Construction companies remain consistent in their concern about risk exposure in 2016, with respondents reporting in a new survey that their “risk sentiment” has remained steady at 4.4 on a scale of 1-10 (it was at 4.4 at the end of 2015 as well). The latest “Sterling Risk Sentiment Index” shows that most report improving profit margins, but while they say their concerns about staffing are decreasing, access to adequate numbers of employees continues as the No. 1 business risk.

Businesses were also surveyed about how the current election cycle is affecting their businesses. A majority said “election year uncertainty” was having an impact and most felt that the election of a Republican President would improve their business.

The survey noted other key issues of concern. Financial & cash flow issues saw a significant jump (up 8%), with increased competition and government regulation remaining high.

Highlights from the Summer 2016 Sterling Risk Sentiment Index

Note: Where noted, comparisons are with the December 2015 Sterling Risk Sentiment Index

● The #1 risk issue is remains overwhelmingly staffing, with construction companies struggling to have enough employees to handle projects. But the percentage is at 47 percent, down from 60 percent in Fall 2015 Risk Index. Economic issues ranked a distant second at 20 percent.

● Staffing again was the issue companies reported they felt least prepared to deal with right now (30 percent). Health care costs were next (15 percent), followed by cash flow and financial issues (9 percent).

● 64 percent say their company’s exposure for risk is lower than a year ago, a drop from December’s 71 percent.

● 86 percent of respondents say they have formal strategies in place to manage their risk, up from 74 percent in December.

● 75 percent have reviewed their risk management plans in the last 12 months, down from 69 percent.

The new survey also asked construction companies several general questions:

● 80 percent of those surveyed said that they’d see an improvement in their business if a Republican was elected President. Just seven (7) percent said Democrat and ten (10) percent said Libertarian.

● 45 percent said the election year uncertainty affected their businesses. Thirty-seven percent said no and 18 percent didn’t know.

Additional Survey Results

● 84 percent say their profit margins are better today than a year ago

● 88 percent say their pipeline of opportunities is better today than a year ago

● 78 percent say they are able to build adequate contingencies into their project budgets

The Summer 2016 Sterling Risk Sentiment Index surveyed 86 top executives in Atlanta’s construction industry using SurveyMonkey.com. The survey was conducted between July and August 2016.

