The US construction & real estate industry saw a drop of 30.4% in overall deal activity during December 2019, when compared with the last 12-month average, according to GlobalData’s deals database.

A total of 48 deals worth $505.11m were announced in December 2019, compared to the 12-month average of 69 deals.

M&A was the leading category in the month in terms of volume with 34 deals which accounted for 70.8% of all deals.

In second place was private equity with 11 deals, followed by venture financing with three transactions, respectively accounting for 22.9% and 6.3% of overall deal activity in the country's construction & real estate industry during the month.

In terms of value of deals, M&A was the leading deal category in the US construction & real estate industry with total deals worth $463.1m, while private equity and venture financing deals totalled $40.21m and $1.8m, respectively.

US construction & real estate industry deals in December 2019: Top deals

The top five construction & real estate industry deals accounted for 99.6% of the overall value during December 2019.

The combined value of the top five construction & real estate deals stood at $503m, against the overall value of $505.11m recorded for the month.

The top five construction & real estate industry deals of December 2019 tracked by GlobalData were:

1. Huntsman's $350m acquisition of Icynene-Lapolla

2. The $92m acquisition of NewSouth Window Solutions by PGT Innovations

3. Accomplice, Insight Partners, JLL Spark Global Venture Fund, Navitas Capital and Pritzker Group Venture Capital's $34.2m venture financing of HqO

4. The $20.8m asset transaction with CBL & Associates Properties by Horizon Group Properties

5. Halogen Ventures, Link Ventures, LLLP, Luma Launch, Rest Seed Fund, Techstars Ventures and Western Technology Investment's venture financing of Trust & Will for $6m.

Related Stories

Market Data | Nov 2, 2020

More contractors report canceled projects than starts, survey finds

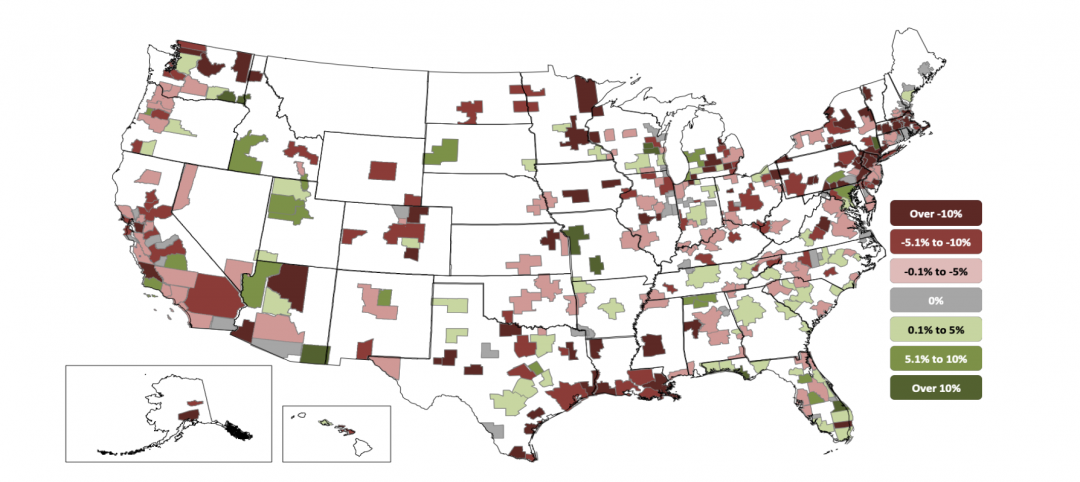

Construction employment declined in most metros in latest 12 months.

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

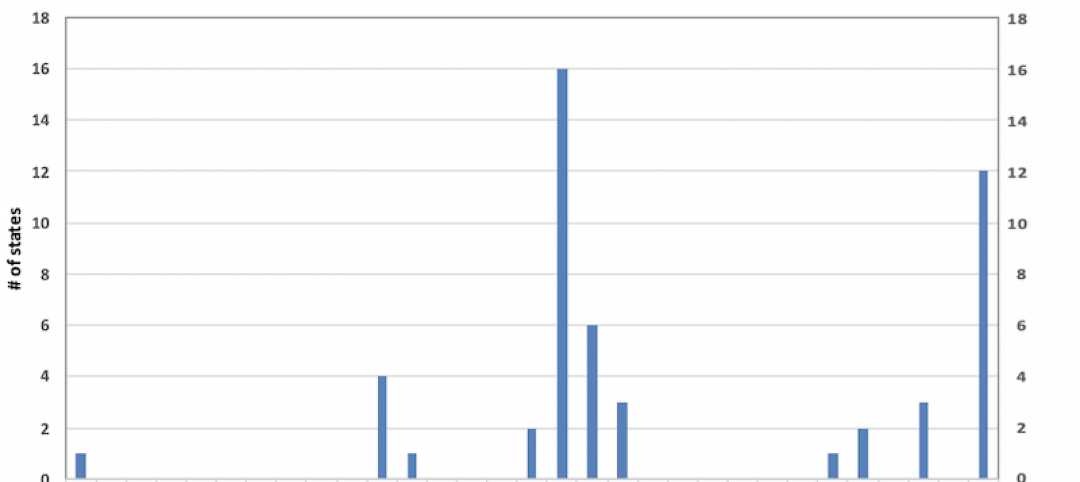

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.