The U.S. economy continues to show slow, steady progress despite fears of a global economic downturn and some domestic headwinds, according to the latest edition of “The Briefing,” a Transwestern report that covers the global economy and commercial real estate. Declining corporate profits, business investment and net exports combined with a rising dollar have been offset by consistent job gains, wage growth and resilient consumer spending.

Additionally, aggressive global stimulus plans appear to be having the desired effect. There is now $17 trillion of negative yielding debt in the world, and eurozone first-quarter 2016 gross domestic product growth came in at 2.2%, beating the U.S. for the first time in several years.

“While some see an economy in its final innings, there is little evidence of the financial excess, weak credit, deteriorating underwriting and surging defaults that typically signal the end of an expansion,” said Tom McNearney, Transwestern’s chief investment officer.

“Banks are maintaining, if not strengthening, underwriting standards and have even backed away from higher-yielding, risky loans to energy companies and highly leveraged corporate buyouts,” McNearney continued. “CMBS delinquencies also continue to reflect underwriting discipline. This caution by lenders is likely to prolong the cycle, not expedite a recession.”

The sporting goods retailer Sports Authority declared bankruptcy in March and announced in May that it would close all of its 450-plus stores. Photo: Phillip Pessar/Creative Commons.

The sporting goods retailer Sports Authority declared bankruptcy in March and announced in May that it would close all of its 450-plus stores. Photo: Phillip Pessar/Creative Commons.

20 FAST FACTS FOR THE BIG PICTURE

- Business investment was up 1.4% in first quarter, but nondefense orders excluding aircraft fell by 2.4%.

- The number of energy loans in danger of default in 2016 is on track to exceed 50%.

- Standard & Poor’s 500 index second-quarter earnings are estimated to decline 4.8%, which would mark the first time the index has recorded five consecutive quarters of year-over-year declines since 2008 – 2009.

- S&P 500 lowered China’s credit rating from AA-neutral to AA-negative watch.

- Exxon was downgraded to AA+ from AAA by S&P 500.

- Arbor launched ALEX, the first online agency lending platform for multifamily in early 2016.

- Amazon plans to lease 20 767 Boeing Freighters from air cargo firm ATSG to further control distribution channels.

- Robots are more prevalent on the job as costs come down and programming is more versatile.

- Technology has boosted cancer research to light speed, which potentially could cause Big Pharma to lose $1.2 trillion in market capitalization.

- New Securities and Exchange Commission crowdfunding rules went into effect May 18, 2016.

- MetLife is selling life insurance business and 4,000 agents to MassMutual in advance of new capital rules and to avoid Dodd Frank designation as “systematically important.”

- New home sales show continued growth, up 17% in April over March, and a recent U.S. Census update shows suburbs are thriving while urban population growth has slowed.

- WeWork raised $430 million in a round of Chinese-led financing, providing an implied valuation of $16 billion for a startup company with limited owned space.

- Major retailers such as Sears and Wal-Mart plan to close stores, while Kohl’s, Gap and Nordstrom experienced sharply lower sales and profits, and Sports Authority filed for bankruptcy.

- Home Depot and TJX Companies first-quarter sales were up 10% and 7%, respectively, and Amazon is now second behind Wal-Mart in apparel sales.

- Auto sales continue at a record pace, with some signs companies are stretching to feed demand.

- First-quarter property sales were down 20%, but pullback was partially due to difficult-to-replicate portfolio and entity-level activity in 2015. Single asset sales were down 11% year-over-year.

- First-quarter CMBS issuance was down 25% due to swap spread volatility and ongoing uncertainty about risk retention rules taking effect December 2016.

- FPL Advisory Group forecast some tapering of pension investment in 2016 to $40 billion despite a recent Preqin survey reporting 78% of investors expect to commit the same amount or more to commercial real estate in 2016.

- The Federal Aviation Administration approved Houston’s Ellington Airport as a launch site: The U.S. will send astronauts and cargo to the International Space Station in 2017 – instead of paying Russia $71 million per flight.

