ConstructConnect announced today the release of its Q3 2017 Forecast Quarterly Report. The U.S. grand total construction starts growth projection for 2017 over 2016 in ConstructConnect’s Q3 report has been revised down slightly to +4.5% from +4.8%. 2018 remains about the same at +5.9% year over year (y/y). Earlier, it had been estimated at +6.0%.

“The outlook for U.S. construction starts, as calculated by ConstructConnect, has diminished slightly in the short term,” said to Chief Economist Alex Carrick. “Prospects for some private sector project initiations (e.g., in retail) have stalled, while high hopes for an early launch of a much-needed super-infrastructure program, to be sponsored, promoted and perhaps largely financed by the new administration in Washington, have been deflated.”

The forecast which combines ConstructConnect's proprietary data with macroeconomic factors and Oxford Economics econometric expertise, shows the type-of-structure sub-categories among non-residential building starts that will have banner years in 2017:

- Hotels/motels (+38.2%)

- Warehouses (+16.3%)

- Sports stadiums (+47.3%)

- Courthouses (+110.0%)

The 2017 forecast for non-residential building starts was adjusted to -0.8% y/y, versus a flat (0.0%) performance that was expected in Q2’s forecast report. According to the forecast, non-residential building starts in 2018 will rebound to +3.3%, with private office buildings and industrial/manufacturing doing better with less downward drag being exerted by retail and medical projects. The boom in hotel/motel work will begin to lose steam.

Based on a heightened record of ‘actual’ starts through the first half of this year (+25.2%), civil/engineering starts in 2017 were revised upwards to +16.5% y/y from +8.9% in Q2’s report. 2018 growth in this category has also been raised, to +7.4% (from +5.8%).

The forecast includes a few notable high points in the 2017 y/y engineering sub-categories:

- Airports (+38.0%)

- Roads (+14.0%)

- Bridges (+31.0%)

- Power/oil and gas (+30.8%)

The report states among major sub-sectors, residential construction’s 2017 y/y increase has been scaled down to +4.8% from +8.1%. The robust multi-family market of the last several years has been pulling back of late, as rental rates in many regions soared. Single-family starts also stalled, despite a need for substantial growth activity, since they declined so horrendously in the Great Recession. Also, new family formations, specifically among millennials, point to a tremendous potential that for the moment is not being realized.

Related Stories

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.

Market Data | Jan 4, 2021

Nonresidential construction spending shrinks further in November

Many commercial projects languish, even while homebuilding soars.

Market Data | Dec 29, 2020

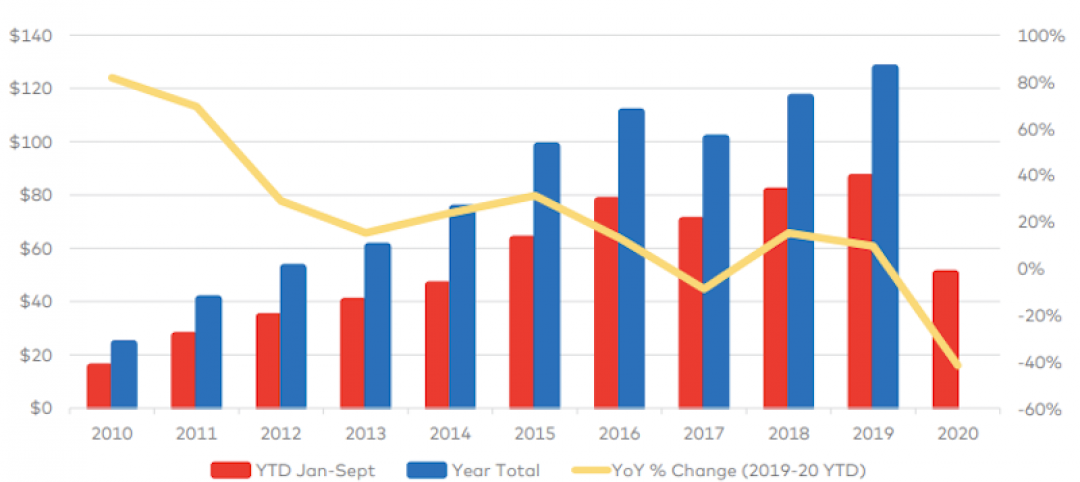

Multifamily transactions drop sharply in 2020, according to special report from Yardi Matrix

Sales completions at end of Q3 were down over 41 percent from the same period a year ago.

Market Data | Dec 28, 2020

New coronavirus recovery measure will provide some needed relief for contractors coping with project cancellations, falling demand

Measure’s modest amount of funding for infrastructure projects and clarification that PPP loans may not be taxed will help offset some of the challenges facing the construction industry.

Market Data | Dec 28, 2020

Construction employment trails pre-pandemic levels in 35 states despite gains in industry jobs from October to November in 31 states

New York and Vermont record worst February-November losses, Virginia has largest pickup.

Market Data | Dec 16, 2020

Architecture billings lose ground in November

The pace of decline during November accelerated from October, posting an Architecture Billings Index (ABI) score of 46.3 from 47.5.

AEC Tech | Dec 8, 2020

COVID-19 affects the industry’s adoption of ConTech in different ways

A new JLL report assesses which tech options got a pandemic “boost.”

Market Data | Dec 7, 2020

Construction sector adds 27,000 jobs in November

Project cancellations, looming PPP tax bill will undercut future job gains.

Market Data | Dec 3, 2020

Only 30% of metro areas add construction jobs in latest 12 months

Widespread project postponements and cancellations force layoffs.

Market Data | Dec 2, 2020

New Passive House standards offers prescriptive path that reduces costs

Eliminates requirement for a Passive House consultant and attendant modeling.