Analysts at Lodging Econometrics (LE) report that at the close of the second quarter of 2020, the total U.S. hotel construction pipeline stands at 5,582 projects/687,801 rooms, down a mere 1% by projects and rooms, Year-Over-Year (YOY). Remarkably, despite some project cancelations, postponements, and delays, there has been minimal impact on the U.S. construction pipeline. Contrary to what is being experienced with hotel operations, the pipeline remains robust as interest rates are at all-time lows.

Projects currently under construction stand at 1,771 projects/235,467 rooms, up 3% and 1% respectively, YOY. Projects scheduled to start construction in the next 12 months total 2,389 projects/276,247 rooms. Projects in the early planning stage stand at 1,422 projects/176,087 rooms. As expected, developers with projects under construction are still experiencing some opening delays. However, projects continue to move forward, albeit with extended timelines. As was the case at the end of the first quarter, developers with projects scheduled to start construction in the next 12 months continue to monitor current events and make adjustments to their construction start and opening dates.

In the first half of 2020, the U.S. opened 313 new hotels with 36,992 rooms. Additionally, there were 481 new projects with 56,823 rooms announced into the pipeline in the first half of 2020. Of those totals, 169 new project announcements with 20,359 rooms occurred in the second quarter. With franchise development staff largely working from home, non-essential travel halted, and with the on-going pandemic, the ability to get a new development deal signed has slowed. This has resulted in a 53% decrease in new project announcements compared to the second quarter of 2019 when 359 projects/44,895 rooms were recorded.

With the arrival of summer, the country has begun to see an uptick in domestic leisure travel. As a result, more and more hotels are re-opening, and many others have begun to move-up renovation plans and/or are repositioning their property with a brand conversion. In the first half of 2020, LE recorded 1,465 active renovation projects/314,043 rooms and 1,196 active conversion projects/136,110 rooms throughout the United States.

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

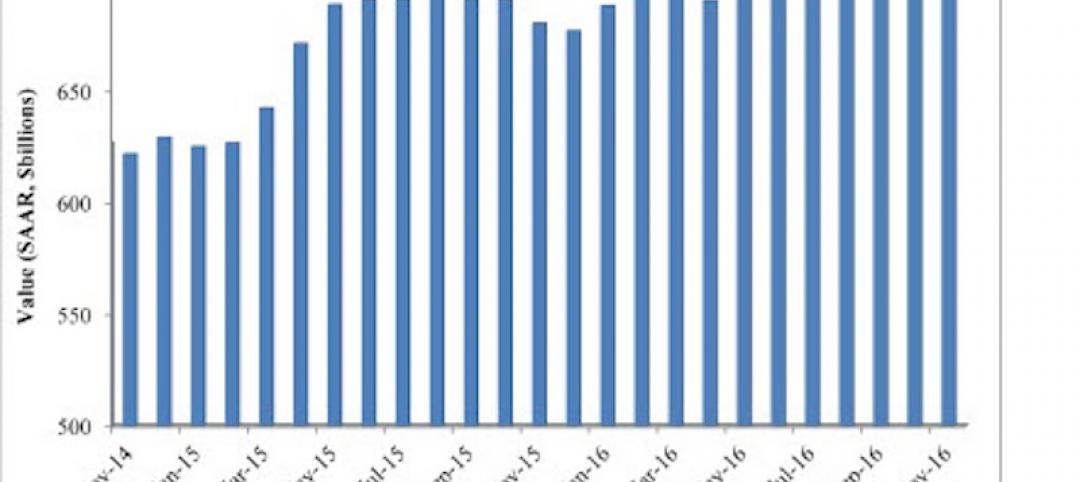

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

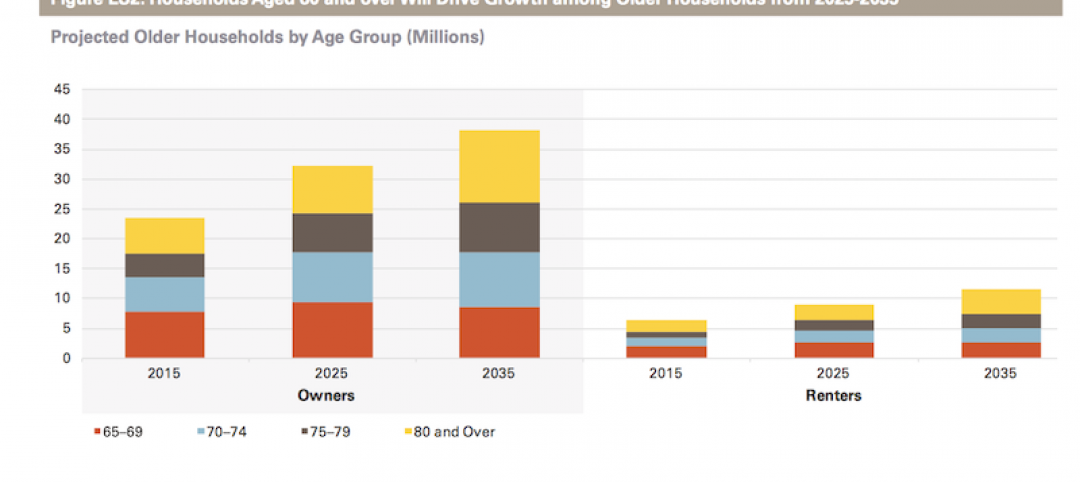

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

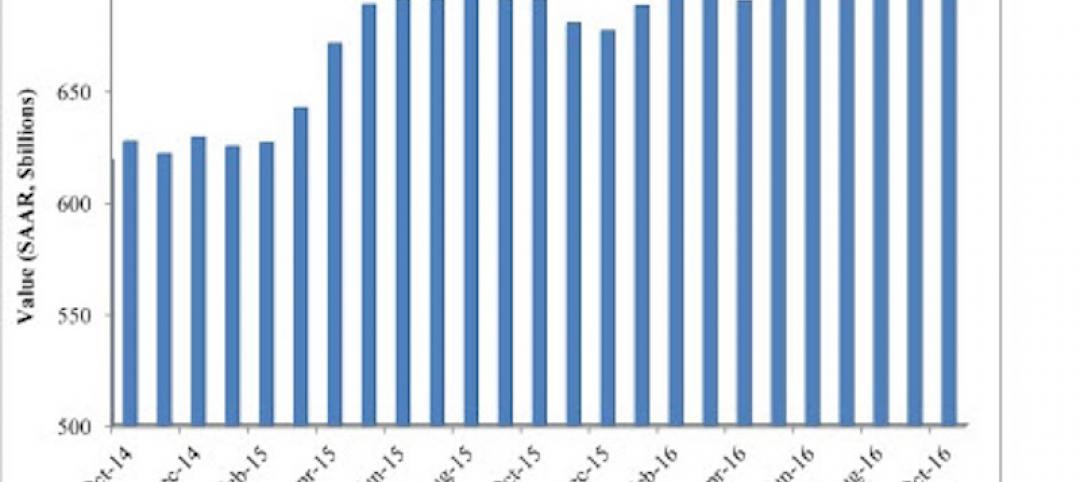

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.