Societies continue to move toward megacity cultures, lifestyles, and economies that are becoming more vital, in some cases, than the countries that spawn them.

One result of this trend has been a growing tendency among owners, developers, and their Building Teams to package smaller and multiple commercial projects into large, single megaprojects whose construction costs exceed $1 billion, in spite of such projects’ historically erratic success rates and shortcomings.

“Speed to market has become critical for owners. In addition, construction companies are getting larger, making it more feasible for them to handle bigger projects,” explains Ron Magnus, a founding Principal with the market research firm FMI, which has just come out with a new study titled “Megaprojects: Changing the Conversation.”

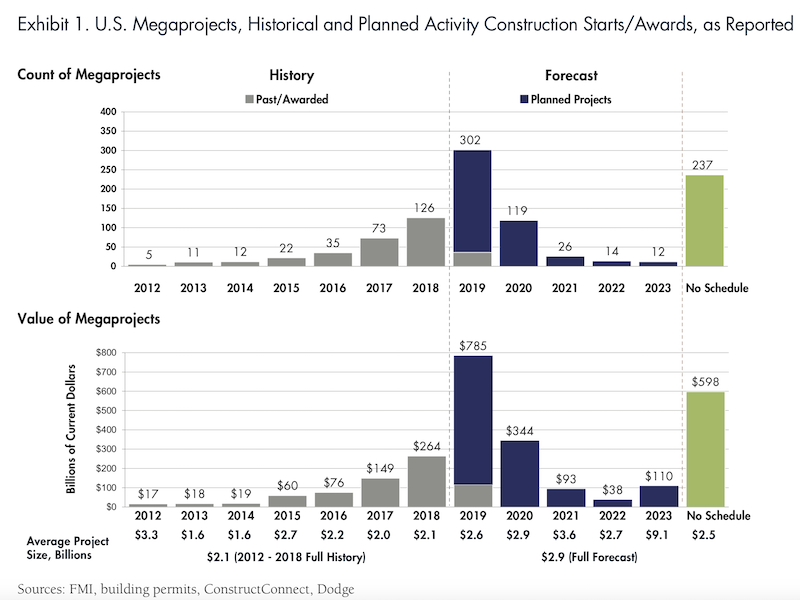

FMI’s report, authored by its content director Sabine Hoover, indicates that at least 320 megaprojects have been awarded in the U.S. alone since 2012—at an aggregate investment valued at over $700 billion.

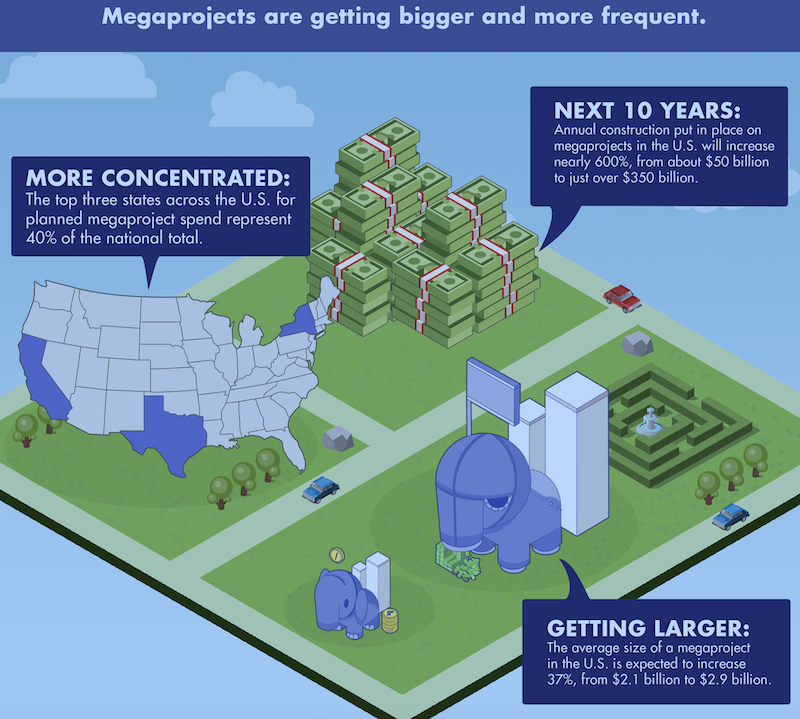

Additionally, more than 670 megaprojects are being planned, a future investment opportunity likely to reach $2 trillion. Most of these planned megaprojects are expected to be built in the South and West, with three states accounting for 40% of the total starts value (New York, 15%; California, 15%; and Texas, 10%).

