An estimated 140 million sf of shopping center space was built in the U.S. between 2002 and 2008, according ChainLinks Advisors’ Fall/Winter 2013 Retail Review & Forecast. Since then, retail construction has slowed, even as the U.S. remains the world’s largest market in shopping center space, accounting for two-thirds of total gross leasable area tracked by Cushman & Wakefield, according to its latest Global Shopping Center Development Report.

Retail net absorption totaled 109.8 million sf in 2014, according to JLL’s Fourth Quarter 2014 Retail Outlook. Last year exhibited the strongest absorption rate since 2008. But deliveries, at 60.6 million sf, still fell well below absorptions. JLL reported that 55% of last year’s construction activity was “general retail,” consisting of single-tenant freestanding general commercial buildings with parking. Shopping centers accounted for 19.2% of retail construction, malls 18.1%, power centers 4.4%, and specialty retail centers 3.3%.

New York, Miami, and Washington, D. C., showed the highest absorption rates and rent growth. Combined, they accounted for more than two million sf of storefront construction, or about 7% of the U.S. total last year.

Retailers could be doing a better job of meeting customer expectations. The latest American Customer Satisfaction Index, based on surveys of 70,000 customers, found that all retail categories, with the exception of online retail, showed weakening or flat customer satisfaction in 2014.

JLL cites a report by the Royal Bank of Canada and Retail Lease Trac, which estimates that U.S. retailers in RBC’s database plan to open a total of 77,547 stores over the next two years. Some of these stores might end up replacing retailers commonly found in malls that have announced hundreds of store closings, including Macy’s, JC Penney, and Sears, as well as Radio Shack and Wet Seal, both of which have filed for bankruptcy protection.

Retailers could be doing a better job of meeting customer expectations. The latest American Customer Satisfaction Index, based on surveys of 70,000 customers, found that all retail categories, with the exception of online retail, showed weakening or flat customer satisfaction in 2014.

Nordstrom, which is among the handful of retailers that mall developers covet most as anchors, registered the highest satisfaction index—86—of any brick-and-mortar dealer tracked, matching Amazon.com’s 86 index. However, department and discount stores registered their lowest index since 2007. ACSI data show that customers were dissatisfied with their layouts, cleanliness, inventory availability, and speed of checkout.

JLL suggests that malls and shopping centers are more effective as destinations when their tenant mix appeals to customers’ lifestyles beyond shopping and includes fitness centers, gourmet cooking shops, and sustainable-product options.

The success of any mall redevelopment hinges on the appeal of its tenants. JLL singles out Nordstrom, Neiman Marcus, and fashion retailers H&M and Forever 21 as “huge draws.” It also notes that entertainment is “essential” to injecting “new vitality” into a shopping center. This can include casual restaurants like Chipolte or Smashburger, luxury movie theaters like iPic, or specialty big boxes like Dick’s Field & Stream.

JLL recommends that as malls reinvent themselves, they should add more green space, lounging areas, and free WiFi. Technology tools like beacons (see www.BDCnetwork.com/beacon) can help a retail center connect more directly with customers. “By tracking the location of shoppers and interacting with them through their mobile devices, landlords and retailers gain greater control over the timing and customization of their marketing messages,” says JLL.

Related Stories

| Dec 28, 2014

AIA course: Enhancing interior comfort while improving overall building efficacy

Providing more comfortable conditions to building occupants has become a top priority in today’s interior designs. This course is worth 1.0 AIA LU/HSW.

| Dec 28, 2014

7 fresh retail design strategies

Generic ‘boxes’ and indifferent service won’t cut it with today’s savvy shoppers. Retailers are seeking a technology-rich-but-handmade vibe, plus greater speed to market and adaptability.

| Dec 8, 2014

How brick and mortar enables online retail

According to a shopping preferences study conducted by A.T. Kearney, as many as two-thirds of shoppers go to a physical store before or after making an online purchase, writes Gensler's Jill Nickels.

| Dec 2, 2014

Nashville planning retail district made from 21 shipping containers

OneC1TY, a healthcare- and technology-focused community under construction on 18.7 acres near Nashville, Tenn., will include a mini retail district made from 21 shipping containers, the first time in this market containers have been repurposed for such use.

| Nov 26, 2014

Need some pep on the job site? Check out this ruggedized coffeemaker on Kickstarter

The CoffeeBoxx single-serve brewer is billed as the world’s first ruggedized coffeemaker.

| Nov 18, 2014

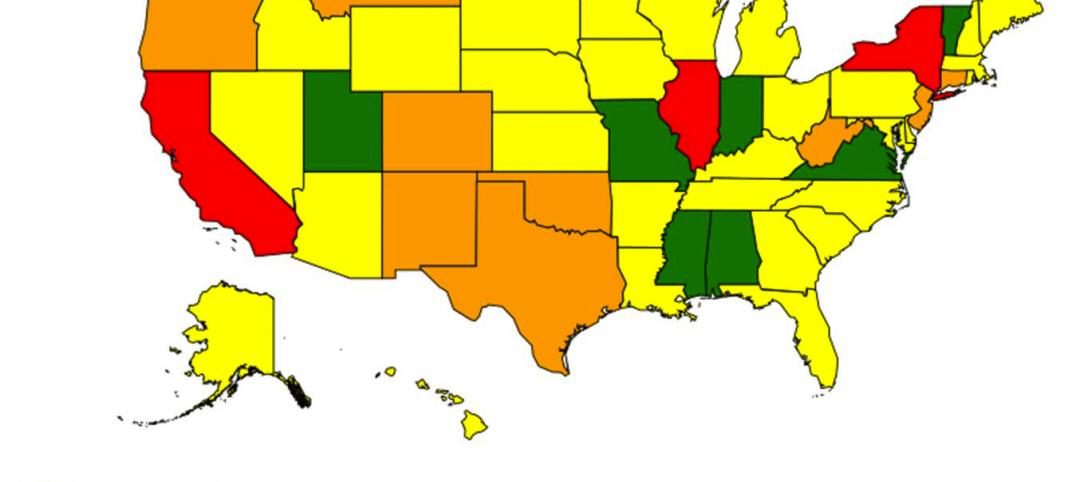

New tool helps developers, contractors identify geographic risk for construction

The new interactive tool from Aon Risk Solutions provides real-time updates pertaining to the risk climate of municipalities across the U.S.

| Nov 10, 2014

Hotel construction pipeline hits five-year high

The hotel construction pipeline hit a five-year high in the third quarter, clocking in at 3,516 projects and 443,936 rooms, Lodging Econometrics reports.

| Nov 3, 2014

Cairo's ultra-green mixed-use development will be topped with flowing solar canopy

The solar canopy will shade green rooftop terraces and sky villas atop the nine-story structure.

| Oct 31, 2014

Dubai plans world’s next tallest towers

Emaar Properties has unveiled plans for a new project containing two towers that will top the charts in height, making them the world’s tallest towers once completed.

| Oct 29, 2014

Better guidance for appraising green buildings is steadily emerging

The Appraisal Foundation is striving to improve appraisers’ understanding of green valuation.