Related Stories

Market Data | Aug 2, 2017

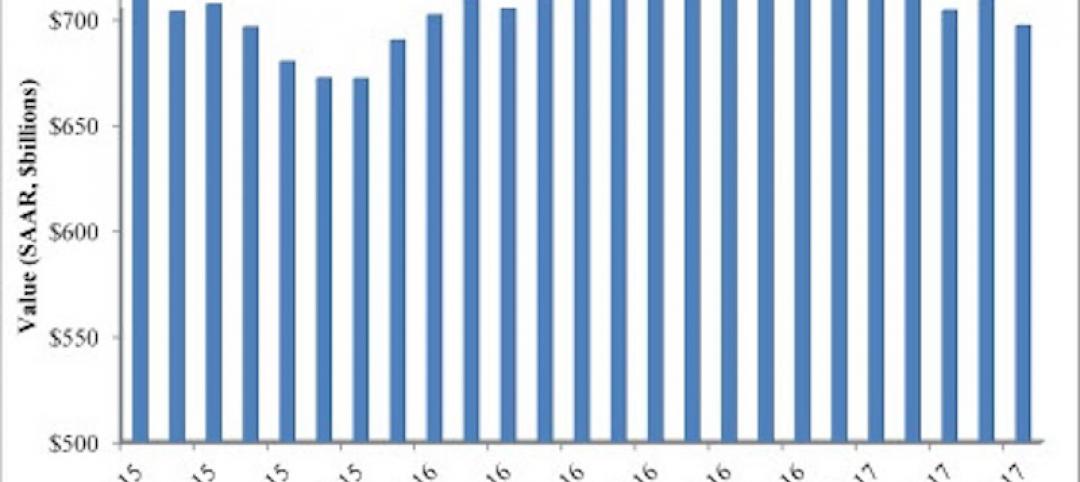

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

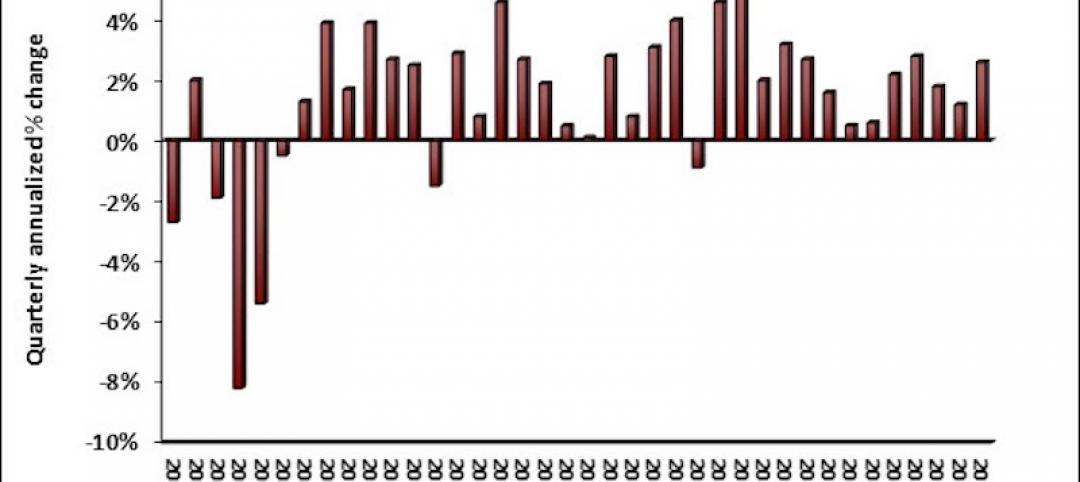

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Architects | Jul 25, 2017

AIA 2030 Commitment expands beyond 400 architecture firms

The 2016 Progress Report is now available.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Industry Research | Jun 27, 2017

What does the client really want?

In order to deliver superior outcomes to our healthcare clients, we have to know what our clients want.

Industry Research | Jun 26, 2017

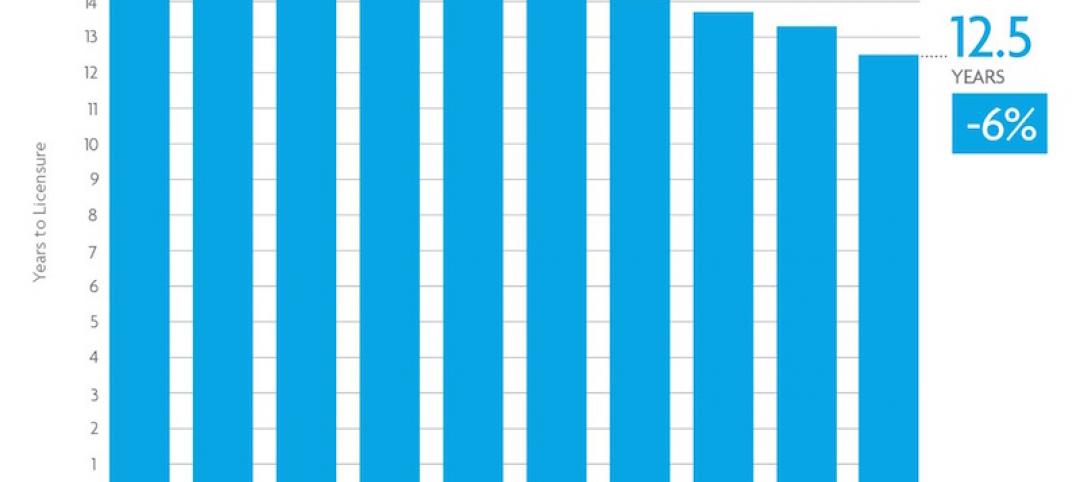

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

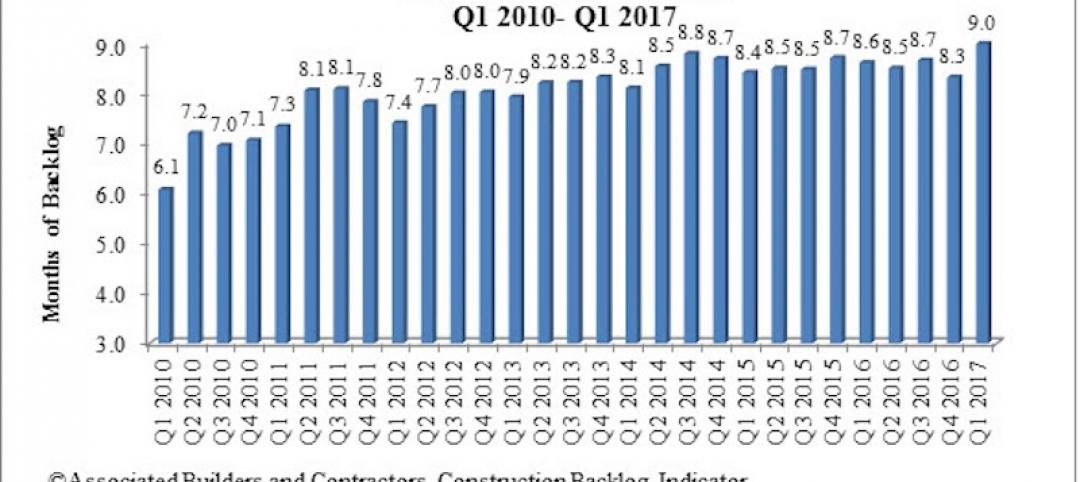

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.