The University of Southern California Lusk Center for Real Estate’s annual analysis of industrial and office real estate in Los Angeles County, Orange County and the Inland Empire shows signs of a slow market recovery.

The 10th Annual Casden Southern California Industrial and Office Forecast reveals that all three areas experienced job growth and increased demand for both property types in 2011. An analysis of each area’s submarkets found lower vacancy rates in 11 of 17 office submarkets and 11 of 14 industrial submarkets. On the rent side, four office submarkets and eight industrial submarkets experienced increases. Overall, declines were smaller than in the previous two years.

“Although Southern California is a long way from pre-crisis levels of economic health, the improved employment picture and profound turnaround in the industrial market are signs of a slow recovery,” said study author Tracey Seslen. “The office market is only slightly improved over last year and vacancy rates may continue to fall for many months before we see rents stabilize.”

As a result, while office demand is expected to grow over the next two years, office rents were down for the third straight year and will continue to decline. On the industrial side, all three markets are expected to see ongoing declines in vacancies and increases in rents over the next two years.

In particular, the Inland Empire’s industrial market – the top performer in 2011 with a 6.4% increase in rents and nearly 17 million square feet of net absorption – is expected to see more growth in the next two years, but the magnitude will depend on rail and port activity.

“Sovereign risk in Europe, geopolitical turmoil and the growing U.S. debt crisis are undermining consumer confidence. Port and rail traffic, particularly activity at the Port of Long Beach, is down and could hinder the positive outlook for industrial rents,” Seslen said. BD+C

Related Stories

Architects | May 26, 2017

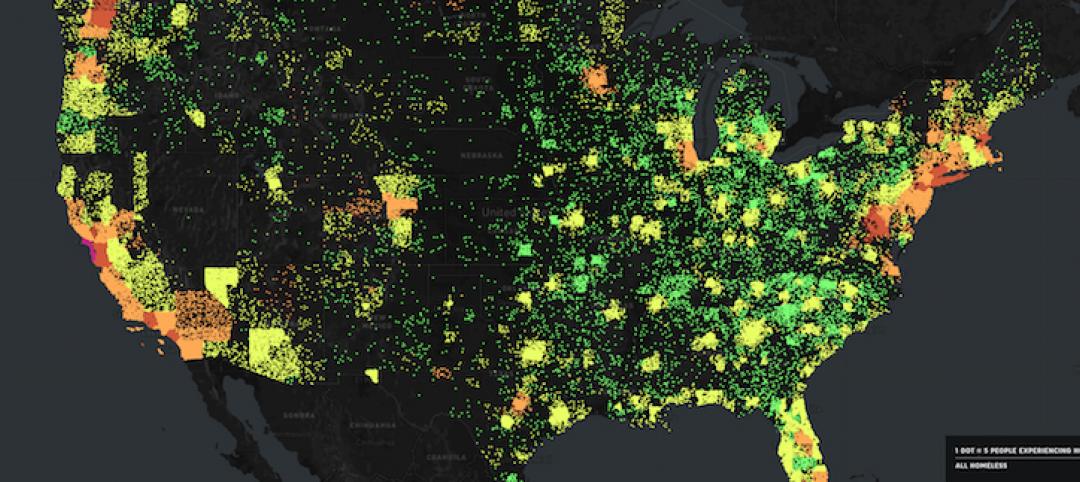

Innovations in addressing homelessness

Parks departments and designers find new approaches to ameliorate homelessness.

Architects | May 26, 2017

BIG plans: Architecture isn’t Bjarke Ingels Group’s only growth path

Kai-Uwe Bergmann, the firm’s head of global business development, says engineering and urban planning are key opportunities. And how about that Hyperloop?

Museums | May 25, 2017

The museum as workspace

Many museum staff are resistant to the idea of open offices.

| May 24, 2017

Accelerate Live! talk: Applying machine learning to building design, Daniel Davis, WeWork

Daniel Davis offers a glimpse into the world at WeWork, and how his team is rethinking workplace design with the help of machine learning tools.

| May 24, 2017

Accelerate Live! talk: Learning from Silicon Valley - Using SaaS to automate AEC, Sean Parham, Aditazz

Sean Parham shares how Aditazz is shaking up the traditional design and construction approaches by applying lessons from the tech world.

| May 24, 2017

Accelerate Live! talk: The data-driven future for AEC, Nathan Miller, Proving Ground

In this 15-minute talk at BD+C’s Accelerate Live! (May 11, 2017, Chicago), Nathan Miller presents his vision of a data-driven future for the business of design.

Architects | May 23, 2017

Queens Museum exhibit shows New York City as it could have been

The installation will showcase 200 years worth of unrealized Big Apple projects via original drawings, renderings, newly commissioned models, and 3D visualizations.

Education Facilities | May 22, 2017

Educational design taking lessons from tech firms

Recently, in educational design, we have seen a trend toward more flexible learning spaces.

Architects | May 16, 2017

Architecture that helps children fall in love with the environment

The coming decades present a major ecological challenge... so let’s encourage the next generation to do something about it!

AEC Tech | May 11, 2017

Accelerate Live!: Social media reactions from BD+C's AEC innovation conference

BD+C's inaugural Accelerate Live! innovation conference took place May 11, in Chicago.