Construction companies remain consistent in their concern about risk exposure in 2016, with respondents reporting in a new survey that their “risk sentiment” has remained steady at 4.4 on a scale of 1-10 (it was at 4.4 at the end of 2015 as well). The latest “Sterling Risk Sentiment Index” shows that most report improving profit margins, but while they say their concerns about staffing are decreasing, access to adequate numbers of employees continues as the No. 1 business risk.

Businesses were also surveyed about how the current election cycle is affecting their businesses. A majority said “election year uncertainty” was having an impact and most felt that the election of a Republican President would improve their business.

The survey noted other key issues of concern. Financial & cash flow issues saw a significant jump (up 8%), with increased competition and government regulation remaining high.

Highlights from the Summer 2016 Sterling Risk Sentiment Index

Note: Where noted, comparisons are with the December 2015 Sterling Risk Sentiment Index

● The #1 risk issue is remains overwhelmingly staffing, with construction companies struggling to have enough employees to handle projects. But the percentage is at 47 percent, down from 60 percent in Fall 2015 Risk Index. Economic issues ranked a distant second at 20 percent.

● Staffing again was the issue companies reported they felt least prepared to deal with right now (30 percent). Health care costs were next (15 percent), followed by cash flow and financial issues (9 percent).

● 64 percent say their company’s exposure for risk is lower than a year ago, a drop from December’s 71 percent.

● 86 percent of respondents say they have formal strategies in place to manage their risk, up from 74 percent in December.

● 75 percent have reviewed their risk management plans in the last 12 months, down from 69 percent.

The new survey also asked construction companies several general questions:

● 80 percent of those surveyed said that they’d see an improvement in their business if a Republican was elected President. Just seven (7) percent said Democrat and ten (10) percent said Libertarian.

● 45 percent said the election year uncertainty affected their businesses. Thirty-seven percent said no and 18 percent didn’t know.

Additional Survey Results

● 84 percent say their profit margins are better today than a year ago

● 88 percent say their pipeline of opportunities is better today than a year ago

● 78 percent say they are able to build adequate contingencies into their project budgets

The Summer 2016 Sterling Risk Sentiment Index surveyed 86 top executives in Atlanta’s construction industry using SurveyMonkey.com. The survey was conducted between July and August 2016.

Related Stories

Mass Timber | Jun 2, 2023

First-of-its-kind shake test concludes mass timber’s seismic resilience

Last month, a 10-story mass timber structure underwent a seismic shake test on the largest shake table in the world.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Industry Research | Apr 25, 2023

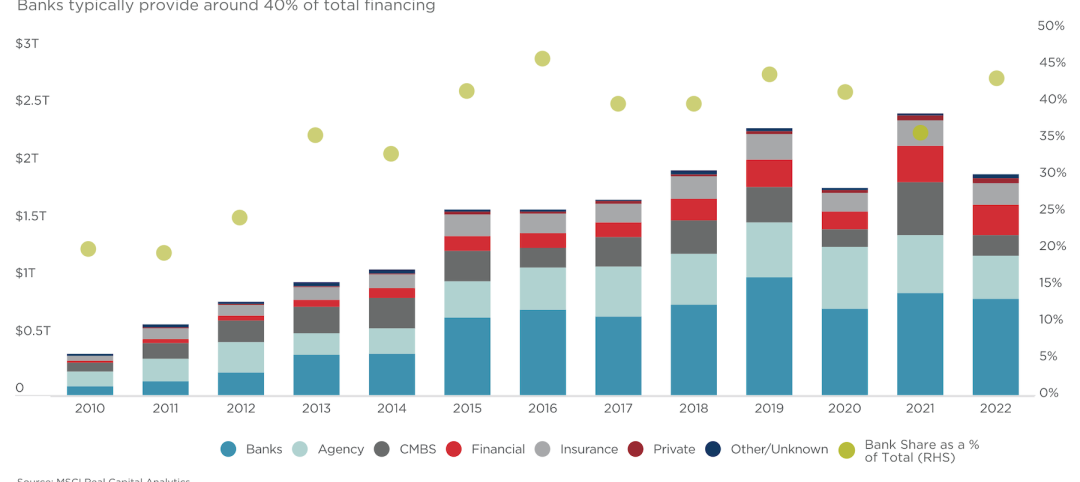

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Self-Storage Facilities | Apr 25, 2023

1 in 5 Americans rent self-storage units, study finds

StorageCafe’s survey of nearly 18,000 people reveals that 21% of Americans are currently using self-storage. The self-storage sector, though not the most glamorous, is essential for those with practical needs for extra space.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

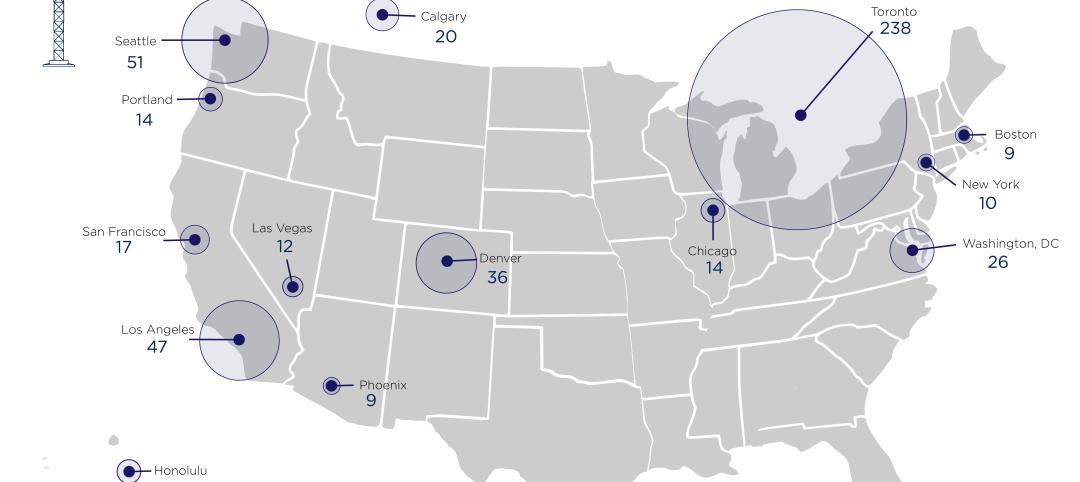

Market Data | Apr 11, 2023

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.