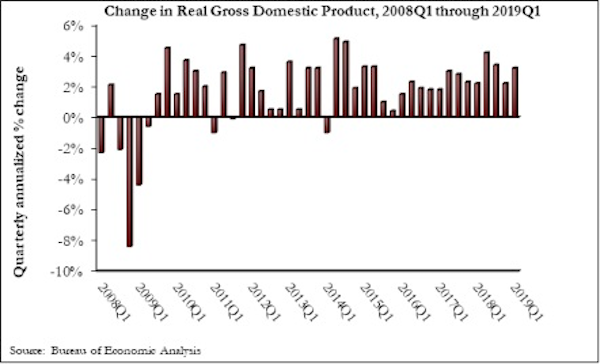

The U.S. economy expanded at an annualized 3.2% rate during the first quarter of 2019, according to an Associated Builders and Contractors assessment of data released today by the U.S. Bureau of Economic Analysis. The pace of growth exceeded expectations, as many economists predicted growth would be closer to 2.5%.

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property. However, residential investment declined.

“Today’s headline number was a blockbuster,” said ABC Chief Economist Anirban Basu. “Despite a slowing global economy, growing labor shortages, soft residential construction and generally lackluster first quarter growth, the overall U.S. economy got off to a fast start in 2019. What’s more, that rapid growth continues to be associated with only moderate inflation.

“That said, nonresidential building investment declined for a third consecutive quarter during the first quarter of 2019, though the pace of decline was not as noteworthy as it was during the third and fourth quarters of last year,” said Basu. “There are many conceivable factors, including weather-induced interruptions in construction activity, concern about overbuilding in office, lodging and other commercial segments, as well as the inability of contractors to fully address demand for construction services due to a dearth of available skilled workers.

“With the year off to a strong start, there appears to be enough momentum to carry the U.S. economy through 2019,” said Basu. “Any fears of a near-term recession have likely been quashed. However, the surprising strength of the U.S. economy may result in a reassessment of policymaking by the Federal Reserve, even though recent statements made by Fed officials have suggested that there wouldn’t be a further rate increase in 2019. If the Federal Reserve decides to pivot and raise rates again later this year, that would represent a negative in terms of demand for construction services due to a corresponding increase in the cost of capital to finance projects.”

Related Stories

Market Data | Aug 13, 2018

First Half 2018 commercial and multifamily construction starts show mixed performance across top metropolitan areas

Gains reported in five of the top ten markets.

Market Data | Aug 10, 2018

Construction material prices inch down in July

Nonresidential construction input prices increased fell 0.3% in July but are up 9.6% year over year.

Market Data | Aug 9, 2018

Projections reveal nonresidential construction spending to grow

AIA releases latest Consensus Construction Forecast.

Market Data | Aug 7, 2018

New supply's impact illustrated in Yardi Matrix national self storage report for July

The metro with the most units under construction and planned as a percent of existing inventory in mid-July was Nashville, Tenn.

Market Data | Aug 3, 2018

U.S. multifamily rents reach new heights in July

Favorable economic conditions produce a sunny summer for the apartment sector.

Market Data | Aug 2, 2018

Nonresidential construction spending dips in June

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu.

Market Data | Aug 1, 2018

U.S. hotel construction pipeline continues moderate growth year-over-year

The hotel construction pipeline has been growing moderately and incrementally each quarter.

Market Data | Jul 30, 2018

Nonresidential fixed investment surges in second quarter

Nonresidential fixed investment represented an especially important element of second quarter strength in the advance estimate.

Market Data | Jul 11, 2018

Construction material prices increase steadily in June

June represents the latest month associated with rapidly rising construction input prices.

Market Data | Jun 26, 2018

Yardi Matrix examines potential regional multifamily supply overload

Outsize development activity in some major metros could increase vacancy rates and stagnate rent growth.