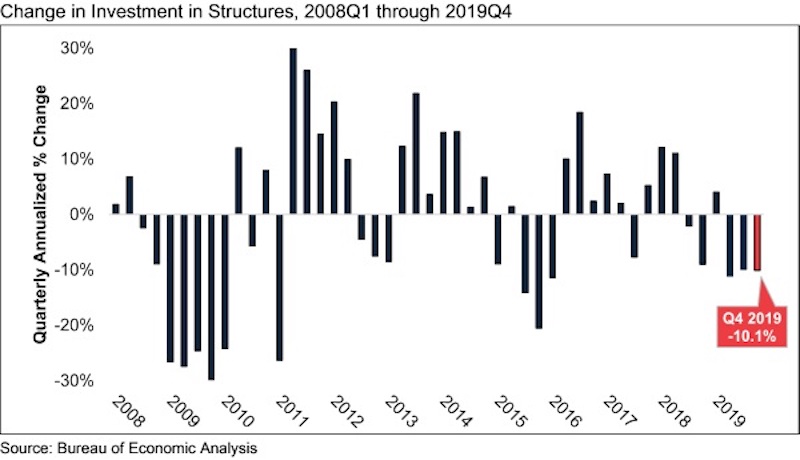

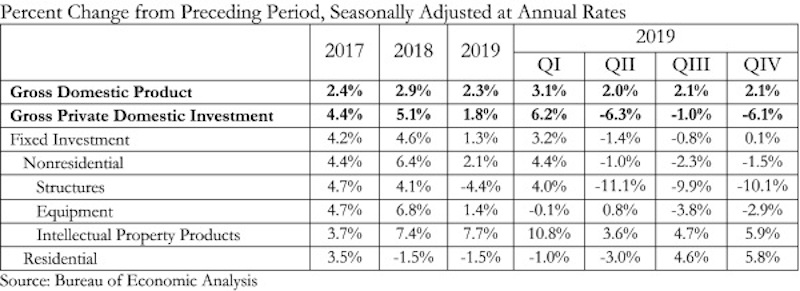

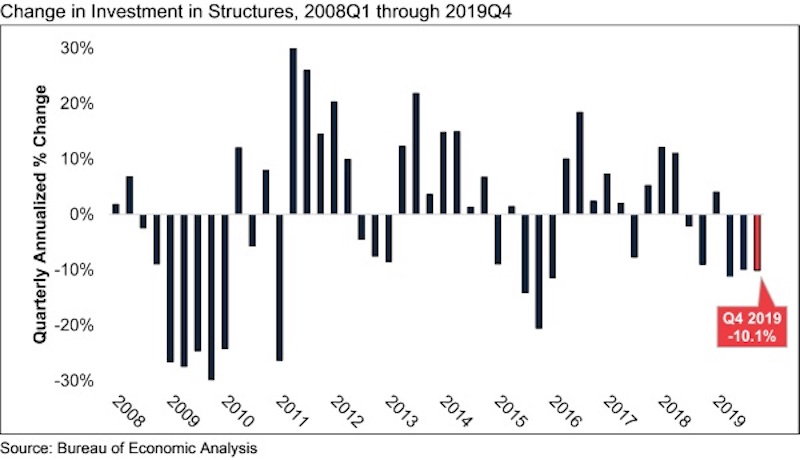

The U.S. economy expanded at an annualized rate of 2.1% in the fourth quarter of 2019, despite investment in structures declining at an annualized rate of 10.1%, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. Investment in structures contracted for three consecutive quarters and declined 4.4% during 2019.

In 2019, real GDP expanded by 2.3%, which was slower than the 2.9% rate of growth observed in 2018. Investment in structures contracted 4.4% in 2019 after expanding by 4.1% in 2018.

