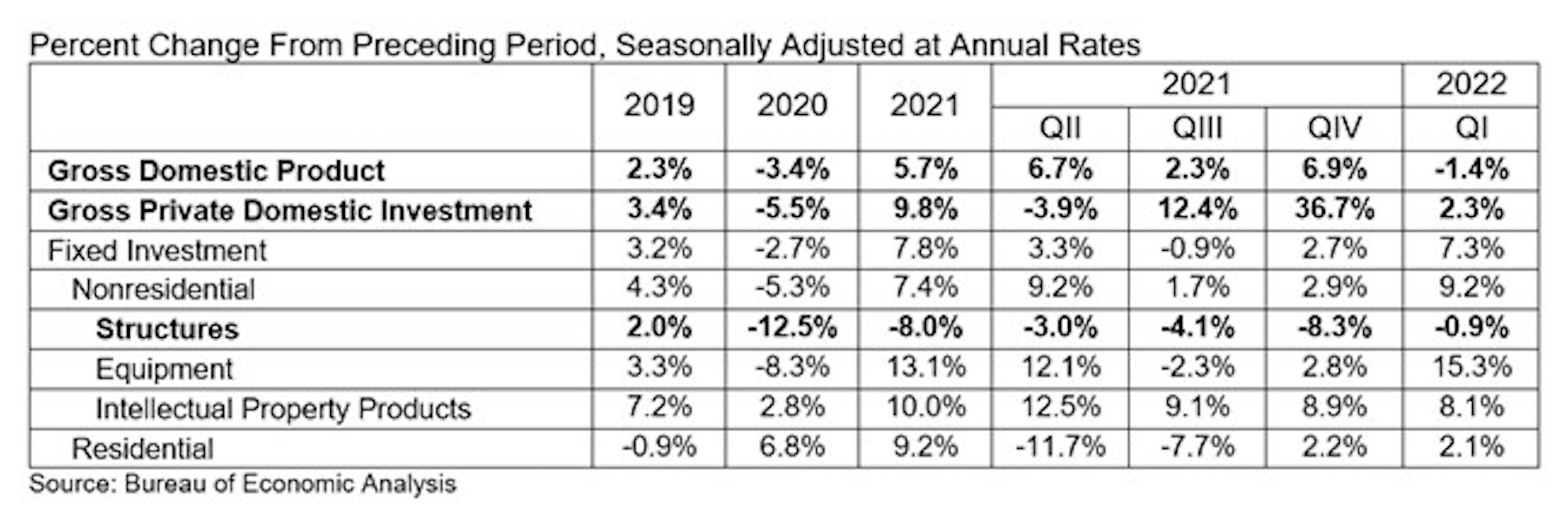

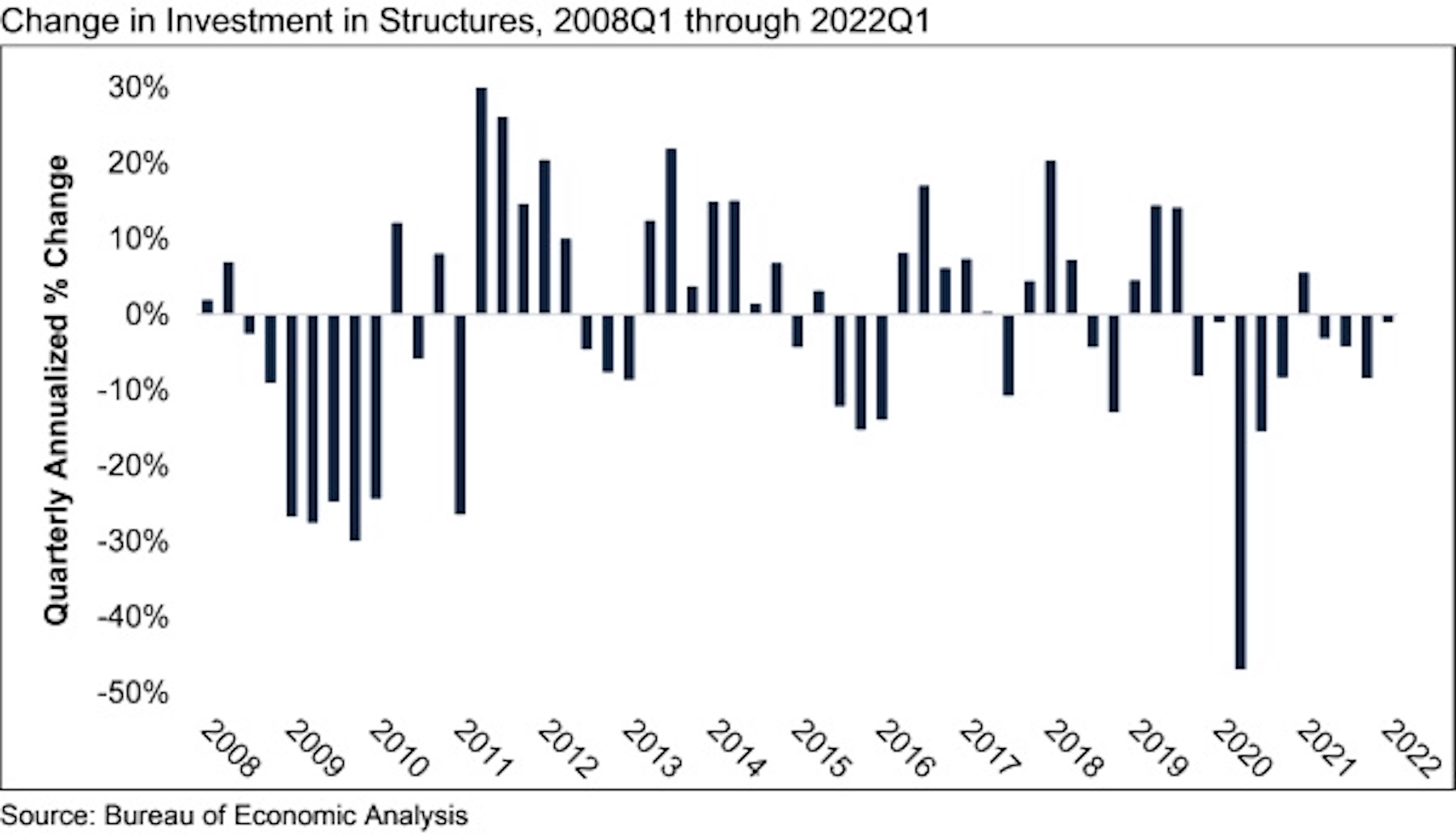

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022. Investment in nonresidential structures declined at an annual rate of 0.9% during the quarter and has contracted nine of the past 10 quarters, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis.

“The economy’s woeful performance during 2022’s first quarter complicates matters,” said ABC Chief Economist Anirban Basu. “Conventional wisdom says the economy has enough momentum to contend with the tighter monetary policy the Federal Reserve is pursuing to countervail inflation. Today’s data indicate that the economy is weaker than thought, which means the Federal Reserve will have a very difficult time curbing inflation without driving the economy into recession in late 2022 or 2023.

“That said, the economy should manage to generate some positive momentum during the next two to three quarters,” said Basu. “Consumer demand for goods and services remains strong. The omicron variant affected the economy during the first quarter and that does not appear to be the case during the second. Global supply chains have been adjusting to the dislocations caused by the Russian-Ukraine war. Many state and local governments are flush with cash and continue to plan for a period of elevated infrastructure outlays.

“There is one other bit of good news,” said Basu. “The weakness exhibited by the economy during the first quarter may persuade monetary policymakers to raise interest rates less aggressively. This is a matter of significance for nonresidential contractors, who have become less confident in recent months, according to ABC’s Construction Confidence Indicator. Investment in structures continues to decline in America, in part due to weakness in office, lodging and shopping mall segments. Presumably, additional rapid increases in borrowing costs would further dampen new construction in these categories. It may be that the Federal Reserve will raise interest rates more gradually than they would have knowing that the U.S. economy is already rather fragile.”

Related Stories

Construction Costs | May 16, 2024

