The US construction & real estate industry saw a drop of 30.4% in overall deal activity during December 2019, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 deals worth $505.11m were announced in December 2019, compared to the 12-month average of 69 deals.

M&A was the leading category in the month in terms of volume with 34 deals which accounted for 70.8% of all deals.

In second place was private equity with 11 deals, followed by venture financing with three transactions, respectively accounting for 22.9% and 6.3% of overall deal activity in the country's construction & real estate industry during the month.

In terms of value of deals, M&A was the leading deal category in the US construction & real estate industry with total deals worth $463.1m, while private equity and venture financing deals totalled $40.21m and $1.8m, respectively.

US construction & real estate industry deals in December 2019: Top deals

The top five construction & real estate industry deals accounted for 99.6% of the overall value during December 2019.

The combined value of the top five construction & real estate deals stood at $503m, against the overall value of $505.11m recorded for the month.

The top five construction & real estate industry deals of December 2019 tracked by GlobalData were:

1. Huntsman's $350m acquisition of Icynene-Lapolla

2. The $92m acquisition of NewSouth Window Solutions by PGT Innovations

3. Accomplice, Insight Partners, JLL Spark Global Venture Fund, Navitas Capital and Pritzker Group Venture Capital's $34.2m venture financing of HqO

4. The $20.8m asset transaction with CBL & Associates Properties by Horizon Group Properties

5. Halogen Ventures, Link Ventures, LLLP, Luma Launch, Rest Seed Fund, Techstars Ventures and Western Technology Investment's venture financing of Trust & Will for $6m.

Related Stories

Market Data | Jul 19, 2021

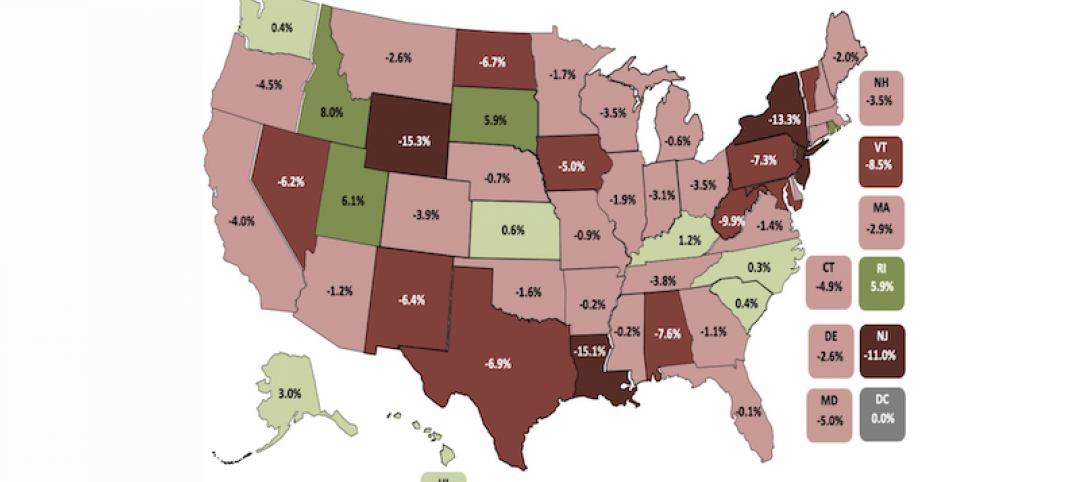

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

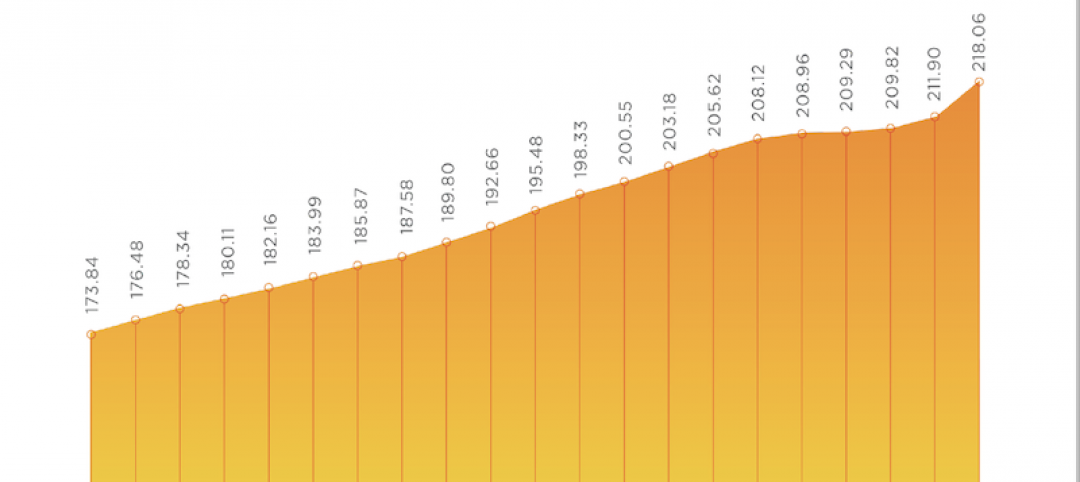

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

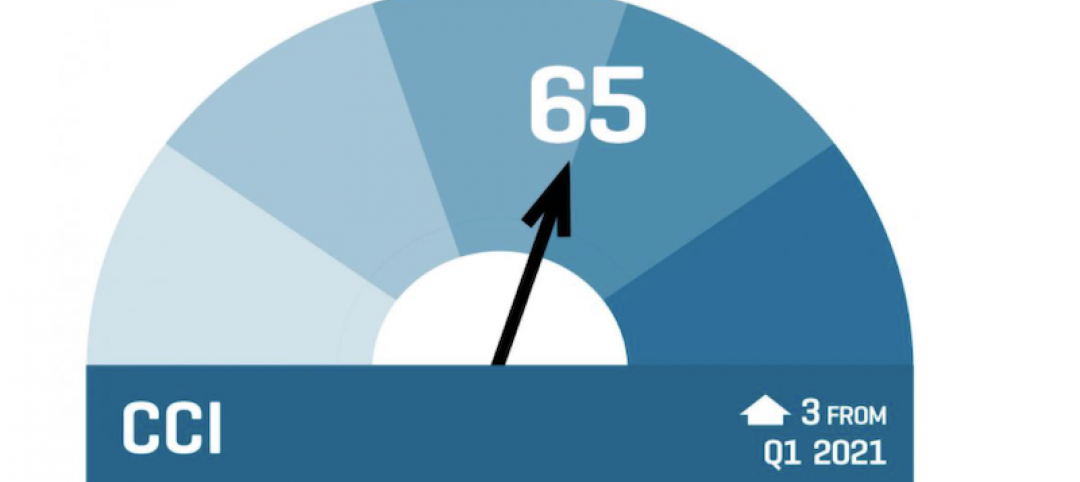

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.