A recent study of over 100 clients, all senior-level real estate development or property management executives by construction management firm Structure Tone finds that while much more common than in years past, sustainable building practices are still seen as cost-prohibitive by many building and real estate leaders.

The anonymous survey was intended to take a snapshot of sustainability in practice across the real estate community. Questions centered on participants’ opinions on third-party certification systems like LEED, challenges to building green, and the newer pressures of climate change resilience and wellness in the built environment.

The responses, collected informally and not as a scientific sampling, illuminated several key points:

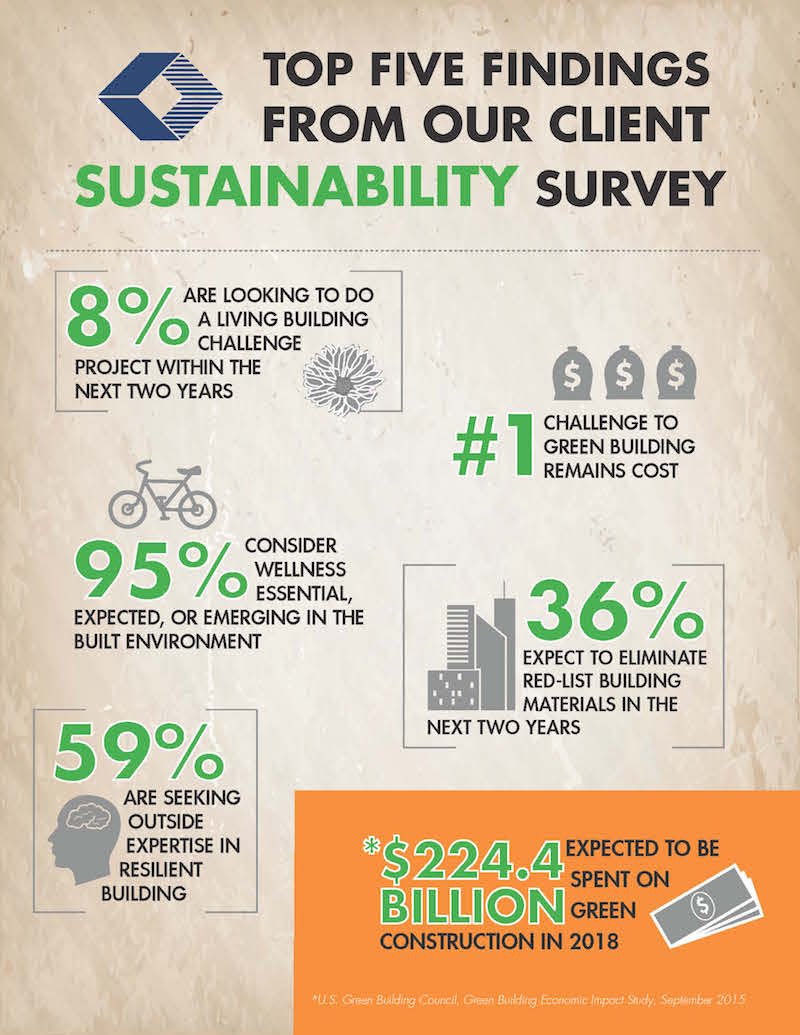

1. Sustainability is more commonplace but still seen as cost prohibitive: 66% of respondents reported incorporating green features to lower operating costs and 36% are looking to eliminate red-list building materials, but upfront costs are still seen as the #1 hindrance to true sustainability.

2. LEED is still the most prevalent program but others are growing. 8% of respondents plan to do a Living Building Challenge within the next two years.

3. Resiliency is a growing concern. 59% reported they are seeking outside expertise in resilient building.

4. Employee wellness is also a rising factor. 95% consider wellness essential, expected or emerging in the built environment. Leadership (44%) and the millennial generation (40%) are seen as driving this new focus and reported attracting and retaining employees as the #1 reason for the growing interest.

“Now that sustainability is well established in our industry and resilience and wellness are increasingly being included in that conversation, we really wanted to take the real-life pulse of how much these issues affect our clients’ decision making,” says Jennifer Taranto, Director of Sustainability at Structure Tone, in a press release. “While the findings aren’t necessarily surprising, they definitely indicate a shift in priorities when it comes to holistic, sustainable building across the real estate development community.”

The survey will be conducted on an annual basis with the intention of using the results to help detect and analyze trends resulting from changing building practices and contextual circumstances and determine what impact these trends may have on the state of sustainable building.

Related Stories

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Industry Research | Jan 31, 2024

ASID identifies 11 design trends coming in 2024

The Trends Outlook Report by the American Society of Interior Designers (ASID) is the first of a three-part outlook series on interior design. This design trends report demonstrates the importance of connection and authenticity.

Apartments | Jan 26, 2024

New apartment supply: Top 5 metros delivering in 2024

Nationally, the total new apartment supply amounts to around 1.4 million units—well exceeding the apartment development historical average of 980,000 units.

Self-Storage Facilities | Jan 25, 2024

One-quarter of self-storage renters are Millennials

Interest in self-storage has increased in over 75% of the top metros according to the latest StorageCafe survey of self-storage preferences. Today, Millennials make up 25% of all self-storage renters.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Adaptive Reuse | Jan 23, 2024

Adaptive reuse report shows 55K impact of office-to-residential conversions

The latest RentCafe annual Adaptive Reuse report shows that there are 55,300 office-to-residential units in the pipeline as of 2024—four times as much compared to 2021.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Multifamily Housing | Jan 15, 2024

Multifamily rent growth rate unchanged at 0.3%

The National Multifamily Report by Yardi Matrix highlights the highs and lows of the multifamily market in 2023. Despite strong demand, rent growth remained unchanged at 0.3 percent.

Apartments | Jan 9, 2024

Apartment developer survey indicates dramatic decrease in starts this year

Over 56 developers, operators, and investors across the country were surveyed in John Burns Research and Consulting's recently-launched Apartment Developer and Investor Survey.