International design and architecture firm Perkins Eastman recently announced the publication of its 2017 Survey on The State of Senior Living: “An Industry in Transition.” For this, the third in a series of industry surveys conducted by Perkins Eastman Research, led by Associate and Senior Design Researcher Emily Chmielewski EDAC, nearly 200 respondents from mostly not-for-profit life plan communities share their expertise and insights on five key issues that “keep them up at night”: Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Some of the respondents’ feedback for “An Industry in Transition” was recorded at the 2016 LeadingAge Conference in Indianapolis, conducted at Perkins Eastman’s exhibition booth, in which a random sampling of senior living providers—mostly from the not-for-profit sector—volunteered to answer an on-the-spot survey question about the key issues facing the industry.

Further survey results and feedback revealed that, among the key focus areas being examined, staff recruitment and retention was the #1 concern among respondents. On this topic, many of those surveyed expressed unease toward how wages significantly outpaced job empowerment, benefits, and/or training, while as many as one in three respondents cited recent improvements in recruitment and retention with the help of job role empowerment interventions. Boomer expectations and healthcare reform were close seconds in terms of respondents’ chief concerns for their respective communities and the industry at large going forward.

The first two State of Senior Living surveys conducted by Perkins Eastman Research were published in 2009/10, in the immediate wake of the Great Recession, and in 2015, which was sub-titled “An Industry Poised for Change.” The reason for the relatively brief turnaround time between the second and third surveys has to do strategic alliances, in particular the expressed importance of partnering with healthcare providers. According to the Survey’s authors, “Our 2015 survey saw a remarkable gap between the current alignment with healthcare systems (29% had no relationship) and their belief that an alignment was in the future (74%). What a difference two years makes! Models involving strategic alliance, partnerships and primary referrals all saw significant growth” during this time.

As a rapidly aging Boomer population reevaluates its priorities going forward, and senior living models readjust to accommodate greater demand for everything from urban settings and intergenerational apartment environments to a la carte services for middle-income residents, the 2017 survey’s findings strongly indicate that strategic partnerships with healthcare systems is on the increase industry-wide. “Given some of the shifts in concerns and priorities, we believe [this latest] survey does speak for an industry already in transition and not just poised for change.”

“An Industry in Transition” is available for free download here.