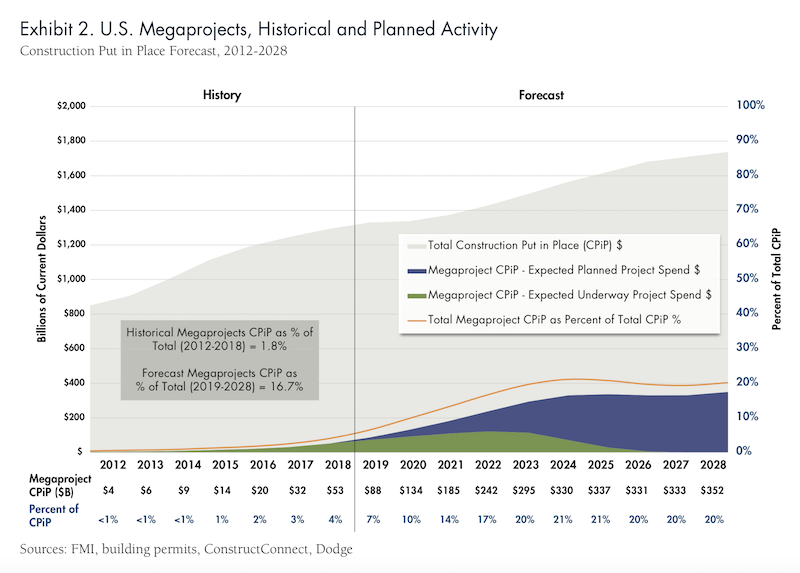

FMI predicts that megaprojects could account for 20% or more of construction spending within the next five years. Chart: FMI

Megaprojects have been expanding in number and value. Between 2013 and 2018, the annual value of U.S. megaproject starts increased from 3% to approximately 33% of all U.S. construction project starts. FMI predicts that, over the next decade, annual construction put in place on megaprojects will explode by nearly 600% to $350 billion.

Measured another way, megaproject construction put in place accounted for only 1.8% of total CPiP between 2012 and 2018. FMI estimates that within the next decade—and possibly within the next five or six years—annual megaproject spending could equal around 20% of total construction spending.

While FMI acknowledges that industrial and infrastructure starts have accounted for the bulk of megaproject starts (61% in 2018), it also sees more evidence of this trend in nonresidential building.

The value of megaproject starts could rise at an especially brisk clip over the next two years. Chart: FMI

The big question, though, is whether the industry is ready to meet this demand. Part of FMI’s research for this report included input from a roundtable of 22 stakeholders—AEC firms, owners, academics—that have engaged megaprojects in the past. From that discussion FMI gleaned five key success factors:

•Trust. Stakeholders on successful megaprojects invest a lot of time upfront in building trust through off-site meetings, getting to know each other on a personal basis. “Trust is the cornerstone, the basic building block,” says Jim Whitaker, FAIA, FDBIA, Principal and Senior Vice President with HKS Inc.

•Culture of Cohesion and Collaboration. DPR Construction on one megaproject spent two weeks with the owner and architect charting the work and setting up its organizational structure. By doing so, the team reduced that project’s budget by $200 million without yielding functionality, square footage, or quality.

Keith Molenaar, associate dean for research at the University of Colorado Boulder, in collaboration with the Pankow Foundation, has studied more than 200 different building projects and found that early collaboration was key to success. The delivery method chosen, on the other hand, had far less impact.

•Transparent and authentic leadership. Effective megaproject leaders, says FMI, are experts in developing a team environment that fosters emotional engagement, shared purpose and accountability.

•Nimble and autonomous teams. Successful megaproject teams are getting away from centralized management and are setting up smaller, more nimble project teams that can move quickly. “Like the platoon model for marines, these teams enjoy a certain degree of autonomy and are empowered to make decisions without approval from the top, and at each decision point,” says FMI.

•Educated and experienced owners. The report quotes Darin Daskarolis, senior director of Global Construction-Data Centers at Facebook, who notes that since commercial construction is largely a relationship-based business, “we knew we had to form strong bonds with our contractors to develop a common and realistic view of the challenges ahead. This common view informed sensible budgets and guided strategic staffing decisions.

The global strategist Parag Khanna sees a world that is becoming more connected by buildings and structures. So where global defense budgets and military spending total about $2 trillion per year, infrastructure spending is expected to increase from $3 trillion today to $9 trillion annually by 2030.

For the U.S., FMI forecasts that half of all megaproject spending over the next three to five years could occur in just 20 metros, and just five of these markets—New York, Los Angeles, Dallas, Houston, and Washington D.C.—will account for one-fifth of total construction in the country. But FMI also ends its report with a cautionary warning for the construction industry. “We have no choice but to completely change our mindsets. Should megaprojects continue to fail just as their spending is expected to reach new heights, the impacts could be devastating to the framework of the E&C industry.”

