The total U.S. hotel construction pipeline stands at 5,090 projects and 606,302 rooms at the end of the first quarter of 2022, up 2% by projects, but down 3% by rooms, according to the Q1 2022 Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE).

In the first quarter of 2022, there were 961 projects/128,784 rooms under construction, down 27% by projects and 28% by rooms YOY.

Projects scheduled to start in the next 12 months, at 1,911 projects/223,030 rooms, are up 2% by projects and 3% by rooms YOY. Projects and rooms in early planning reached a record high in the first quarter, standing at 2,218 projects/254,488 rooms, up 24% by projects and 12% by rooms YOY.

Notably, the upscale and upper-midscale chain scales dominate the pipeline in Q1 with 63% of projects in the total pipeline concentrated in these two chain scales. This has been the case for several years.

There were a total of 1,420 projects/184,692 rooms in the renovation or conversion pipeline in the U.S. during the first quarter. Project conversions and room conversions reached an all-time high in Q1, increasing 59% by projects and 48% by rooms YOY.

Hotel developers eager to break ground on new projects

New projects and development planning that was previously on hold are now getting the green light from investors and developers with buoyed confidence thanks to rather robust domestic leisure travel during the first part of the year. With stronger domestic leisure travel in the U.S., along with the albeit slower revival of corporate and group travel, there is growing confidence in the recovery. Developers are eager to move forward with plans and break ground as this upward trend in hotel business demand is expected to continue throughout 2022.

Through year-end 2021, the U.S. opened 826 projects accounting for 106,192 rooms. A total of 113 hotels/12,464 rooms opened in the first quarter of 2022. Over half of these opens, 68 hotels/7,154 rooms, were in suburban locations, but 41 hotels/4,703 rooms of newly opened hotels, or 36%, were in a top 25 market.

Reflective of the increasing number of projects in early planning and projects scheduled to start in the next 12 months, LE’s forecast for new hotel openings by projects has risen ever so slightly for 2023.

For the remainder of the year, LE forecasts another 649 projects/77,568 rooms to open for a total of 762 hotels/90,032 rooms in 2022, representing a 1.6% increase in new hotel supply. In 2023, LE forecasts an additional 839 hotels/93,169 rooms will open in the U.S., for a 1.6% supply increase.

Related Stories

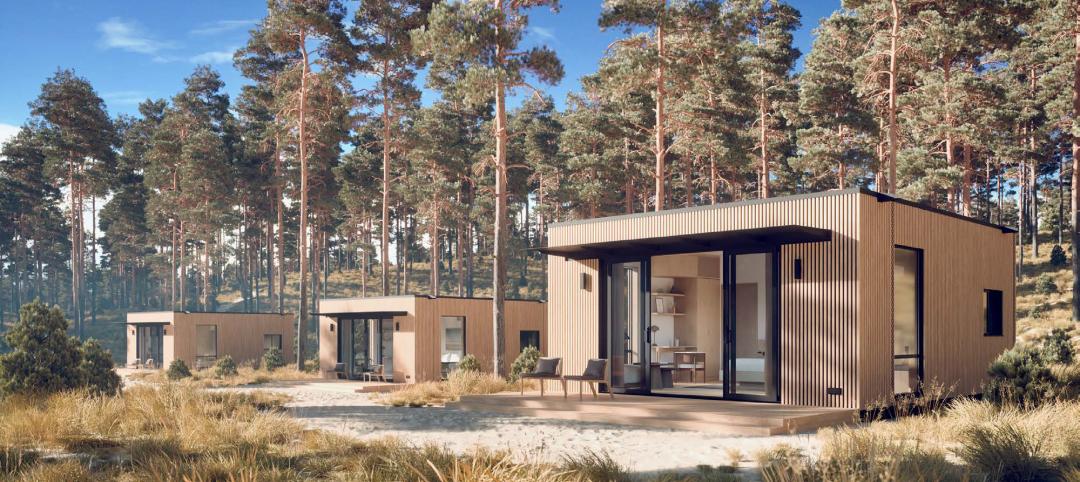

Modular Building | Oct 11, 2023

Development startup brings modular solution to hospitality industry

The company's approach extends to various types of accommodations, from landscape hotels and cozy bed and breakfasts to compact micro hotels and food and wine-themed properties.

Luxury Residential | Oct 2, 2023

Chicago's Belden-Stratford luxury apartments gets centennial facelift

The Belden-Stratford has reopened its doors following a renovation that blends the 100-year-old building’s original architecture with modern residences.

Giants 400 | Sep 20, 2023

Top 80 Hospitality Facility Construction Firms for 2023

Suffolk Construction, The Yates Companies, STO Building Group, and PCL Construction Enterprises top BD+C's ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 20, 2023

Top 75 Hospitality Facility Engineering Firms for 2023

Jacobs, IMEG, EXP, and Tetra Tech top BD+C's ranking of the nation's largest hospitality facilities sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 20, 2023

Top 130 Hospitality Facility Architecture Firms for 2023

Gensler, WATG, HKS, and JCJ Architecture top BD+C's ranking of the nation's largest hospitality facilities sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Mixed-Use | Sep 20, 2023

Tampa Bay Rays, Hines finalize deal for a stadium-anchored multiuse district in St. Petersburg, Fla.

The Tampa Bay Rays Major League Baseball team announced that it has reached an agreement with St. Petersburg and Pinellas County on a $6.5 billion, 86-acre mixed-use development that will include a new 30,000-seat ballpark and an array of office, housing, hotel, retail, and restaurant space totaling 8 million sf.

Hotel Facilities | Sep 15, 2023

The next phase of sustainability in luxury hotels

The luxury hotel market has seen an increase in green-minded guests looking for opportunities to support businesses that are conscientious of the environment.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.