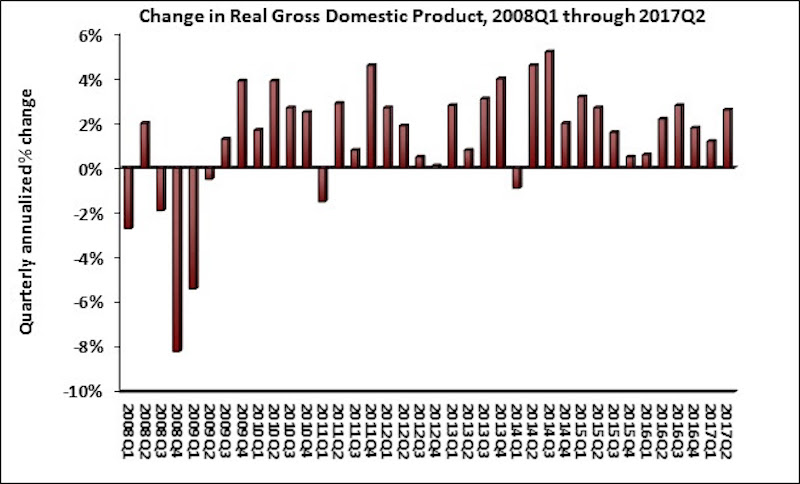

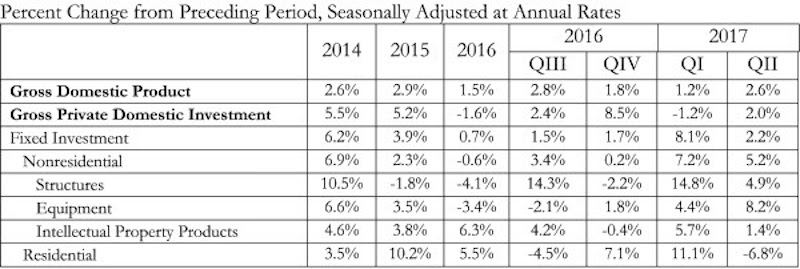

Real gross domestic product (GDP) expanded by 2.6% on a seasonally adjusted annualized basis during the year’s second quarter, according to Associated Builders and Contractors’ analysis of data released today by the Bureau of Economic Analysis. Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate. This follows a 7.2% expansion during the first quarter.

The expansion in nonresidential fixed investment indicates that growth in business outlays continues to support the ongoing economic recovery, now in its ninth year. The expansion of nonresidential fixed investment contributed more than sixth-tenths of a percentage point to GDP growth. This was due in large measure to an uptick in investment in construction equipment. The other two components of nonresidential fixed investment—investment in structures and intellectual property—also expanded, but at a slower pace.

“This was a good report from the perspective of the nation’s nonresidential construction firms, particularly those primarily engaged in private as opposed to public construction,” says ABC Chief Economist Anirban Basu in a release. “The uptick in investment in construction equipment is particularly noteworthy because it signals a general belief that construction activity will continue to recover in America. Backlog among many nonresidential construction firms is already healthy, and today’s report suggests that backlog is not set to decline in any meaningful way anytime soon.

“One might wonder why construction firms remain so busy in an economic environment still characterized by roughly 2 percent growth,” says Basu. “There are many factors at work, including the ongoing boom of the e-commerce economy, which has continued to trigger demand for massive fulfillment and distribution centers even as stores close in massive numbers at America’s malls. The influx of global investment to a number of segments, including hotel and office construction, also helps explain disproportionate growth in certain private categories. With global fixed-income yields remaining so low, investors from around the world, including from the United States, are likely to continue to seek out opportunities for higher rates of return in commercial real estate, which thus far has had the impact of increasing property values and triggering construction.

“For the broader economy to accelerate, policymakers in Washington, D.C., will need to begin to make progress on corporate tax relief and infrastructure,” says Basu.

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.