In the third quarter of 2018, the U.S. office market again showed steady improvement, according to Transwestern’s national outlook for the sector. Absorption reached 22.7 million square feet, vacancy remained stable at 10.1%, and asking rents increased by 4.0%, annually.

Ryan Tharp, Research Director in Dallas, said the strong economy has contributed to the office market’s momentum, despite softer income growth in a very tight labor market.

“Real gross domestic product increased at an annualized 3.5%, according to first estimates, and personal consumption contributed 2.7% to that rate,” Tharp said. “Because inflation has remained in line with the Federal Reserve’s target of 2.0%, consumer and business confidence should keep the office market healthy well into 2019.”

A positive sign is that year-to-date net absorption in the office market was 17.1% higher at the end of the third quarter than it was for the same period last year. Dallas-Fort Worth, San Francisco and Denver led in absorption by a significant margin for the prior 12 months, with a combined 13.3 million square feet.

Meanwhile, demand and supply are headed for equilibrium as new construction activity peaked in early 2017. In the third quarter, only 146.3 million square feet was under construction nationally.

“It’s encouraging to see that office demand is broad-based across multiple sectors, with the technology and coworking sectors driving demand as we move later in the cycle,” said Michael Soto, Research Manager in Los Angeles. “If demand continues unabated, rental rate growth should moderate.”

Year-over-year, Minneapolis, San Antonio, and Charlotte, North Carolina, have experienced the most dramatic rent growth, all coming in at 10% or greater. The strong performance of secondary markets demonstrates that the office sector is not being propped up by a few formidable markets.

Download the national office market report at: http://twurls.com/3q18-us-

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

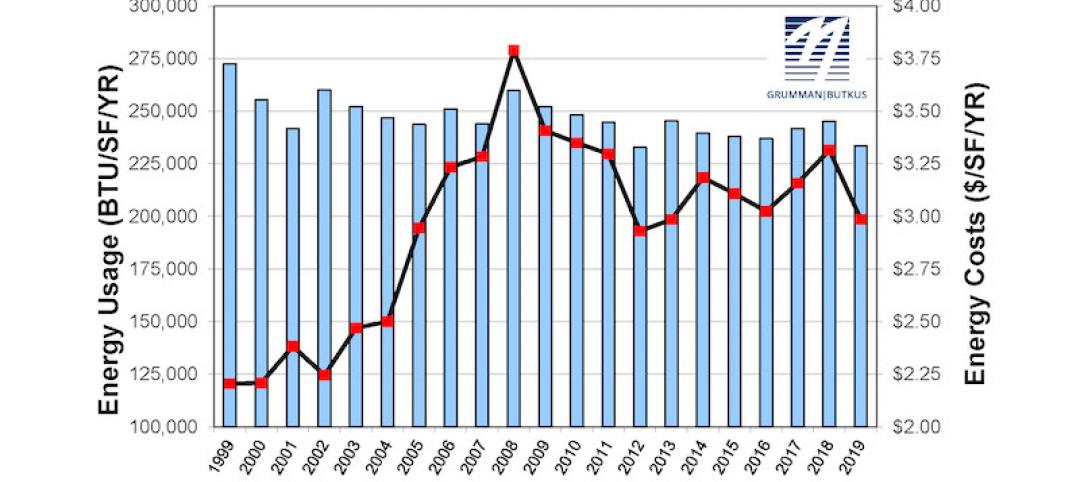

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

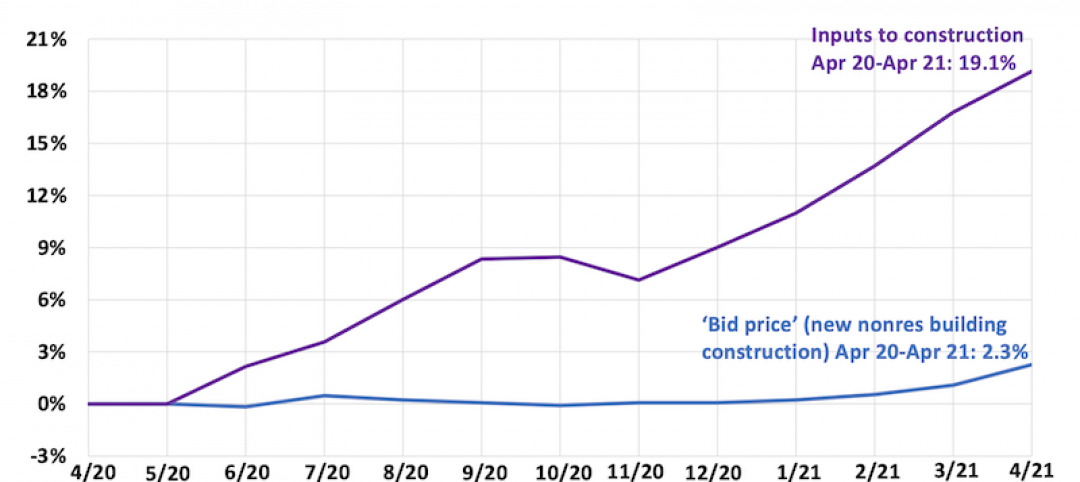

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

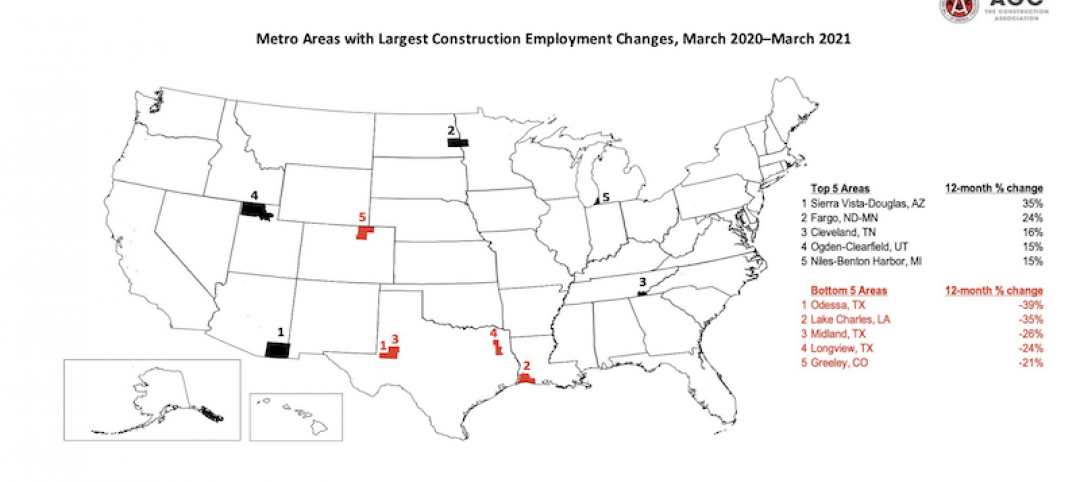

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.