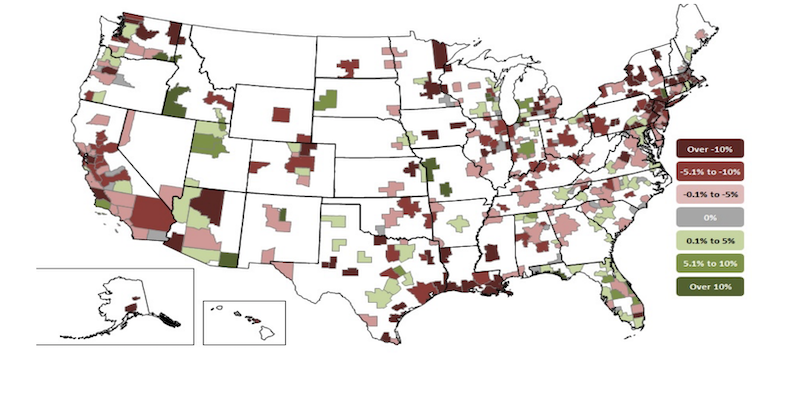

Construction employment decreased in 241, or 67%, out of 358 metro areas between August 2019 and last month, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials urged Congress to pass new coronavirus relief measures before leaving town.

“Although residential construction is picking up in many areas, public and nonresidential construction are shrinking,” said Ken Simonson, the association’s chief economist. “Project cancellations are spreading, and fewer new projects are starting up. That combination makes further employment declines inevitable unless the federal government steps up support for infrastructure.”

Simonson noted that construction employment was stagnant in 29 metro areas and increased in only 88 areas (25%) over the past 12 months. Nineteen metros had all-time lows for August construction employment, while 33 areas had record highs for August, in data going back to 1990 for most areas.

Houston-The Woodlands-Sugar Land, Texas lost the most construction jobs over 12 months (-22,800 jobs, -10%), followed by New York City (-21,700 jobs, -13 percent). Brockton-Bridgewater-Easton, Mass. had the largest percentage decline (-38 percent, -2,200 jobs), followed by Johnstown, Pa. (-34 percent, -1,000 jobs).

Indianapolis-Carmel-Anderson, Ind. added the most construction jobs from August 2019 to August 2020 (4,800 jobs, 9%), followed by Baltimore-Columbia-Towson, Md. (4,300 jobs, 5%). Niles-Benton Harbor, Mich. had the highest percentage increase (16%, 400 jobs), followed by Fond du Lac, Wisc. (15%, 500 jobs) and Walla Walla, Wash. (15%, 100 jobs).

Association officials urged Congressional leaders to not leave town until after the election without passing much-needed new coronavirus relief measures. In particular, the construction officials called on Congress to pass new liability protections for firms that are taking steps to protect workers from the coronavirus. They also urged Congressional leaders to boost investments in infrastructure and pass measures designed to preserve payrolls.

“The coronavirus and efforts to mitigate its spread have left our economy deeply wounded, depressing demand for many types of commercial construction projects,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress can end the downward economic slide and help create needed new construction jobs by passing measures to boost demand and protect honest employers.”

View the metro employment 12-month data, rankings, top 10, and map.

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.