A recent survey of 514 project, site, and construction managers in the U.S. and the United Kingdom, conducted by OnePoll for XYZ Reality, a leading provider of augmented reality applications, found that 94 percent had project backlogs and 63 percent admitted to delivering projects off schedule either “somewhat” to “very frequently.”

“Poor project performance, low productivity, and costly major project failures—and high-profile industry bankruptcies—continue to dog the sector,” wrote KPMG International in its recently released 2023 Global Construction Survey, based on responses from 257 engineering and construction firms and project owners around the world (29 percent of which were based in North America).

Respondents to KPMG’s survey, while mostly “cautiously optimistic” about their industry’s future, still lamented that less than half of their projects are being completed on time. Both surveys cite similar reasons why projects stall, starting with nagging supply-chain delays, labor shortages, and rising construction costs. KPMG is also seeing a “dramatic shift” by contractors away from fixed-price and guaranteed maximum-price contractors for major projects. Colin Cagney, the firm’s director of infrastructure, capital projects, and climate advisory in the U.S., surmises that contractors are attempting to mitigate their primary responsibility for performance risk.

XYZ Reality’s survey notes, too, that construction firms struggle for a variety of reasons to meet their clients’ sustainability goals, and their projects get delayed as well by unexpected design changes, labor shortages, and poor jobsite communication.

The biggest priority for respondents to KPMG’s survey is improving estimating accuracy, transferring risk, and increasing innovation. Both surveys depict an industry turning more toward technology for answers. Engineering-grade AR, AI, robotics, and drones are among the technological solutions preferred by respondents to XYZ Reality’s survey. More than eight in 10 respondents to KPMG’s survey have adopted mobile platforms, 43 percent are using robotics, and 40 percent are in early stages of using artificial intelligence. KPMG’s respondents also believe emerging technologies that include 3D printing have greater potential for delivering better returns on investment.

More than one-fifth of KPMG respondents have adopted modular and offsite manufacturing on all projects, and 60 percent on at least some projects.

“As our business grows, we want to be evolutionary rather than revolutionary,” stated John Murphy, CEO of J. Murphy & Sons Ltd., a London-based infrastructure construction firm, whose comments were among several respondents quoted in KPMG’s report. “We are continuously investing to keep up with the pace of technological change—constantly progressing.”

ESG and DEI are now priorities

This is KPMG’s 14th Global Construction Survey, which allows the firm the benefit of hindsight. One of the trends it has tracked is a stronger commitment among E+C firms to incorporate Environmental, Social, and Governance (ESG) precepts into their project practices. Nearly 54 percent of respondent firms “fully envision” the benefits of ESG and are aggressively pursuing maturity and improvement by embedding ESG into capital projects. (Admittedly, some of these pursuits are being mandated by stricter legislation.)

Firuzan Speroni, KPMG’s U.S. director of infrastructure, capital projects, and climate advisory, sees “a huge opportunity” for E+C firms and owners to commit to decarbonization of their buildings by measuring potential embodied carbon and choosing building materials with help to reduce it.

Respondents to the 2023 global survey ranked Diversity, Equity, and Inclusion as the third-most-important factor determining their success. Half of those respondents cited the importance of diversified workplace demographics to help address disruption. And 46 percent agreed that updating models for remote working and jobsite travel can contribute to construction projects’ resilience. However, the survey also found that the industry needs to do a better job of attracting and retaining talent. (For example, owners were only “relatively” concerned about reducing greenhouse gas emissions from their projects.)

Finding answers in tech

Both surveys highlight the centrality of innovation to the success of projects and businesses. For example, in 2017 E+C firms were only starting to deploy project management information systems, sensors, drones, or other robotics. This year’s survey, on the other hand, found that 81 percent of respondents from E+C firms say their organizations have adopted, or are starting to adopt, mobile platforms. The use of virtual reality tool has almost doubled (to 56 percent of respondents from 28 percent in 2017). Nearly half of E+C firms responding to the survey have adopted digital twin on at least some of their projects.

“The successful adopters are championing innovation from the very top, and investing in educating their teams,” observed Suneal Vora, a Partner in Business Consulting-Capital Projects and Industry 4.0 for KPMG in India. E+C firms must advocate for innovation, though, as owners seem somewhat less willing to adopt new technologies for their projects.

Keep up with a changing landscape

In summary, the key takeaways from the KPMG Global Construction Survey are:

•Address productivity as a matter of urgency, by taking an outside-in approach

•Master enterprise risk management, and have the confidence to resist a race to the bottom in choosing and financing projects

•Truly embed ESG as a component of a company’s sustainability profile and access to capital and talent

•Become data masters, which can help make jobsites safer and attract a new breed of digital worker.

Related Stories

Industry Research | Nov 4, 2016

New survey exposes achievement gap between men and women designers

Female architects still feel disadvantaged when it comes to career advancement.