Related Stories

Market Data | Aug 2, 2017

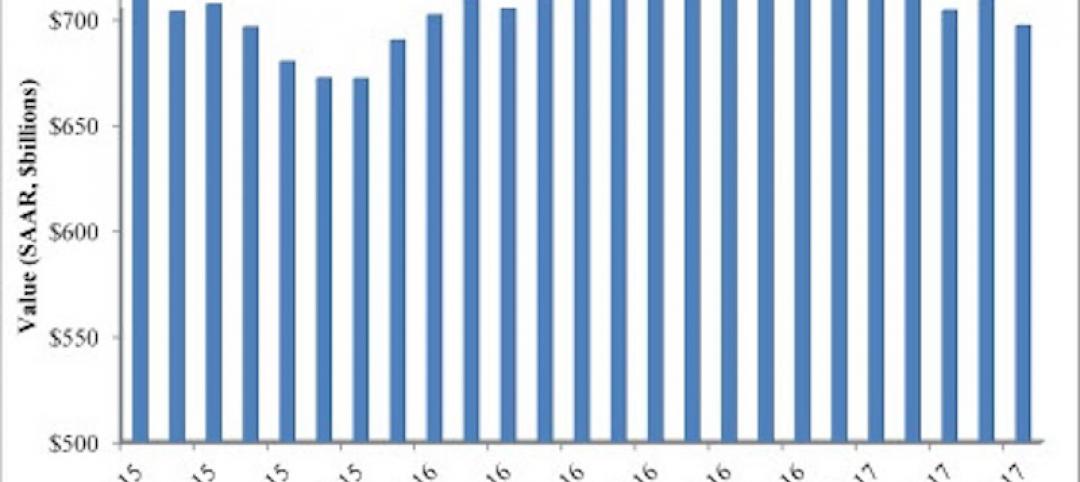

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

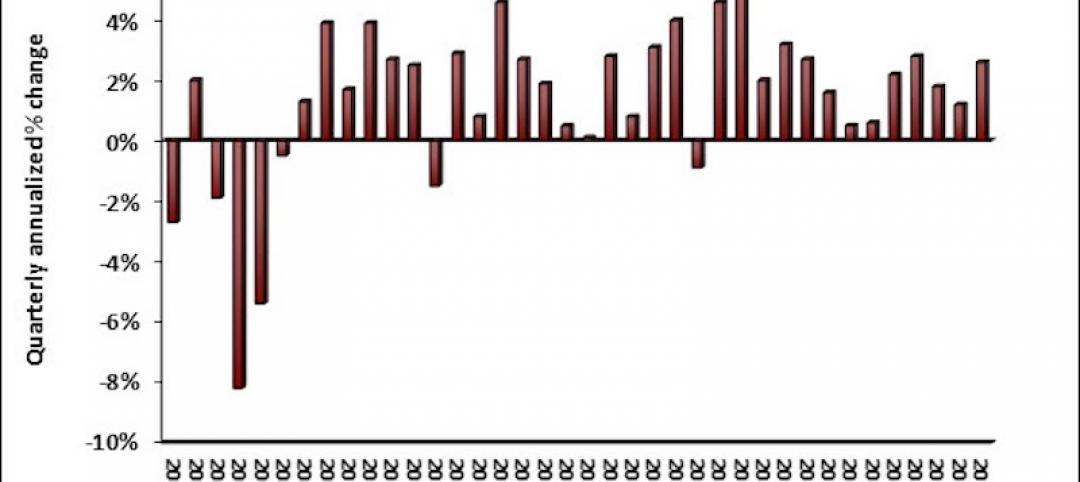

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Architects | Jul 25, 2017

AIA 2030 Commitment expands beyond 400 architecture firms

The 2016 Progress Report is now available.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Industry Research | Jun 27, 2017

What does the client really want?

In order to deliver superior outcomes to our healthcare clients, we have to know what our clients want.

Industry Research | Jun 26, 2017

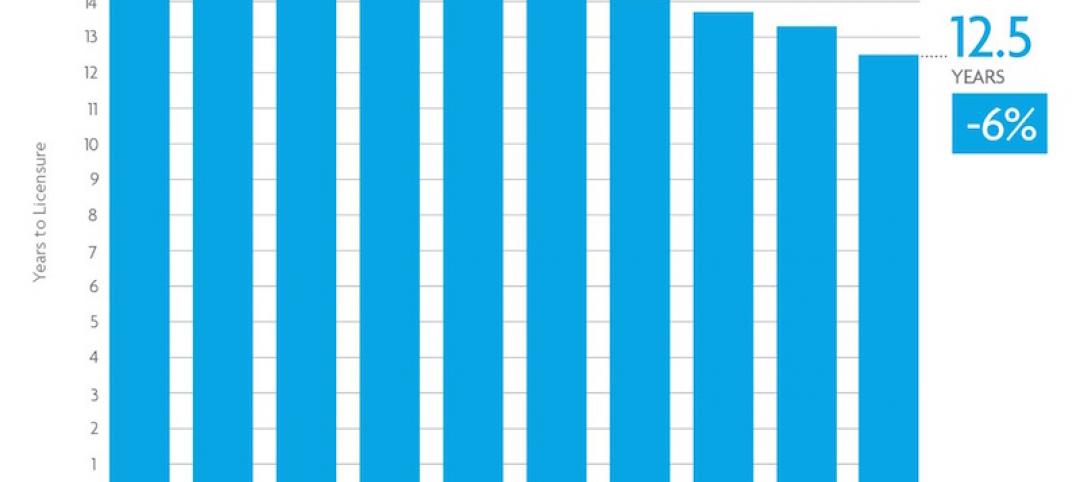

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

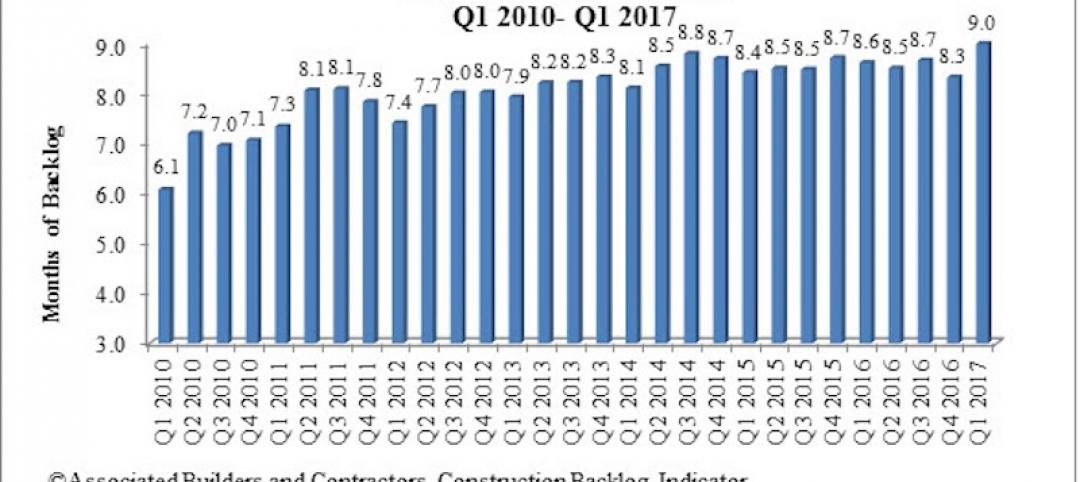

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.