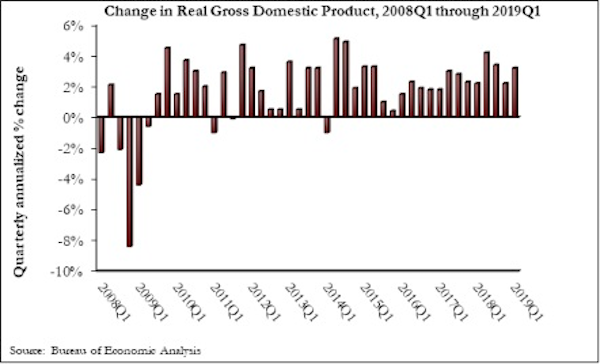

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Market Data | Aug 12, 2021

Steep rise in producer prices for construction materials and services continues in July.

The producer price index for new nonresidential construction rose 4.4% over the past 12 months.

Market Data | Aug 6, 2021

Construction industry adds 11,000 jobs in July

Nonresidential sector trails overall recovery.

Market Data | Aug 2, 2021

Nonresidential construction spending falls again in June

The fall was driven by a big drop in funding for highway and street construction and other public work.

Market Data | Jul 29, 2021

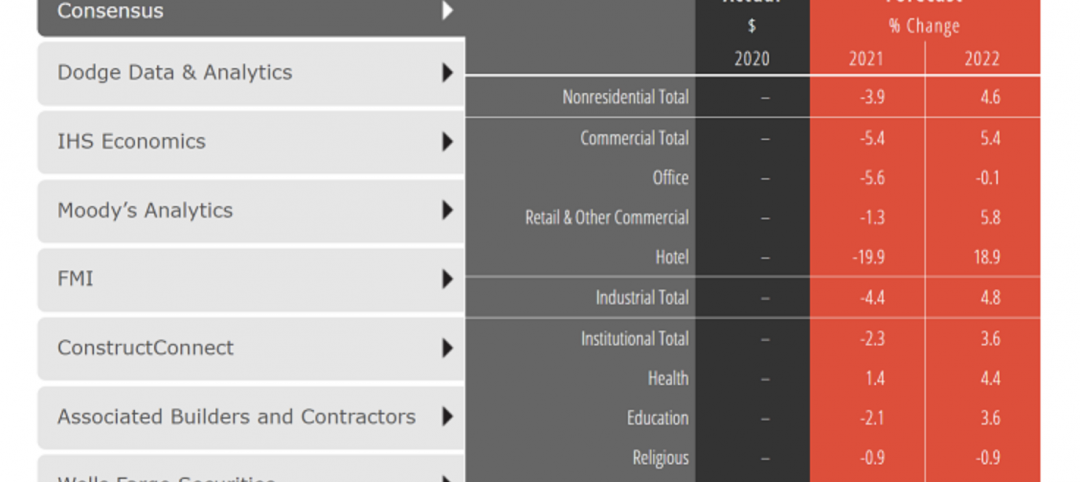

Outlook for construction spending improves with the upturn in the economy

The strongest design sector performers for the remainder of this year are expected to be health care facilities.

Market Data | Jul 29, 2021

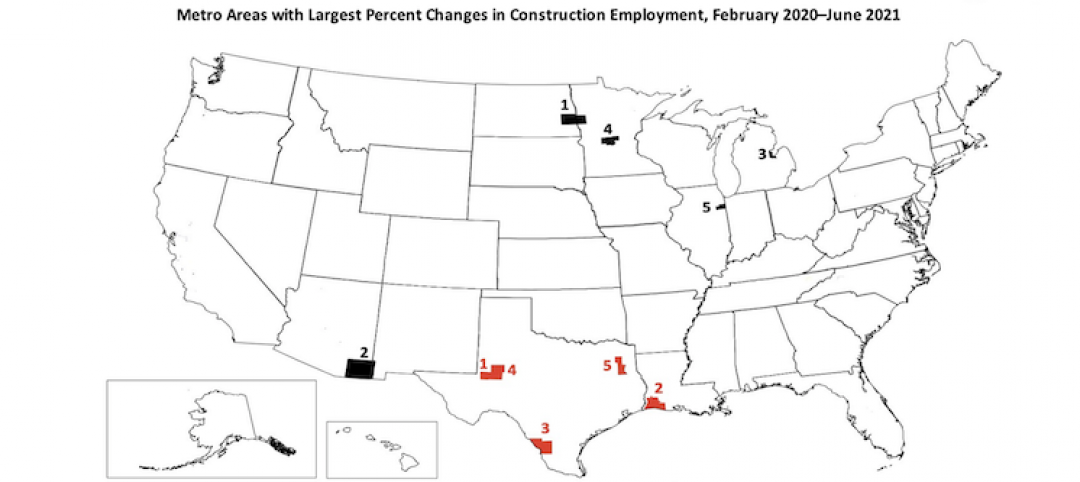

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.