Market Data | Nov 2, 2016

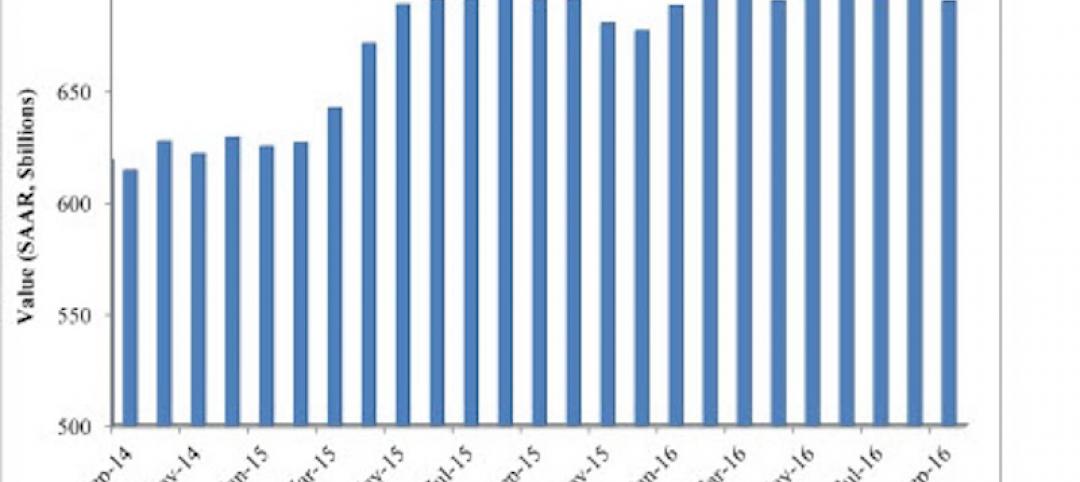

Nonresidential construction spending down in September, but August data upwardly revised

The government revised the August nonresidential construction spending estimate from $686.6 billion to $696.6 billion.

Industry Research | Nov 1, 2016

Perkins Eastman Research releases white paper on ‘Centers for Healthy Living’ and whole-person wellness

Among the spotlight projects used as case studies for this white paper are C.C. Young, Dallas, Texas; Clark-Lindsey Village, Urbana, Ill.; Moorings Park, Naples, Fla.; NewBridge on the Charles, Dedham, Mass.; Rockwood Retirement Living: The Summit, Spokane, Wash.; Saint John’s on the Lake, Milwaukee, Wis.; and Spring Lake Village, Santa Rosa, Calif.

Market Data | Oct 31, 2016

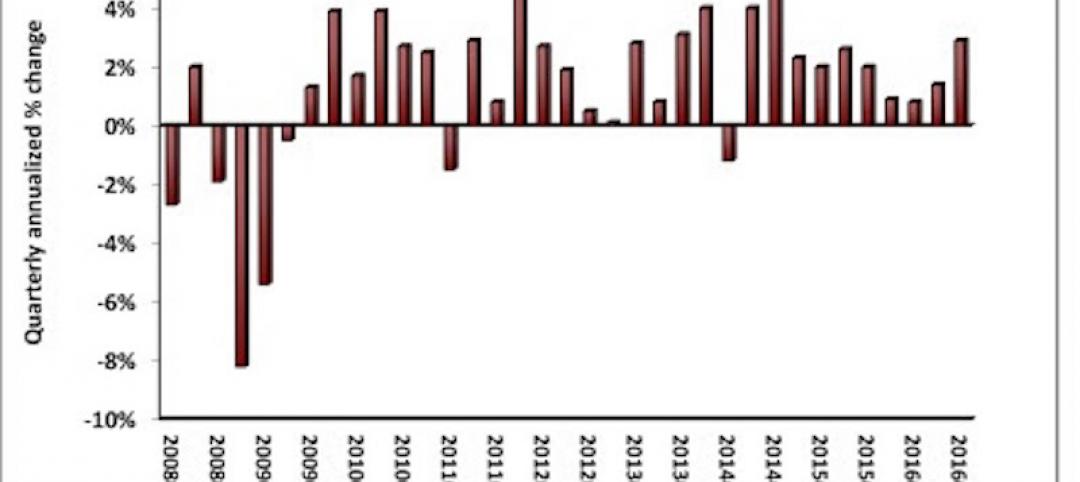

Nonresidential fixed investment expands again during solid third quarter

The acceleration in real GDP growth was driven by a combination of factors, including an upturn in exports, a smaller decrease in state and local government spending and an upturn in federal government spending, says ABC Chief Economist Anirban Basu.

Market Data | Oct 28, 2016

U.S. construction solid and stable in Q3 of 2016; Presidential election seen as influence on industry for 2017

Rider Levett Bucknall’s Third Quarter 2016 USA Construction Cost Report puts the complete spectrum of construction sectors and markets in perspective as it assesses the current state of the industry.

Industry Research | Oct 25, 2016

New HOK/CoreNet Global report explores impact of coworking on corporate real rstate

“Although coworking space makes up less than one percent of the world’s office space, it represents an important workforce trend and highlights the strong desire of today’s employees to have workplace choices, community and flexibility,” says Kay Sargent, Director of WorkPlace at HOK.

Market Data | Oct 24, 2016

New construction starts in 2017 to increase 5% to $713 billion

Dodge Outlook Report predicts moderate growth for most project types – single family housing, commercial and institutional building, and public works, while multifamily housing levels off and electric utilities/gas plants decline.

Industry Research | Oct 20, 2016

New book from HDR explores opportunities for how healthcare organizations can reinvent the patient experience

Delta offers a close look at specific activities and behaviors that can help healthcare providers and caregivers discover revolutionary concepts to help them embrace and thrive in the rapid change that surrounds them.

Designers | Oct 12, 2016

Perkins Eastman and EwingCole co-publish new white paper examining the benefits and challenges of design research

The survey’s findings, combined with input from the EDRA conference, informed the content produced for “Where Are We Now?”

Market Data | Oct 11, 2016

Building design revenue topped $28 billion in 2015

Growing profitability at architecture firms has led to reinvestment and expansion