When the Trump Administration imposed tariffs of 25% on steel and 10% on aluminum in March, it kicked off one of the nation’s most heated and far-reaching trade wars since the Smoot-Hawley Tariff Act of 1930. That legislation, which was expanded by President Hoover to include more than 20,000 products across the agriculture and industrial sectors, is viewed historically as an abject failure and a prime reason for the sustained economic depression through the 1930s.

Seven months into Trump’s trade war, the jury is still out. The circumstances today are markedly different than 88 years ago, of course. The economy is strong. But America is no longer the global manufacturing powerhouse it once was, and the nation has operated a global trade deficit of $100 billion or more annually since the late 1990s (last year: $795 billion).

Opponents of Trump’s actions on trade argue that the policies are outmoded, shortsighted measures that undermine a free trade economy. Pundits in Trump’s camp believe that any short-term hit to U.S. businesses is worth the potential long-term impact to the economy, particularly the manufacturing sector.

“For the last 25 years, China has been waging a trade war against the United States,” said Dan DiMicco, a senior trade adviser to President Trump’s campaign, during a talk at Metalcon last month. “A lot of us have been fighting that war, but without the resources to win it, until now.”

DiMicco should know. As the former CEO of Nucor Corp., the nation’s largest steel producer, he’s seen firsthand the power a government-controlled economy like China’s can wield. The nation is home to half of the world’s 10 largest steel production operations, and has been known to “dump cheap steel” on the world market to artificially deflate material prices, said DiMicco. More alarming, he said, is the potential threat to national security: “Our defense department says we can no longer supply parts we need for our military. You cannot be a leader of the world if you don’t have a strong manufacturing base and a strong steel industry.”

Meanwhile, the U.S. construction industry keeps humming along. Prices for aluminum- and steel-based materials have soared, but the construction sector seems to be taking it in stride. Nonresidential construction spending reached a record-high $762.7 billion in August, bolstered by a healthy backlog of work. And even when the impacts from the tariffs are factored in, construction industry economists remain largely upbeat with their forecasts for 2019 (tinyurl.com/y9qwcwln).

For now, Building Teams are finding a way to get their projects completed under increasingly onerous circumstances. Is there a tipping point when escalating costs will force developers to shelve projects? Or will prices stabilize to a “new normal” that keeps the work flowing? The answers, unfortunately, are anyone’s guess.

Related Stories

Building Materials | Apr 14, 2015

French firm proposes sand and bacteria as building material in the Sahara

Deserts are already abundant with sand, so why not construct buildings out of it? This was the thought behind Flohara, a collection of shelters developed by Paris-based XTU Architects.

Sponsored | Windows and Doors | Apr 14, 2015

Energy Retrofits: Getting the Whole Picture on Energy Analysis

Modular Building | Mar 10, 2015

Must see: 57-story modular skyscraper was completed in 19 days

After erecting the mega prefab tower in Changsha, China, modular builder BSB stated, “three floors in a day is China’s new normal.”

Sponsored | Metals | Mar 10, 2015

Metal Building Systems: A Rising Star in the Market

A new report by the Metal Building Manufacturer's Association explains the entity's efforts in refining and extending metal building systems as a construction choice.

Building Materials | Feb 19, 2015

Prices for construction materials fall in January, following plummet of oil prices

The decline in oil and petroleum prices finally showed up in the produce price index data, according to ABC Chief Economist Anirban Basu.

Steel Buildings | Feb 10, 2015

Korean researchers discover 'super steel'

The new alloy makes steel as strong as titanium.

| Dec 29, 2014

From Ag waste to organic brick: Corn stalks reused to make construction materials [BD+C's 2014 Great Solutions Report]

Ecovative Design applies its cradle-to-cradle process to produce 10,000 organic bricks used to build a three-tower structure in Long Island City, N.Y. The demonstration project was named a 2014 Great Solution by the editors of Building Design+Construction.

| Dec 28, 2014

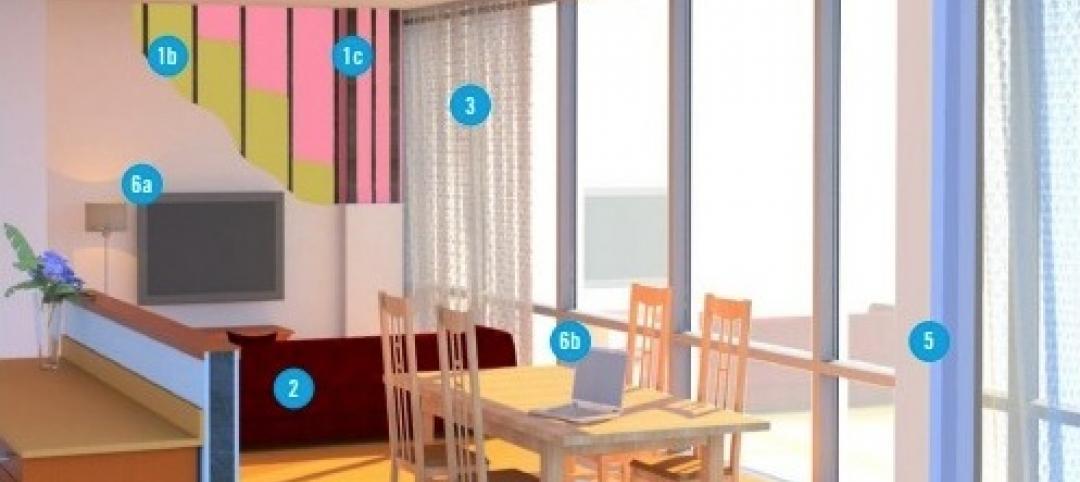

New trends in ceiling designs and materials [AIA course]

A broad array of new and improved ceiling products offers designers everything from superior acoustics and closed-loop, recycled content to eased integration with lighting systems, HVAC diffusers, fire sprinkler heads, and other overhead problems. This course describes how Building Teams are exploring ways to go beyond the treatment of ceilings as white, monolithic planes.

| Oct 30, 2014

CannonDesign releases guide for specifying flooring in healthcare settings

The new report, "Flooring Applications in Healthcare Settings," compares and contrasts different flooring types in the context of parameters such as health and safety impact, design and operational issues, environmental considerations, economics, and product options.

| Oct 16, 2014

Perkins+Will white paper examines alternatives to flame retardant building materials

The white paper includes a list of 193 flame retardants, including 29 discovered in building and household products, 50 found in the indoor environment, and 33 in human blood, milk, and tissues.