New download: BD+C's May 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Contractors | May 15, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of April 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Healthcare Facilities | May 6, 2024

Hospital construction costs for 2024

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Contractors | May 1, 2024

Nonresidential construction spending rises 0.2% in March 2024 to $1.19 trillion

National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

AEC Tech | Apr 30, 2024

Lack of organizational readiness is biggest hurdle to artificial intelligence adoption

Managers of companies in the industrial sector, including construction, have bought the hype of artificial intelligence (AI) as a transformative technology, but their organizations are not ready to realize its promise, according to research from IFS, a global cloud enterprise software company. An IFS survey of 1,700 senior decision-makers found that 84% of executives anticipate massive organizational benefits from AI.

Hotel Facilities | Apr 24, 2024

The U.S. hotel construction market sees record highs in the first quarter of 2024

As seen in the Q1 2024 U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), at the end of the first quarter, there are 6,065 projects with 702,990 rooms in the pipeline. This new all-time high represents a 9% year-over-year (YOY) increase in projects and a 7% YOY increase in rooms compared to last year.

Construction Costs | Apr 18, 2024

New download: BD+C's April 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Market Data | Apr 16, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of March 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.2 months in March from 8.1 months in February, according to an ABC member survey conducted March 20 to April 3. The reading is down 0.5 months from March 2023.

K-12 Schools | Apr 10, 2024

Surprise, surprise: Students excel in modernized K-12 school buildings

Too many of the nation’s school districts are having to make it work with less-than-ideal educational facilities. But at what cost to student performance and staff satisfaction?

Multifamily Housing | Apr 9, 2024

March reports record gains in multifamily rent growth in 20 months

Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.