A recent study of over 100 clients, all senior-level real estate development or property management executives by construction management firm Structure Tone finds that while much more common than in years past, sustainable building practices are still seen as cost-prohibitive by many building and real estate leaders.

The anonymous survey was intended to take a snapshot of sustainability in practice across the real estate community. Questions centered on participants’ opinions on third-party certification systems like LEED, challenges to building green, and the newer pressures of climate change resilience and wellness in the built environment.

The responses, collected informally and not as a scientific sampling, illuminated several key points:

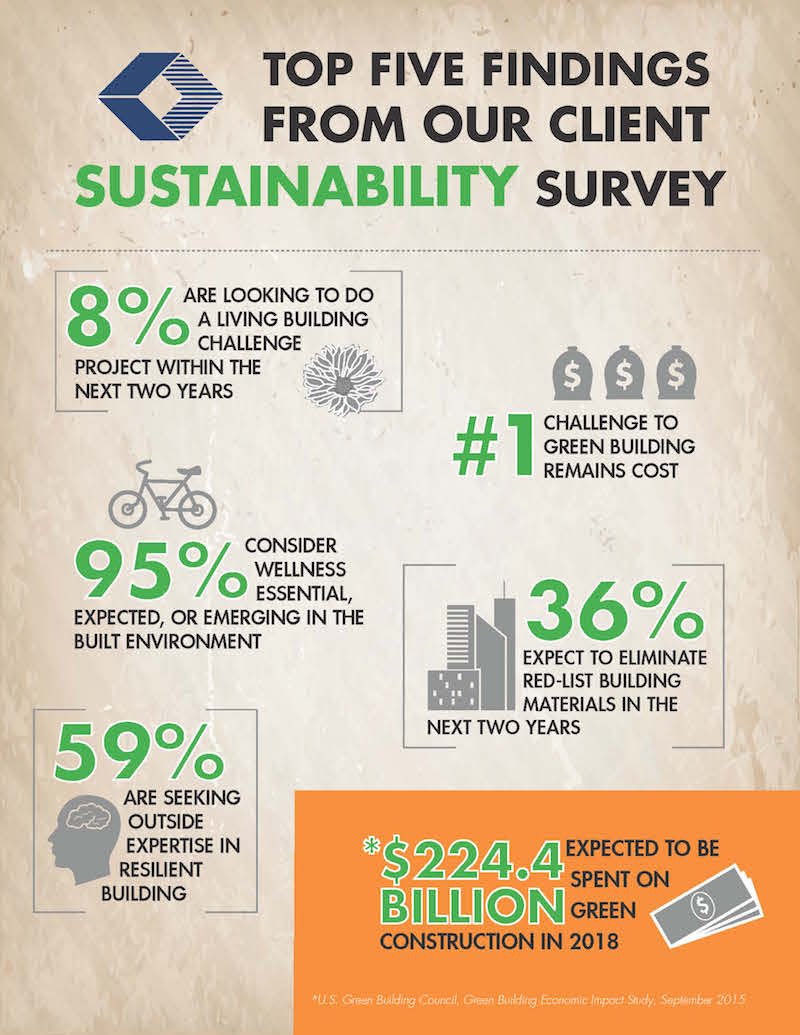

1. Sustainability is more commonplace but still seen as cost prohibitive: 66% of respondents reported incorporating green features to lower operating costs and 36% are looking to eliminate red-list building materials, but upfront costs are still seen as the #1 hindrance to true sustainability.

2. LEED is still the most prevalent program but others are growing. 8% of respondents plan to do a Living Building Challenge within the next two years.

3. Resiliency is a growing concern. 59% reported they are seeking outside expertise in resilient building.

4. Employee wellness is also a rising factor. 95% consider wellness essential, expected or emerging in the built environment. Leadership (44%) and the millennial generation (40%) are seen as driving this new focus and reported attracting and retaining employees as the #1 reason for the growing interest.

“Now that sustainability is well established in our industry and resilience and wellness are increasingly being included in that conversation, we really wanted to take the real-life pulse of how much these issues affect our clients’ decision making,” says Jennifer Taranto, Director of Sustainability at Structure Tone, in a press release. “While the findings aren’t necessarily surprising, they definitely indicate a shift in priorities when it comes to holistic, sustainable building across the real estate development community.”

The survey will be conducted on an annual basis with the intention of using the results to help detect and analyze trends resulting from changing building practices and contextual circumstances and determine what impact these trends may have on the state of sustainable building.

Related Stories

Market Data | May 2, 2017

Nonresidential Spending loses steam after strong start to year

Spending in the segment totaled $708.6 billion on a seasonally adjusted, annualized basis.

Market Data | May 1, 2017

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.