According to a recent report by Lodging Econometrics (LE), the U.S. Construction Pipeline stands at 4,973 Projects/598,371 Rooms, with projects up 7% Year-Over-Year (YOY).

There are 1,520 Projects/198,710 Rooms Under Construction, up 10% YOY, and are the highest counts recorded this cycle. Projects Scheduled to Start Construction in the Next 12 Months, at 2,312 Projects/264,924 Rooms, are up 5% YOY. Projects in Early Planning are at 1,141 Projects/134,737 Rooms and are up 8%, YOY. However, it’s slightly down from last quarter which, so far, is the peak level this cycle.

For the economy, the rate of growth may be low but it’s running on all cylinders. So, too, with the Total Pipeline whose growth rate is also stalling.

20% increase in new supply forecast for 2017 in the U.S.

448 Hotels/50,521 Rooms have already opened in the U.S. with another 573 Projects/64,385 Rooms forecast to open by year-end according to analysts at Lodging Econometrics (LE). The Total 2017 Forecast for 1,021 Projects/114,906 Rooms, represents a 20% increase over the actual number of Hotel Openings in 2016, which stood at 849 Hotels/99,872 Rooms. 344 of the New Openings, or 34%, will be in the Top 25 Markets.

Almost half of the hotels that are expected to open this year are Upper Midscale, at 477 Projects/46,093 Rooms and another 289 Projects/37,914 Rooms are Upscale. These two chain scales represent 75% of the 1,021 projects anticipated to open through the end of 2017. 497 of the projects will be between 100 and 200 rooms, while 464 of the projects will be Suburban locations.

LE forecasts that 1,160 Projects/133,880 Rooms will open in 2018 and another 1,193 Projects/137,393 Rooms will open in 2019, still a distance from the annualized New Openings peak of 1,316 Projects/140,227 Rooms, set in 2009.

Related Stories

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

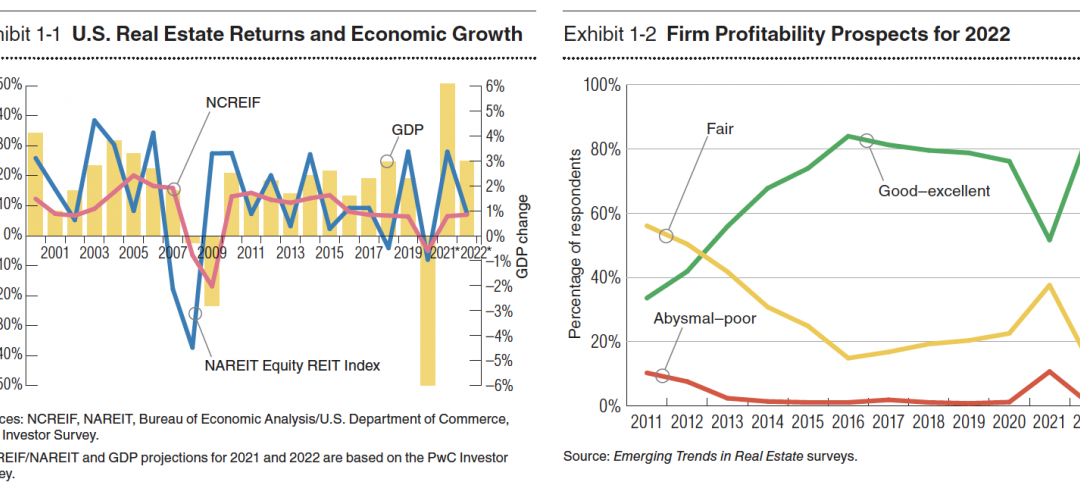

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

No decline in construction costs in sight

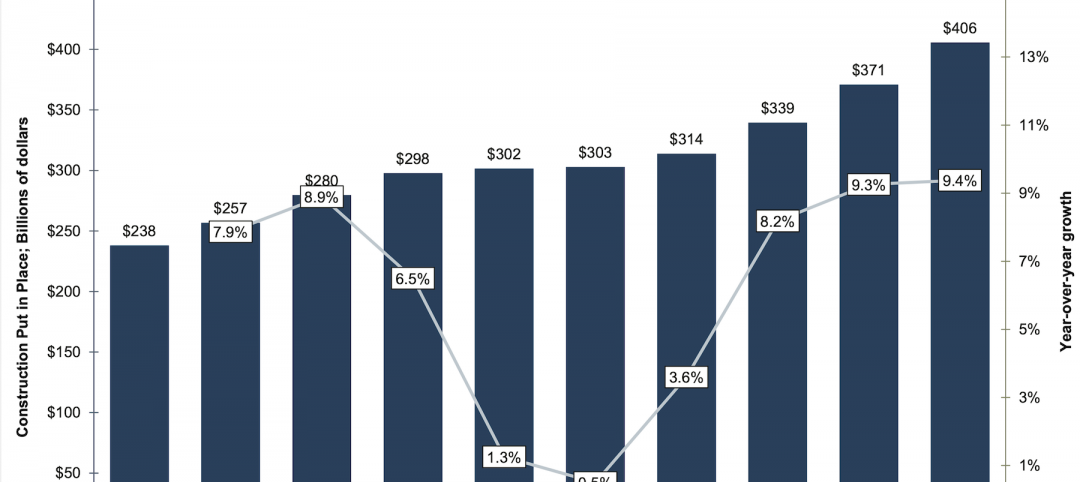

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

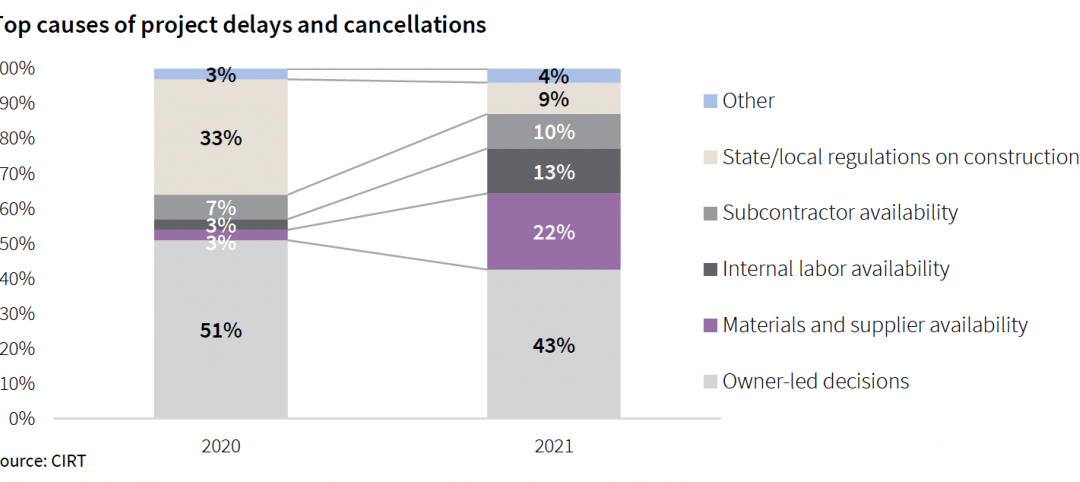

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.