Related Stories

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

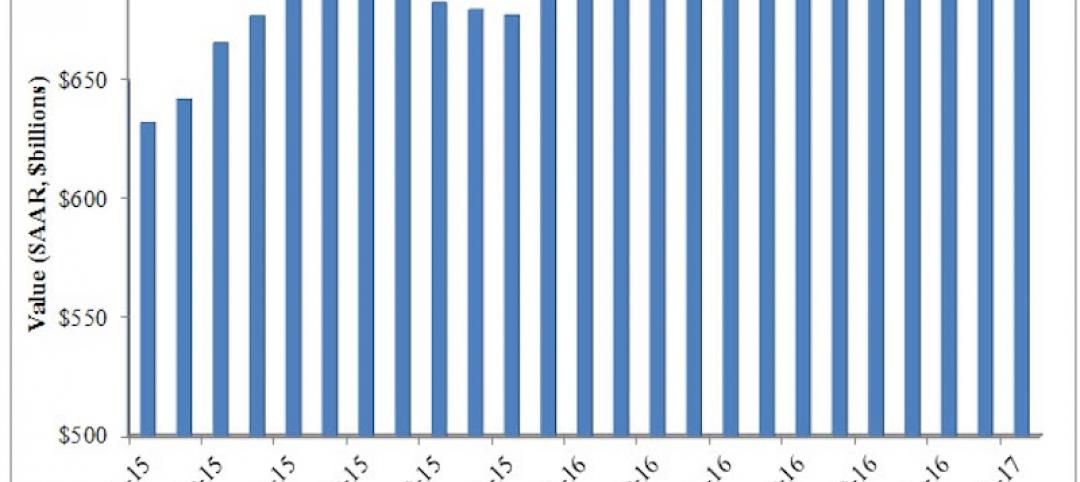

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

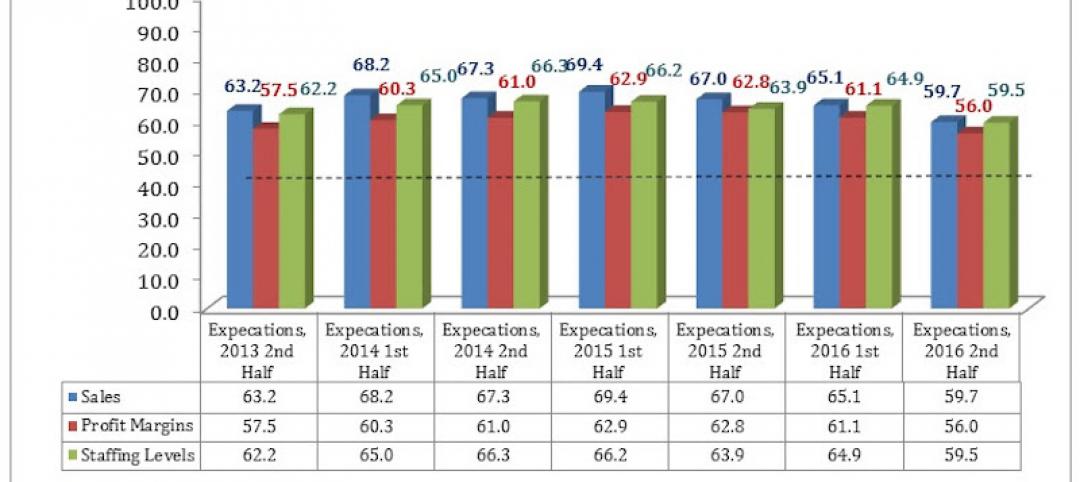

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

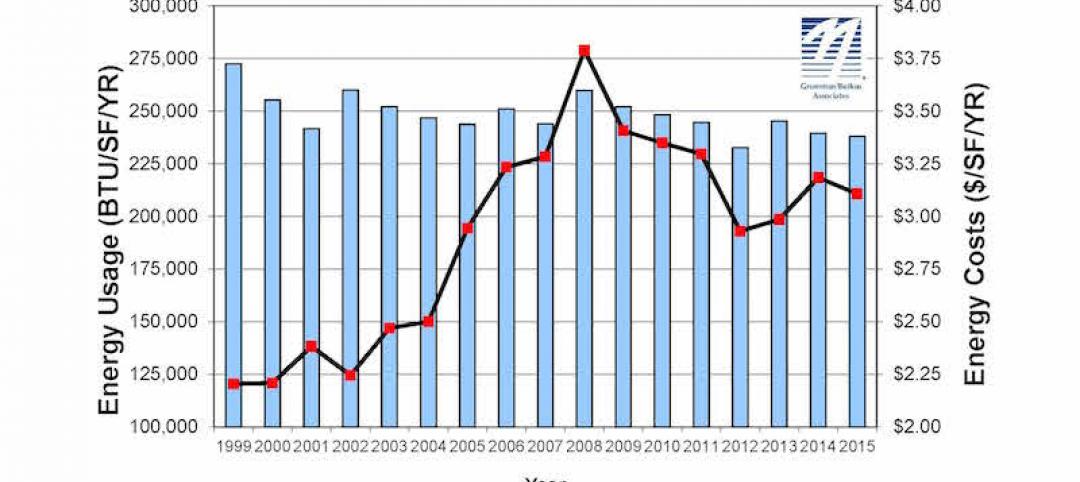

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

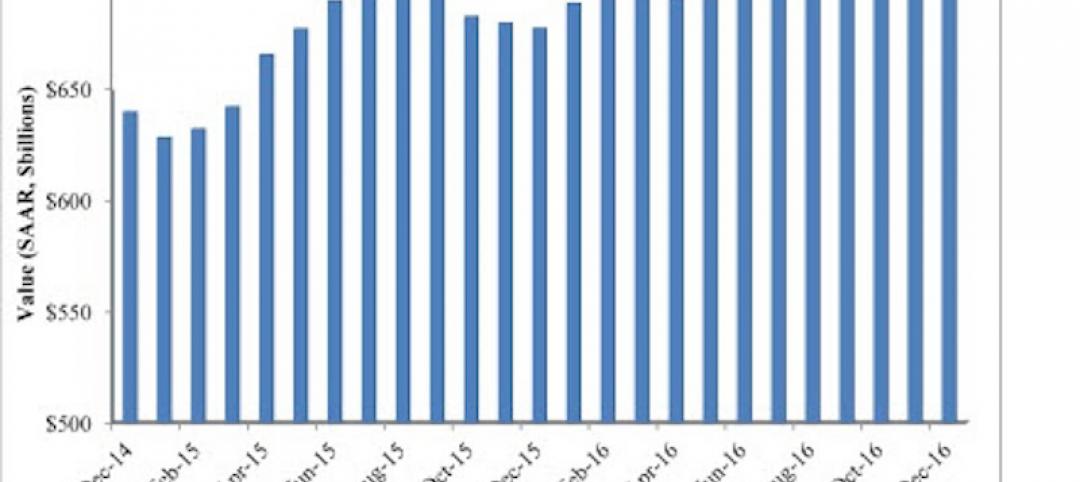

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.