The CBRE Investor Survey was sent to influential senior housing investors, developers, and brokers throughout the U.S. with the objective of identifying key trends in the senior housing real estate industry in an effort to better understand the state of the rapidly evolving senior housing and care market.

The sector closed another record-setting year in 2015, with 514 institutional transactions closed and $18.7 billion in institutional sales, despite a slowdown in the fourth quarter, according to data from the National Investment Center for the Seniors Housing & Care Industry (NIC). The increase in volume over 2014 was 4.5%, revealing a significant decrease in growth rate, a trend that is consistent with the overall U.S. commercial real estate market.

Among the key findings from the survey: 48% of respondents expect no change in cap rates over the next 12-month period, while 31% expect an increase in cap rates; 21% are expecting to see compression.

The change in capitalization rates in 2015 was minimal compared to prior survey results, signaling that the market cycle is close to reaching a peak. Investor interest (old and new) remains high with 58% of respondents looking to increase their exposure to the space, while participation by public REITs in 2016 is a significant, yet unknown variable.

Senior housing cap rates have averaged at a spread of roughly 518 basis points (bps) to the 10-year Treasury, with the most recent indicated spread falling above the historical average at 554 bps. This indicates room for further compression as interest rates creep upward, according to CBRE. As a point of reference, multifamily cap rates currently represent a 215 bps spread.

Total senior housing returns were reported at 16.3%, 14.8%, and 13.3% over a one-, five-, and 10-year period. These returns have outperformed multifamily returns and the NCREIF Property Index over the same periods.

The number of units under construction has increased from 22,975 at the end of 2012 to 48,903 as of 4Q 2015. With an average development period of 12 to 15 months, a significant portion of this supply will come on line in 2016. This is a major concern in the industry.

“The seniors housing landscape is evolving with the increased presence of sophisticated capital, market transparency, operational efficiencies and technological advances. This can be compared to the institutionalization that the multifamily sector experienced from the mid-1990s to early 2000s,” said Zach Bowyer, MAI, National Practice Leader for CBRE’s seniors housing specialty practice. “Increased investment activity, coupled with increased construction activity, has resulted in an increased demand for experienced operators. Growing pains are expected as the market expands, and property management continues to be a key factor in protecting the value of a seniors housing asset.”

For a PDF copy of the CBRE Senior Housing Investor Survey & Market Outlook, click here.

Related Stories

Multifamily Housing | Apr 12, 2024

Habitat starts leasing Cassidy on Canal, a new luxury rental high-rise in Chicago

New 33-story Class A rental tower, designed by SCB, will offer 343 rental units.

MFPRO+ News | Apr 10, 2024

5 key design trends shaping tomorrow’s rental apartments

The multifamily landscape is ever-evolving as changing demographics, health concerns, and work patterns shape what tenants are looking for in their next home.

Mixed-Use | Apr 9, 2024

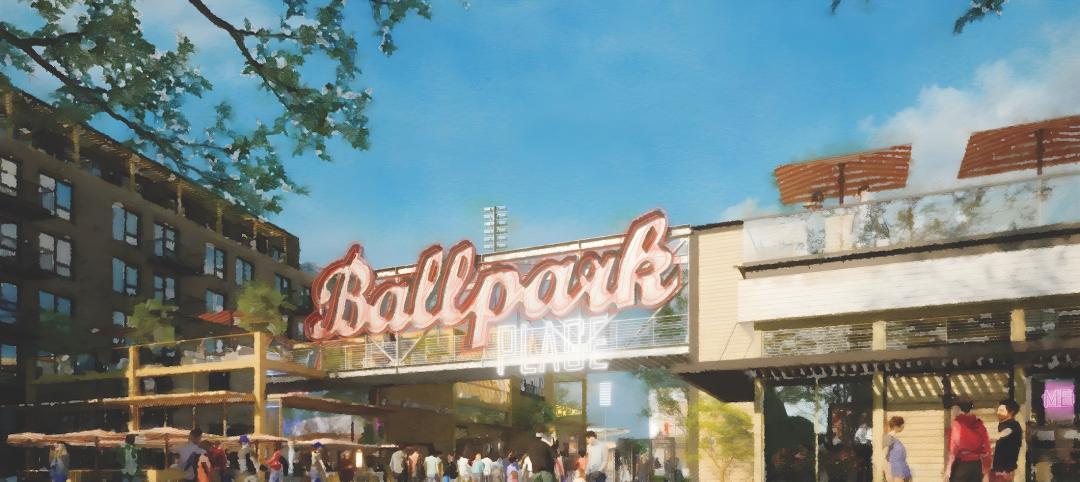

A surging master-planned community in Utah gets its own entertainment district

Since its construction began two decades ago, Daybreak, the 4,100-acre master-planned community in South Jordan, Utah, has been a catalyst and model for regional growth. The latest addition is a 200-acre mixed-use entertainment district that will serve as a walkable and bikeable neighborhood within the community, anchored by a minor-league baseball park and a cinema/entertainment complex.

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

Industry Research | Apr 4, 2024

Expenses per multifamily unit reach $8,950 nationally

Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

Affordable Housing | Apr 1, 2024

Biden Administration considers ways to influence local housing regulations

The Biden Administration is considering how to spur more affordable housing construction with strategies to influence reform of local housing regulations.

Affordable Housing | Apr 1, 2024

Chicago voters nix ‘mansion tax’ to fund efforts to reduce homelessness

Chicago voters in March rejected a proposed “mansion tax” that would have funded efforts to reduce homelessness in the city.

Standards | Apr 1, 2024

New technical bulletin covers window opening control devices

A new technical bulletin clarifies the definition of a window opening control device (WOCD) to promote greater understanding of the role of WOCDs and provide an understanding of a WOCD’s function.

Adaptive Reuse | Mar 26, 2024

Adaptive Reuse Scorecard released to help developers assess project viability

Lamar Johnson Collaborative announced the debut of the firm’s Adaptive Reuse Scorecard, a proprietary methodology to quickly analyze the viability of converting buildings to other uses.

Green | Mar 25, 2024

Zero-carbon multifamily development designed for transactive energy

Living EmPower House, which is set to be the first zero-carbon, replicable, and equitable multifamily development designed for transactive energy, recently was awarded a $9 million Next EPIC Grant Construction Loan from the State of California.