In its latest report on the U.S. office market, JLL notes that a second-quarter rebound this year delivered 11.7 million sf of new office space. Much of what’s being built in the office sector is occurring in the central business districts of cities around the country, as companies gravitate closer to where they believe they’ll have their best shots at attracting Millennial workers.

But to paraphrase Mark Twain, news of the death of suburban office space may be greatly exaggerated. Corporate America hasn’t quite abandoned the suburbs to the extent that some experts were predicting not to long ago.

In its Second-Quarter 2017 Office Market Report, Transwestern singles out New Jersey, where “renewed interest” in suburban office properties helped push the Garden State’s overall average office rents to $26.42 per sf, nearly $2 per sf higher than five years ago and the market’s highest mid-year level since 2001.

CBRE this summer looked at the 25 largest suburban markets it covers, and found “they have performed better than is commonly perceived.” CBRE went on to state that suburban office submarkets with urban characteristics—higher densities of office space, housing, and retail, as well as transportation access—are in the best position to capture occupier demand.

CBRE also found that rents in more than half of the most established suburban submarkets exceed their downtown counterparts.

Despite the flight from suburbs to cities over the past few years by such high-profile companies as General Electric, McDonald’s, Aetna, and ConAgra, suburban and urban office properties that collateralize commercial mortgage-backed securities (CMBS) loans have comparable occupancy rates (89.1% vs. 89.6%), according to a new analysis by Trepp, a leading data provider to the CMBS and banking industries.

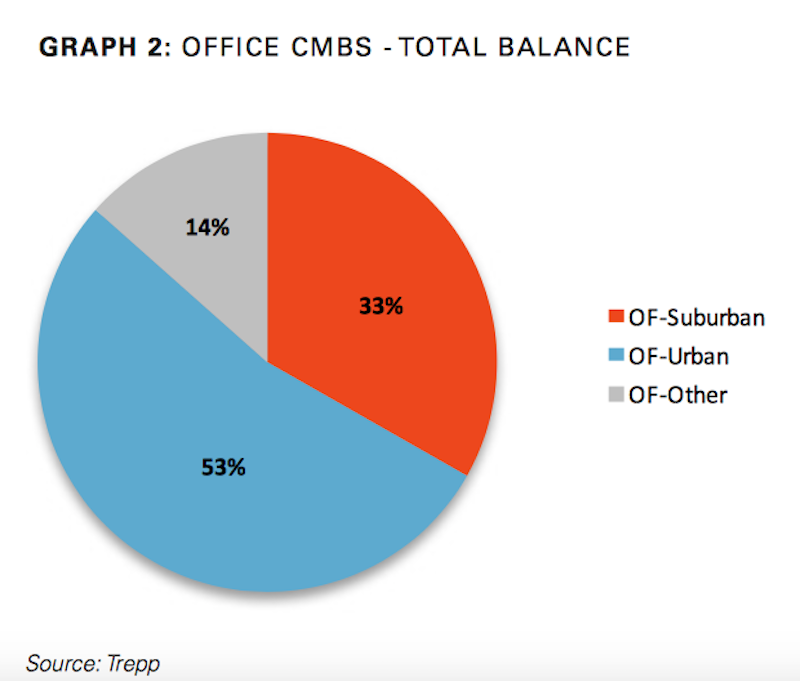

Suburban office loans account for one-third of outstanding CMBS debt. However, they are often more distressed than urban office loans, and have higher rates of delinquency. Image: Trepp

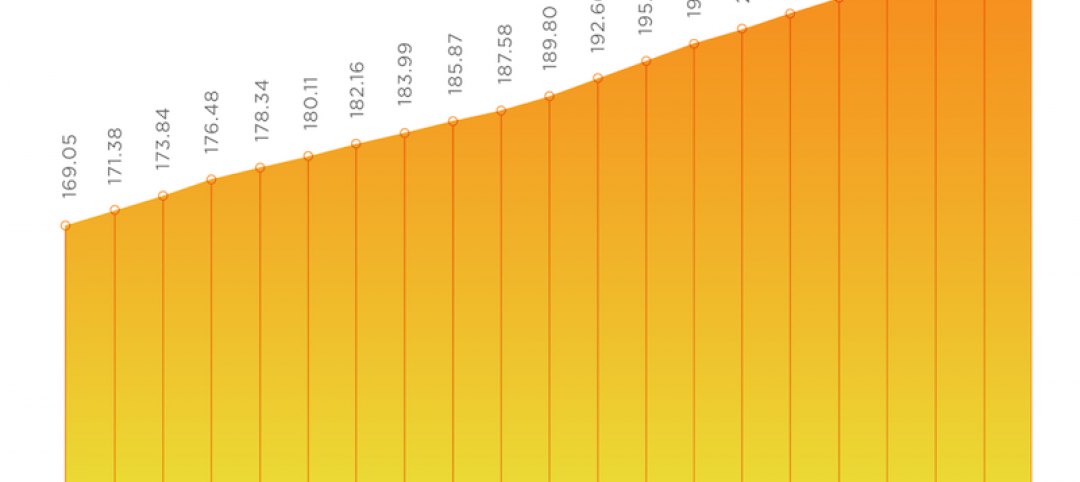

Trepp estimates that suburban office loans account for one-third of the $125.1 billion in outstanding CMBS debt. And new issuance for suburban offices reached $3.2 billion in the first half of 2017, up 43% compared to the same period a year ago. Trepp infers that from these data that “demand is still relatively steady” for suburban office space.

There are caveats, though, not the least of which being that suburban offices carry the highest percentage of distressed debt in the sector: 14.5%, compared to 4.9% for urban office loans. Suburban office loans also carry a noticeably high delinquency rate: 13.3%, which is down from 15.9% in April, but still nearly five percentage points higher than the broader office sector’s delinquencies.

In its analysis, Trepp quotes from Hartford Business, a journal in Connecticut, which observes that the nationwide migration toward urban office space is often a management trend, where companies are reallocating resources and their top talent to office space in cities, but still keep the bulk of their employees in suburban offices.

Related Stories

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.