPRO+ News | Nov 21, 2023

Underused strip malls offer great potential for conversions to residential use

Replacing moribund strip malls with multifamily housing could make a notable dent in the housing shortage and revitalize under-used properties across the country, according to a report from housing nonprofit Enterprise Community Partners.

MFPRO+ News | Nov 21, 2023

Renters value amenities that support a mobile, connected lifestyle

Multifamily renters prioritize features and amenities that reflect a mobile, connected lifestyle, according to the National Multifamily Housing Council (NMHC) and Grace Hill 2024 Renter Preferences Survey.

Sustainability | Nov 20, 2023

8 strategies for multifamily passive house design projects

Stantec's Brett Lambert, Principal of Architecture and Passive House Certified Consultant, uses the Northland Newton Development project to guide designers with eight tips for designing multifamily passive house projects.