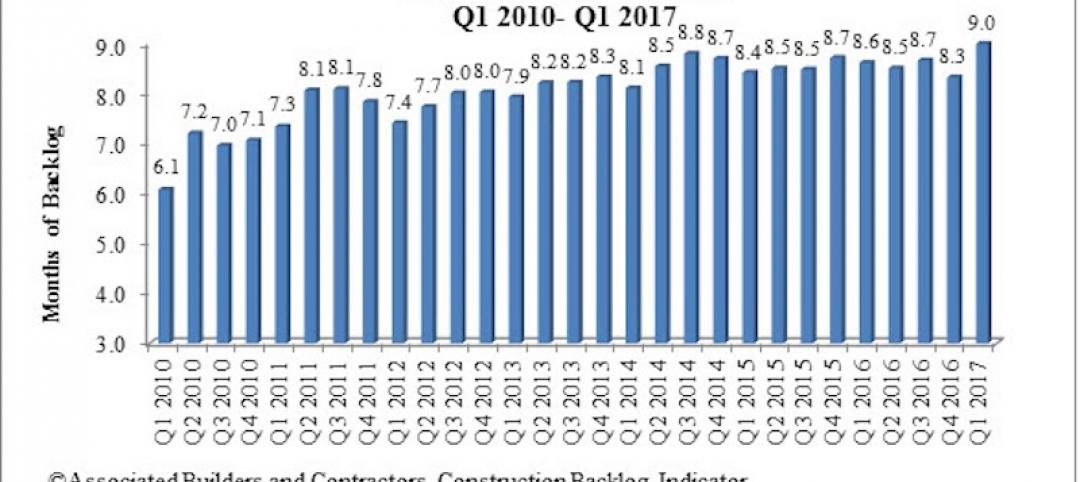

“Last year will be remembered as decent but unspectacular for the U.S. economy,” said ABC Chief Economist Anirban Basu. “Strong consumer spending, historically low unemployment, surging asset prices and healthy backlog levels, according to ABC’s Construction Backlog Indicator, were offset by soft business investment, flattening levels of nonresidential construction and soaring national debt. In addition, key segments of the economy, including manufacturing and agriculture, were particularly weak.

“But 2019 tells us little about 2020 dynamics,” said Basu. “Coming into last year, many expected interest rates and the general cost of capital to rise. Instead, interest rates dipped, creating an improved environment for purchasers of construction services. Last year was also shrouded by fears of worsening trade wars, but with the ratification of the USMCA and the attainment of a first phase trade deal with China, the level of uncertainty has abated. Through the first month of 2020, this has translated into rising stock prices, which should induce greater business investment.

“This year’s presidential election may cause some purchasers of construction services to adopt a wait-and-see attitude,” said Basu. “Contractors are currently upbeat about their prospects over the next two quarters, according to ABC’s Construction Confidence Index. However, given contracting levels of investment in structures, it is unclear if that will persist through the end of 2020.”

Related Stories

Market Data | Aug 2, 2017

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

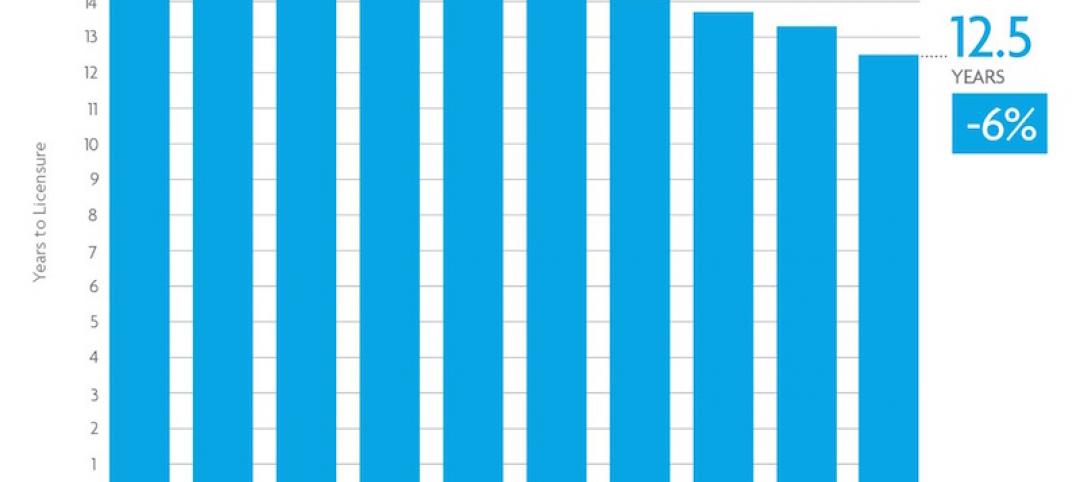

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.