Related Stories

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

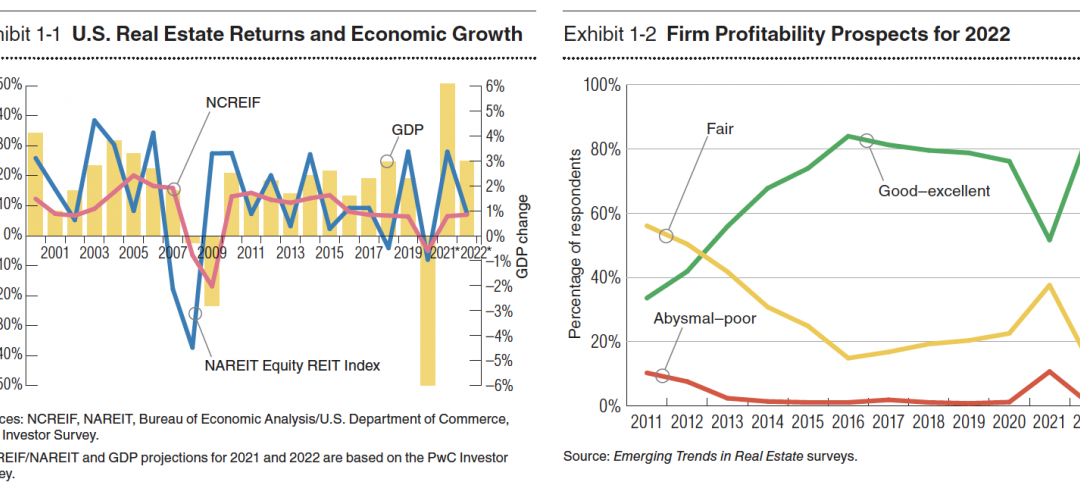

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

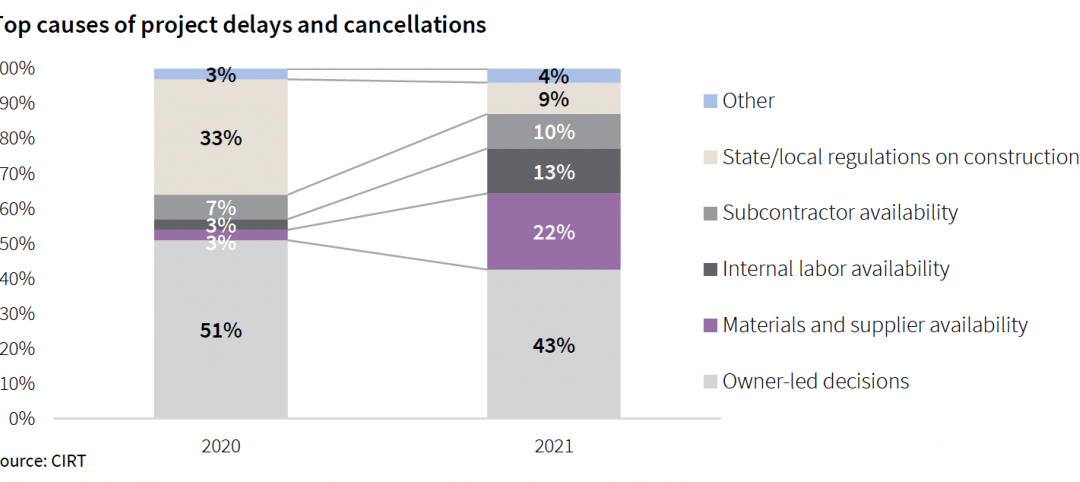

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

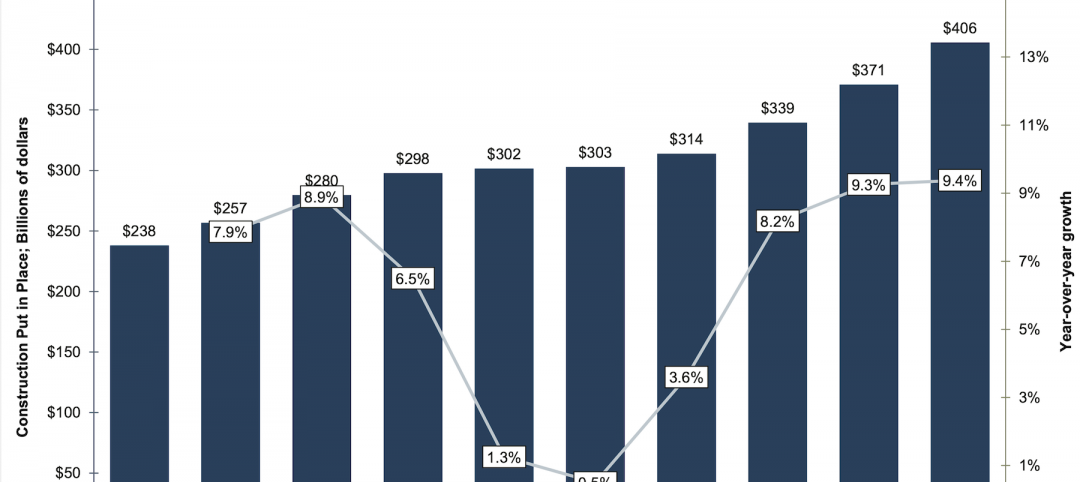

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.